Behind SMIC's Target Price Hike: AI Inference Chip Orders Flood In, Domestic Substitution Logic Rewr

Key Points

AI Chip Demand Explodes: Chinese cloud service providers and AI chip manufacturers are accelerating the deployment of AI infrastructure, driving dual demand for both mature and advanced process chips. $SMIC(00981)$

SMIC stands to benefit directly: As China's largest and most technologically comprehensive foundry, SMIC will continue to secure incremental orders in areas such as AI inference and edge computing.

Valuation Slightly Upward Revised: After raising 2028–2029 earnings forecasts, Goldman Sachs' target price is increased to HK$83.5, implying 13.8% upside potential.

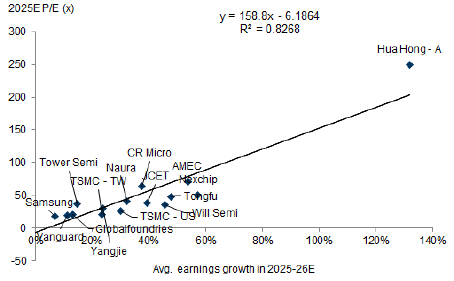

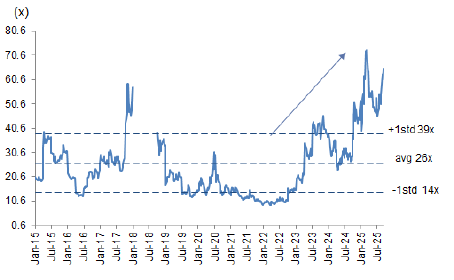

Valuation Logic Reassessment: Improved market expectations for the long-term growth of China's semiconductor sector have driven SMIC's forward price-to-earnings ratio up from 40 times to 45.2 times.

Why is SMIC now viewed favorably?

1. Accelerated investment in AI infrastructure strengthens the logic of domestic substitution.

China is experiencing a new wave of AI infrastructure development. The most prominent example is $CHINA MOBILE(00941)$ announcing in August a ¥1.7 billion investment to procure AI inference servers. This represents not merely a procurement deal, but a clear signal of Chinese cloud service providers shifting their capital expenditures (capex) toward AI.

Meanwhile, domestic AI chip manufacturers are also rapidly emerging: Huawei released its Ascend 950/960/970 series AI chips, scheduled for sequential market launches from Q1 2026 to Q4 2028. These are complemented by the Atlas 950/960 SuperPod and SuperCluster, supporting collaborative computing across hundreds of thousands to millions of NPUs; $Cambricon Technologies Corporation Limited(688256)$ has already demonstrated robust performance in the second quarter of 2025.

While not all of these chips may be manufactured by SMIC, a significant number of edge AI devices and inference chips still rely on mature processes such as 55nm–14nm—precisely SMIC's core area of strength.

Although SMIC has yet to join the first tier of advanced logic processes below 7nm, it boasts exceptionally high capacity utilization and customer loyalty at its mature nodes of 28nm and above. AI edge devices—such as smart cameras, automotive chips, and industrial terminals—are cost-sensitive and have relatively low process requirements, precisely aligning with SMIC's core strengths.

More importantly, the company continues to expand its production capacity and possesses the capability to flexibly allocate production lines based on market demand—a significant operational advantage in the current context of structural differentiation in AI demand (training vs. inference vs. edge computing).

3. Double-digit growth in profits and valuations is expected.

Goldman Sachs recently raised its revenue and gross margin forecasts for SMIC in 2028–2029, reflecting improved visibility on long-term AI demand and profit margin optimization driven by higher utilization rates.

Geopolitical Uncertainty: U.S. semiconductor export controls on China remain a sword of Damocles, potentially restricting equipment procurement and technological upgrades;

Capital Expenditure Pressure: Continued capacity expansion requires substantial funding, with free cash flow remaining negative (FCF yield ranging from -13.5% to -1.8% from 2025 to 2027);

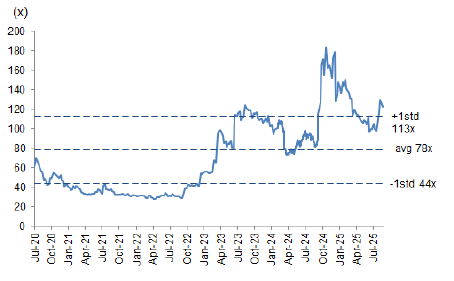

Valuations are no longer cheap: The current P/E ratio of A-shares is approaching historical highs, with potential for short-term volatility.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·09-25How do Americans buy this in Hong Kong if SMIC comes up as "restricted"???LikeReport

- HaydenBruce·09-25Exciting times for SMICLikeReport

- AmyMacaulay·09-25Impressive insights on SMIC! [Wow]LikeReport