Alibaba has hit a new high in more than four years, what strategy should be used to hedge?

The artificial intelligence (AI) investment boom is creating a peculiar new algorithm in the stock market: large-scale AI investment plans can bring market value growth returns that far exceed the amount invested.

On Monday, Nvidia announced that it planned to invest as much as US $100 billion in OpenAI. The stock price closed up 3.9% that day, a record high. Two days later, Alibaba announced additional AI capital expenditures, and Alibaba's U.S. stocks rose sharply. They once rose 10.5% during the session and closed up about 8.2%, a new high in more than four years. Judging from the stock price trends of the two giants, the market seems to have set up an instant reward mechanism for heavy investment in the AI field.

Within three trading days of announcing plans to acquire a $5 billion stake in Intel and invest in OpenAI, Nvidia's market value increased by more than $320 billion, almost three times the company's expected investment amount. Although Alibaba has not announced the specific amount of additional investment, the statement that the expenditure will exceed the previous target size of about 53 billion US dollars has driven the market value to increase by more than 35 billion US dollars.

These phenomena show that investors still have a strong desire for AI-related investments, although only a few companies have shown substantial investment returns in their financial reports.

The market actively responds to Alibaba's AI strategic upgrade

At the 2025 Yunqi Conference that opened on Wednesday, Alibaba CEO Wu Yongming said that global AI investment is expected to reach US $4 trillion in the next five years, and Alibaba must keep pace. Ali is actively promoting the plan announced in February this year to invest 380 billion yuan (about 53 billion US dollars) in cloud and AI hardware infrastructure construction in the next three years, and plans to add more investment, but did not disclose the specific increase amount.

Wu Yongming also revealed an amazing goal: by 2032, the energy consumption scale of Alibaba Cloud's global data centers will increase by 10 times on the basis of 2022.

Alibaba also released the Qwen3-Omni open source model, which can process text, image, audio and video content.

Alibaba Cloud has also reached a software cooperation agreement with Nvidia in the field of Physical AI (Physical AI) to integrate Nvidia's AI development tools for robot and self-driving car training.

Alibaba Cloud's AI platform PAI will integrate Nvidia's Physical AI software stack and will provide enterprise users with full-link platform services such as data preprocessing, simulation data generation, model training evaluation, robot reinforcement learning, and simulation testing, further shortening the development cycle of embodied intelligence, assisted driving and other applications.

Alibaba Cloud's business will build new data centers in Brazil, France and the Netherlands, and its revenue in the April-June quarter increased by 26% year-on-year. Wu Yongming said that AI and cloud computing are listed as Ali's growth engines along with e-commerce.

Wall Street is generally optimistic about Alibaba. According to a FactSet survey, more than 50 analysts gave Ali a buy rating, and none gave a sell rating. Before the U.S. stock market opened on Wednesday, analysts gave Ali an average target price of slightly less than $167, but Ali's U.S. stock market opened close to $176 and rose above $180.10 during the session.

After meeting with Ali's management earlier this month, analysts at Nomura Securities showed optimism about Ali's e-commerce business. Nomura analyst Jialong Shi said that Ali hinted that the expenditure this quarter is still huge, mainly because "in order to cope with the surge in orders, the company needs to invest a lot of money in advance to expand the delivery team and promote the brand of the newly launched instant delivery business."

Shi said that Ali revealed that with the expansion of business scale, Ali plans to reduce the loss of a single order by 50% by October by optimizing operational efficiency and reducing marketing expenses.

Morningstar analyst Chelsey Tam believes that demand in the education and medical industries is emerging, and the development of company tools that use Alibaba's open source AI model for training also brings additional demand. He said: "We believe that (Alibaba's) stock is undervalued, and the market has not fully reflected Alibaba's AI cloud potential and the current management's ability to improve competitiveness."

On Monday, ARK Investment Management Company, a subsidiary of "Sister Wood" Cathie Wood, bought Ali for the first time in four years, with a total value of approximately US $16.3 million, and continued to increase its holdings in Baidu, with the total value of its holdings rising to approximately US $47 million.

The ARK team recently believed: "AI is the next wave of innovation, and companies leading in this field are likely to achieve exponential growth."

In view of Alibaba's booming market, option traders who want to hedge in the short term can consider the bear market bullish spread strategy.

What is a Bear Call Spread Strategy?

A bear call spread is an options strategy in which options traders expect the price of the underlying asset to fall for some time to come, the trader wants to short the underlying and wants to limit trading to a certain risk range.

Specifically, the bear market call spread is achieved by buying a call option at a specific strike price while selling the same number of call options with the same expiration date at a lower strike price.

Specific case of Alibaba hedging

To short$Alibaba (BABA) $For example, Alibaba's current price is $176.44. Assuming that investors expect a short-term correction, they can use the bear market bullish spread strategy.

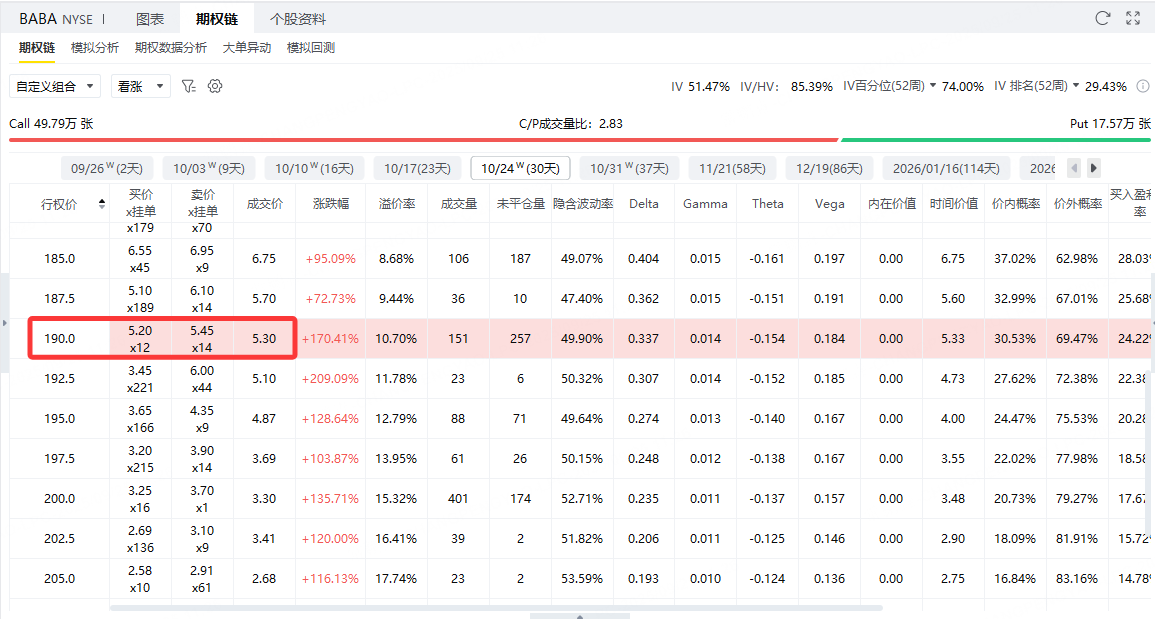

Step 1: Sell the call option with an exercise price of 190 expiring on October 24 and get a $530 premium.

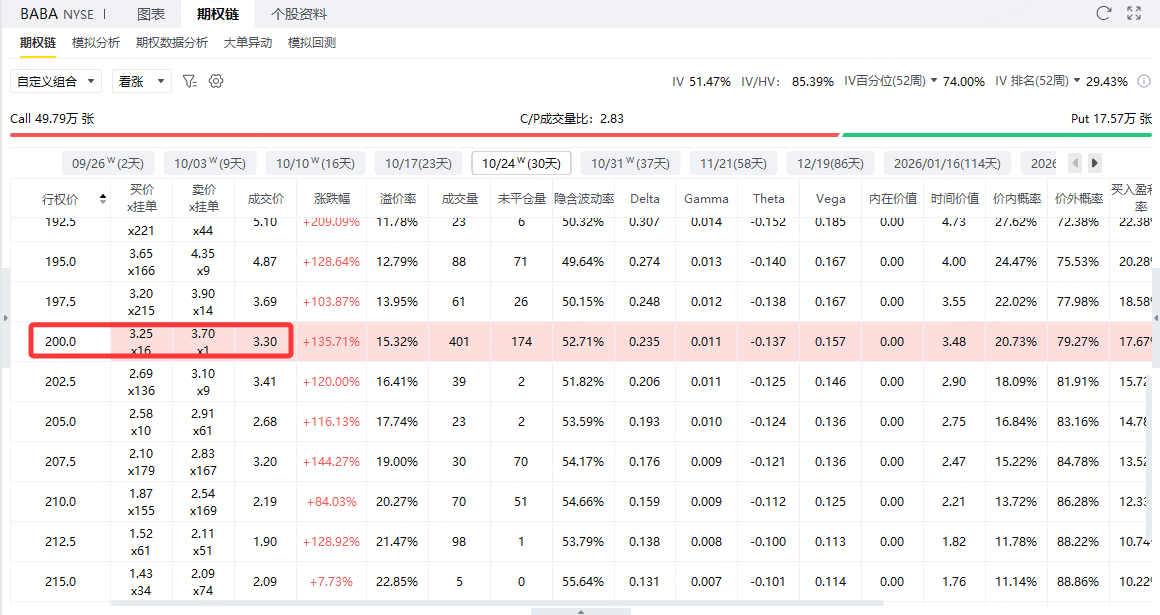

Step 2: Buy a call option with the same expiration date and an exercise price of 200, which costs $330 premium, and the bear market spread is established.

Sell call option: Strike price of $190, premium revenue of $530

Buy call: Strike price of $200, premium payout of $330

Net income: $530-$330 = $200

PROFIT AND LOSS

Maximum benefit:

If Alibaba's share price is below $190 at expiration, neither option will be exercised and you will keep the net income of $200.

Maximum gain = $200.

Maximum loss:

If Alibaba's stock price is higher than $200 at expiration, the selling option with a strike price of $190 will be exercised, and you need to sell it at $190, while the buying option with a strike price of $200 will let you buy it at $200, resulting in a loss of the spread.

Maximum loss calculation: $200-$190-$2 = $10-$2 = $8.

Maximum loss = $8 × 100 = $800.

Break-even point:

The break-even point occurs when Alibaba's stock price just reaches $192, because at this time the net income of $2 just offsets the spread loss.

The main advantage of the bear market call spread is that when the stock price is not expected to rise sharply, it can make a profit from premium income, and at the same time limit the potential loss to a fixed range. The risk is much lower than directly shorting the stock or naked selling call options.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.