Art or Pollution? The Himalayan Marketing Blunder Makes Amer Suffer!

On the summit of the Himalayas, a "Rising Dragon" fireworks display intended as a romantic encounter between art and nature instead ignited a global firestorm of environmental outrage. On September 19, Arc'teryx collaborated with artist Cai Guoqiang to illuminate a fireworks pattern symbolizing the Chinese dragon at an altitude of 5,500 meters on the Tibetan plateau near Shigatse. The slogan proclaimed: "Awaken mountain conservation awareness." But netizens weren't buying it—"An outdoor brand using fireworks to protect nature? Isn't that shooting itself in the foot?" Overnight, the hashtag #ArcTeryxFireworks flooded social media as criticism poured in like an avalanche. The brand apologized, authorities launched an investigation, and its stock price took a tumble.

Arc'teryx's move may appear as artistic marketing on the surface, but at its core, it hits the nerve on environmental, cultural, and brand integrity issues. Ironically, these very people might actually be Arc'teryx's target customers. After all, amid the outdoor gear boom, Arc'teryx is Anta's cash cow. Should any mishap occur, the valuation ship could start rocking.

The platform's views surpassed one million, with netizens exclaiming "It's cutting off the dragon vein!" Western media followed suit, focusing squarely on "high-altitude pollution." By September 24, the authorities' investigation team had ascended the mountain to verify the claims. Both the brand and the artist issued apologies, yet the fallout persists—this is not merely a PR crisis, but a textbook case of a global brand stepping on a landmine.

Pain points identified based on media reports and user feedback | ||||

Point of contention | Detailed description | Supporters' Perspective (Brand/Fans) | Critics' Viewpoints (Netizens/Environmental Organizations) | Potential impact |

Environmental destruction | Firework debris contains heavy metals, polluting glacial water sources and air, while high-altitude ecosystems recover slowly. | "Eco-friendly fireworks" are biodegradable, aiming to raise awareness for environmental protection. | In violation of the United Nations Sustainable Development Goals, snow leopard habitats are suffering. | Ecological restoration is costly; authorities may impose fines or bans. |

Culturally sensitive | Activities on the Tibetan Plateau, conducted without sufficient consultation with Tibetan communities, have raised suspicions of cultural appropriation due to the inclusion of "dragon" elements. | Respect Chinese culture and encourage local organizations to participate. | "Foreign art blasting mountains" ignores minority rights, sparking outrage among Tibetan netizens. | Deepening divisions between China and the West over Tibet, with a wave of boycotts emerging. |

Brand Integrity | Arc'teryx touts its "zero carbon footprint" while staging a high-pollution show, drawing criticism for "greenwashing." | Admitting negligence and pledging donations for restoration. | Double standards in PR: the English apology is brief, while the Chinese version is the one that's humble. | Consumer attrition benefits competitors like Patagonia. |

These incidents aren't isolated; they form a web that has thoroughly exposed Arc'teryx's "nature guardian" persona. NGOs like Greenpeace have spoken out: "Art cannot come at the expense of ecology." On X, 90% of posts are criticisms, while 10% of fans defend artistic freedom—yet paranoia has taken hold. Some have even speculated about "damaging dragon veins," elevating the issue to political feng shui levels. Cai Guoqiang issued a personal apology, acknowledging he "overlooked real-world risks." Arc'teryx's CEO admitted "lessons learned" in an internal email, while fyrevacay quietly deleted posts. The Tibet Environmental Protection Bureau is now focusing on the unauthorized high-altitude activity, with fines or restoration orders likely imminent.

This development will send Anta and Amer Sports' valuations into a tailspin in the short term, while we sit back and watch the drama unfold in the long run.

As Anta Sports' "international ticket" acquired for €4.6 billion in 2020, Arc'teryx serves as its growth engine—H1 2025 revenue hit $2.709 billion, soaring 23.5% year-over-year, with Greater China contributing over half of the total. The company has also declared its ambition for Arc'teryx to surpass $5 billion in revenue by 2030, banking on its premium outdoor positioning and eco-conscious narrative. Yet this fireworks display immediately wiped out RMB 15 billion from its market value.

Stock price reaction? On September 22, AS shares plunged 5.8% in a single day, falling as much as 8.4% intraday. Nomura immediately downgraded the stock from Buy to Neutral, slashing the target price from $43.2 to $38.3. The rationale was straightforward: amplified environmental controversies heightening PR risks and declining orders from the Chinese market. Outdoor retailers reported downward revisions to sales forecasts in China, with consumer loyalty halved in the short term.

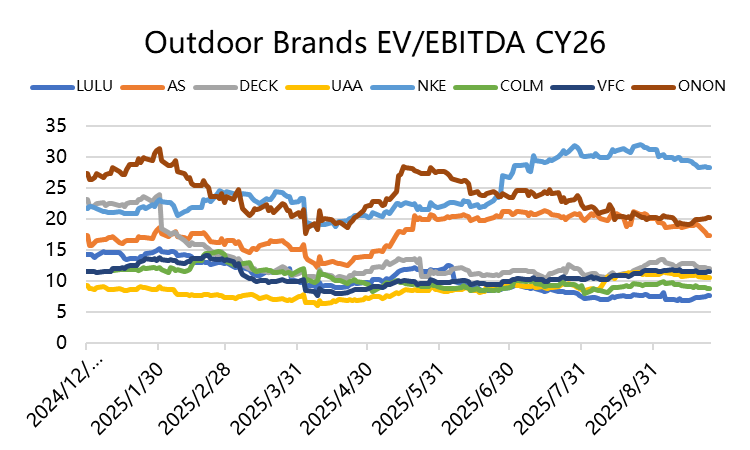

What about the valuation multiples? Amer Sports currently trades at around 20x EV/EBITDA. The previously anticipated upside potential (driven by diversification through Salomon and Wilson) has now been overshadowed by a risk premium, potentially pushing the multiple down to 10x in the short term.

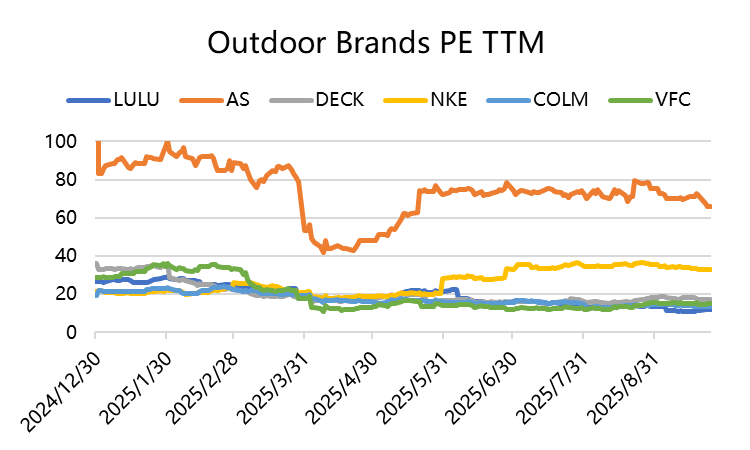

From a PE perspective, the current valuation of $Amer Sports (AS)$ is even higher than other companies in the same industry, such as $lululemon athletica (LULU)$$Nike (NKE)$VF Corporation (VFC)$Deckers Outdoor Corporation (DECK)$Columbia Sportswear (COLM)

Is this crisis a buying opportunity or a risk to avoid?

In the short term, it's definitely a risk to avoid—with investigation results pending and the boycott wave persisting, Q3 earnings will likely be discounted. Long term? Anta's deep expertise in local integration means Arc'teryx generates over 40% of its revenue in China. If the brand pushes a "transparent sustainability" transformation post-incident (e.g., enhanced environmental assessments + donations), it could actually strengthen its connection with local consumers. Consider Patagonia's comeback from environmental lawsuits. Should Amer Sports learn from this, significant valuation recovery potential exists. After all, the outdoor sector remains robust, with global middle-class hiking enthusiasm unabated. Arc'teryx's innovative fabrics and brand influence remain intact.

Investments that are obsessed with environmental protection are essentially bets on whether the sustainability narrative holds true. Arc'teryx's "Ascending Dragon" show, which transformed from an artistic feast into an environmental farce, reminds us that global brands engaging in cultural marketing must first gauge the ecological "dragon veins." Anta's acquisition of Amer Sports may see short-term valuation fluctuations but remains stable long-term—provided they stop blasting mountains.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- ZOE011·2025-09-24Poor choiceLikeReport