China's AI infrastructure narrative has rekindled, is it time to go long?

Goldman Sachs pointed out in a latest report that full-stack cloud vendors represented by Alibaba are ushering in new growth opportunities, benefiting from the accelerated adoption of large models by enterprises and the continued resilience of computing needs.

Data shows that the actual deployment and application of AI in the commercial field is accelerating significantly.The average daily Token consumption of enterprise-level large models in China reached 10.2 trillion in the first half of 2025, a surge of 363% from the second half of 2024.

Goldman Sachs believes that,$Alibaba (BABA) $With its leading model capabilities, 47% of China's public cloud market share, and diversified chip supply, it is well-positioned and has room for international expansion.

Based on an optimistic view on the industry outlook, Goldman Sachs raised Alibaba's price target from $163 to $179, maintaining a "buy" rating. Goldman Sachs specifically raised its valuation of Alibaba Cloud from $36 per ADS to $43, and raised Alibaba Cloud's growth forecast for the second to fourth quarters of fiscal year 2026.

Goldman Sachs analyst Ronald Keung and others emphasized that Chinese cloud vendors have made progress in self-developed inference chips and adopted a "multi-chip strategy", which means that the growth of China's AI cloud industry "no longer depends solely on overseas chip supply." This shift, coupled with a strong capital expenditure outlook, presents compound growth potential for the sector.

Chinese companies are embracing generative AI at an unprecedented rate, a core driver underpinning the infrastructure narrative. According to Frost & Sullivan data, in the first half of 2025, the average daily total Token consumption of enterprise-level large models in China reached 10.2 trillion, a month-on-month increase of 363%.

Among many model providers, Alibaba, ByteDance and DeepSeek have become the top three popular options for Chinese companies when choosing general large models.

Citing Omdia's report, Goldman Sachs pointed out that Alibaba has successfully penetrated most of China's Fortune 500 companies deploying generative AI in 2025 and occupied the first place in this market segment. This business model of billing through API calls and Token usage puts large cloud service providers with leading AI models and proxy capabilities in the most favorable position.

Goldman Sachs believes that the investment narrative of China's AI infrastructure was rekindled after Alibaba announced higher-than-expected cloud business revenue and capital expenditures. The bank predicts that capital expenditures of Chinese cloud service providers (CSPs) will increase by 39% year-on-year in the third quarter of 2025, providing the hardware foundation for the continued growth of AI cloud revenue.

At the same time, the evolution of the chip supply pattern has also enhanced market confidence. Goldman Sachs believes that this diversified chip supply strategy is reshaping the development prospects of China's AI cloud industry.

Based on the above positive trend, Goldman Sachs reiterated its "buy" rating on Alibaba and raised its 12-month SOTP (Segment Valuation Method) price target to $179. Goldman Sachs raised Alibaba Cloud's growth forecast for the second to fourth quarters of fiscal year 2026 from 28%-30% to 30%-32% to reflect its latest AI full-stack products, robust computing needs and capital expenditure prospects.

For investors who want to go long on Zhonggai technology stocks, they can consider adopting a selling put option strategy at this time.

Go Long with Put Options on KWEB

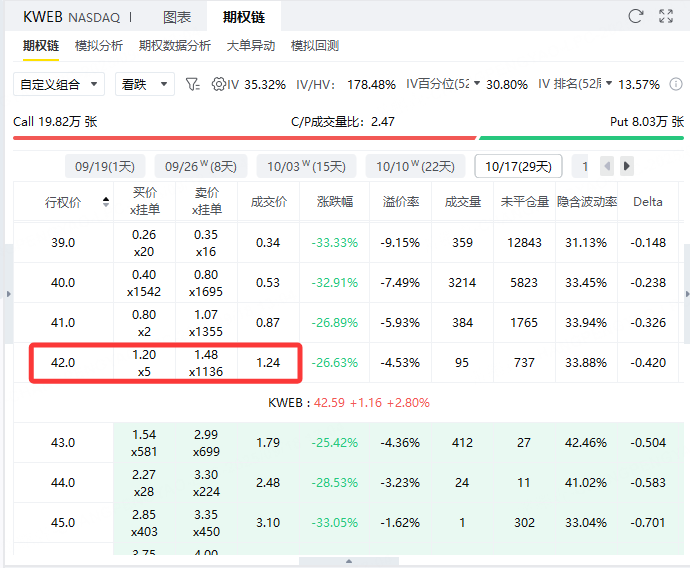

Current$China Overseas Internet ETF-KraneShares (KWEB) $The current price is $42.59, we can sellExpires October 17, 2025, exercise price 42, premium $124Put Option (Put Option) to go long on Chinese technology stocks.

Not only can this strategy profit when KWEB rises, even if KWEB moves sideways or falls slightly, you can still rely on premium to earn gains.Maximum benefit:If the KWEB share price is above or equal to $42 at expiration, the option will not be exercised and you retain the full premium. The maximum gain is $124.Maximum loss:If the KWEB share price drops to $0, you need to buy 100 shares at $42, with a total cost of $4,200. Subtracting premium received of $124, the maximum loss was $4,076.Break-even point:The breakeven point is $40.76 (i.e. the exercise price of $42 minus $1.24 per premium). As long as the KWEB share price is above $40.76 at expiration, you are in a net profit.Advantages:

The limited gain ($124) is locked in at the start;

Higher winning rate, as long as the stock price does not fall sharply, you can make a profit;

If you want to buy KWEB in the first place, this way can reduce the buying cost.

Risk warning:

Profit and loss are asymmetric, the maximum income is limited, but the potential loss is large;

Requires a margin account to support selling naked Put;

Closing positions before expiration or rolling operations can be considered to dynamically manage risk.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.