JPMorgan Chase predicts the impact of interest rate cuts, is it time to go long on U.S. debt?

The moment investors have been waiting for all year has finally arrived.

Markets have been calling on the Federal Reserve to restart its rate cut cycle, and the central bank appears finally ready to cut its target rate at this week's policy meeting. The probability of a rate cut has continued to rise over the past few weeks due to tame inflation data and recent signs of a weak job market. Market pricing on Monday showed a 96.2% probability of the Federal Reserve cutting interest rates by 25 basis points in September.

JPMorgan Chase also believes that interest rate cuts are almost a foregone conclusion. In its latest report, the bank pointed out that the probability of the Fed cutting interest rates in some form is 95%, including an 87.5% probability of a 25 basis point rate cut.

Andrew Tyler, head of global market intelligence at JPMorgan Chase, said: "We believe a dovish rate cut is the most likely outcome, and we expect a positive market gain on the day.He cited research by the bank's chief U.S. economist.

The market expects that trading on the resolution day may fluctuate significantly.$S&P 500 (. SPX) $Option pricing shows that there may be 88 basis points of fluctuation on the day of the interest rate decision.

Here's JPMorgan's forecast of how various potential outcomes will affect U.S. stocks:

25 basis point rate cuts and maintains dovish stance

The bank believes that this is the most likely outcome, with a probability of 47.5%. The Fed will cut interest rates by 25 basis points and make dovish comments on the state of the economy. Taylor said,In this case, the S&P 500 index could rise by about 1% immediately after the rate cut, implying that the index will rise to around 6,650 points.

But the bank added,This may eventually put more downward pressure on U.S. stocks.

Taylor warned: "Looking ahead to the end of the month,Federal Reserve Resolution Day Could Become a 'All Good Points' Event--Investors need time to digest factors such as the macro environment, the Fed's future response mechanism, positions that may be overstretched, temporarily weakening corporate repurchase demand, declining retail investor participation, and portfolio rebalancing at the end of the quarter. " He wrote that if these headwinds ferment in the coming weeks,U.S. stocks may fall as much as 5%, but it will also create multiple buying opportunities for investors.

If there is a "exhausted" U.S. stock reaction, the areas that the bank considers buying include:

Technology stocks: Continue to overweight technology, media and telecommunications stocks, especially ultra-large market capitalization technology and artificial intelligence-themed companies;

Utilities: The sector could rise as interest rate expectations fall and 10-year U.S. Treasury yields lower;

Medical stocks: Based on strong EPS growth and low sector position allocation;

Biotech Stocks: Expect a warming up of M&A activity in this space.

25 basis point rate cut but hawkish comments

The second possible scenario is for the Fed to cut interest rates by 25 basis points as expected, but make hawkish comments on the state of the U.S. economy. Taylor said,This could have a negative impact on U.S. stocks, with the S&P 500 likely to be flat or down 0.5%.

JPMorgan believesThe probability of a hawkish rate cut coming true is 40%.The main reason is that Powell may hint that the job market is now more worrying to the central bank than controlling inflation, "which will partially offset the gains accumulated by the market before the resolution day."

JPMorgan Chase also deduced the low-probability scenarios that may happen this week:

With the Fed keeping interest rates unchanged, the S&P 500 may fall by 1%-2%, or as low as around 6,450 points. The bank believes that the probability of this scenario happening is only 4% unless the August employment report is stronger and the inflation data last month is higher, but this did not happen;

Under the scenario that the Federal Reserve launches a super-large interest rate cut,If interest rates are cut by 50 basis points, the S&P 500 could fluctuate by 1.5% in both directions.JPMorgan Chase believes that this scenario has a 7.5% probability of occurring. Taylor analysis: "Negative results may stem from the market's belief that the Fed's concerns about the labor market are more serious than publicly admitted, and new uncertainties trigger selling; positive results stem from the Fed's belief that it needs to catch up with the economic reality that the labor market is on the verge of collapse."

For investors who want to take advantage of the low level of U.S. bonds to buy U.S. bonds at the bottom, they can consider using the diagonal spread strategy.

What is a diagonal spread?

diagonal spread refers to the spread established using options with different strike prices and different expiration dates. Generally, the duration of the long leg in the spread is longer than that of the short leg. Diagonal spreads include diagonal bull spreads versus diagonal bear spreads.

The diagonal bull spread is basically similar to the bull subscription spread strategy, except that it has been upgraded and improved again.The difference is that the two options for the diagonal spread have different expirations, the trader buys a longer-term call option with a lower strike price and sells a shorter-term call option with a higher strike price. The number of call options bought and sold is still the same.

TLT Diagonal Spread Case

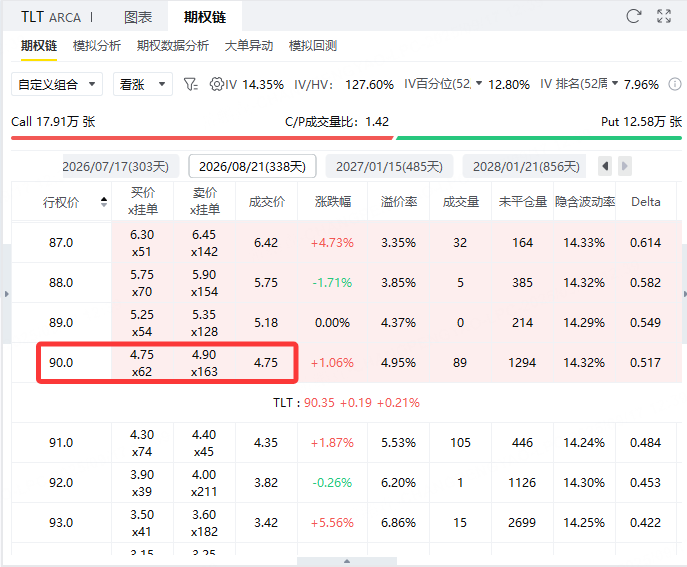

Assuming investors are bullish for the next year$20 + + Years US Treasury Bond ETF-iShares (TLT) $, you can directly buy the call option with an exercise price of 90 and an expiration date of August 21, 2026. This option becomes our long leg, which costs $475 at the latest transaction price.

After the long leg is established, we can establish the short leg according to a shorter cycle than the long leg. Here, we can choose to establish it on a weekly basis. Choose to sell the call option with a strike price of $92 and an expiration date of September 24 and get premium of $18.

Here, if the call option sold is not exercised, it will generate a profit of $18, which is about 3.78% relative to the cost of $475 on the long side. However, the short leg can be executed once a week. When the remaining date of the long leg is as long as 338 days, investors can sell dozens of call options. If some sold call options can successfully obtain premium, it will greatly reduce the cost of buying the call option itself, and even get the call option for free.

Compared with buying bulls alone, the diagonal spread obtains an additional premium income, which reduces the overall net premium expenditure of the strategy, and the break-even point of the strategy is also shifted to the left, and the winning rate is also increased accordingly. AdditionallyThe selling point of the diagonal spread can be controlled by investors themselves, so different short-selling efforts can be selected in different cycles to facilitate investors to control risks. Diagonal spreadEssentially, it is a low-cost call option strategy that is worth investors studying.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.