Apple's iPhone 17 sales surge, time to go long on Apple?

In the last week,$Apple (AAPL) $The iPhone 17 series was grandly launched, especially the "thinnest iPhone ever"-the iPhone 17 Air, aimed at competing with similar products from competitors such as Samsung.

Although the company's stock price has fallen after the release of the new iPhone due to the lack of innovation in artificial intelligence, JPMorgan Chase is still optimistic that the market demand for the new iPhone 17 series may be better than last year's iPhone 16 series.

iPhone 17 performs better first week than last year

Analysts at JPMorgan Chase pointed out in the latest report that judging from the performance in the first week of listing, the market demand for Apple's recently launched iPhone 17 series seems to be stronger than last year's 16 series, which is mainly based on the delivery time of key markets. judgment made.

JPMorgan Chase said that in the first week after launch, the iPhone 17 series wasThe United States, China, Germany and the United Kingdom among othersThe lead times in the market are all "slightly above" the level of the 16 series. Among them, especially the basic model of iPhone 17 and the newly launched ultra-thin Air model, compared with the basic and Plus models of the 16 series, the demand is much greater.

JPMorgan Chase pointed out that although initial trends show that the market demand for the Pro version of the iPhone 17 is slightly weaker than the base model, this does not necessarily mean that the demand for the Pro version (that is, the preference for Apple's higher-end models) will be lower than last year. However, the continued development of this trend may indicate that demand for the base iPhone 17 will grow far more than the market expects.

The delivery cycle of iPhone refers to the length of time Apple customers need to wait from placing an order for a new iPhone to receiving the device. The longer the waiting time, the stronger the market demand.

Currently, in the United States, Apple's most important market (Apple's iPhone shipments in the United States account for about one-third of total shipments), the delivery cycle of the iPhone 17 base and Air models is 4 days and 7 days respectively. While the Pro and Pro Max models have a lead time of 4 days and 21 days respectively.

In contrast, the iPhone 16 and 16 Plus models both had a zero-day delivery cycle in the first week of launch last year, that is, they can be picked up immediately after purchase. While the 16 Pro and Pro Max have lead times of 6 days and 20 days respectively.

Go Long Apple with Put Options

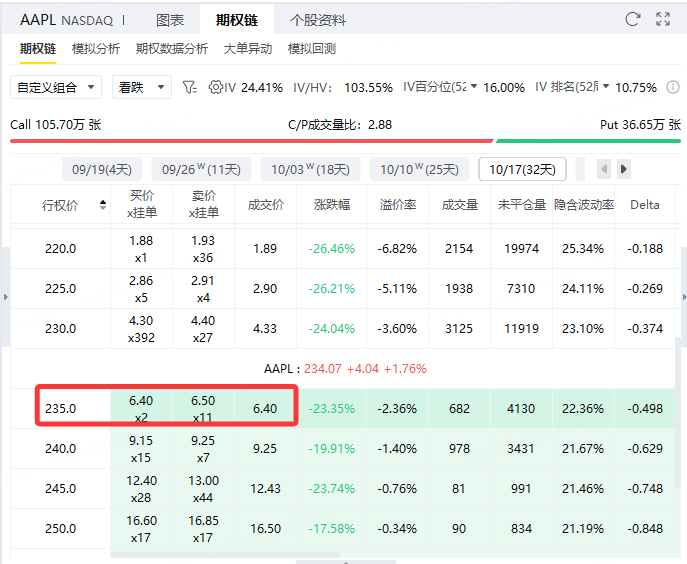

The current price of Apple is $234.98, and we can sell itExpires October 17, 2025, exercise price 235, premium $640Put Option to go long on Apple.

This strategy can not only profit when Apple rises, but even if Apple moves sideways or falls slightly, it can still rely on premium to earn earnings.

Maximum benefit: If Apple's stock price is higher than or equal to at expiration$235, the option will not be exercised, and you retain all premium$640。

Maximum loss: If Apple's stock price falls to$0, you need to start with$235Buy 100 shares for a total cost of $23,500. Subtracting premium received of $640, the maximum loss wasUS $22,860。

Break-even point: The breakeven point is$228.60(i.e. exercise price of $235 minus $6.40 per premium). As long as Apple's stock price is higher than $228.60 at expiration, you are a net profit.

advantage:

The limited gain ($640) is locked in at the start;

Higher winning rate, as long as the stock price does not fall sharply, you can make a profit;

If you want to buy Apple stock in the first place, this way can reduce the cost of buying.

Risk warning:

Profit and loss are asymmetric, the maximum income is limited, but the potential loss is large;

Requires a margin account to support selling cash-secured put options;

Closing positions before expiration or rolling operations can be considered to dynamically manage risk.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.