Oracle Bone Inscriptions becomes the "New Nvidia", how to play the bear market spread?

Explosive growth prospects are transforming Oracle from a traditional database company into a core player in the wave of AI infrastructure.

In the recently released Q1 financial report, Oracle boldly predicted that its revenue will double in the next three years. This explosive growth trajectory is making it a hot "new Nvidia" in the eyes of investors.

Its remaining performance obligations-RPO, or revenue contracted but not yet recognized-more than tripled in three months to $455 billion, the report showed. Equally surprisingly, Oracle Bone Inscriptions claims that there are more multi-billion-dollar deals under negotiation, which will soon push the number past the $500 billion mark.

This sharp surge in contract revenue is mainly driven by the huge demand for AI computing power from giants such as OpenAI, and has prompted Oracle to make extremely bold predictions for the next few years.Currently, Oracle expects its cloud infrastructure revenue to reach $114 billion in fiscal year 2029, compared to just over $10 billion in the fiscal year ending in May this year.

Boosted by this news, the cumulative increase of 45% this year$Oracle (ORCL) $The stock price soared another 35% on Wednesday, nearly doubling during the year, and the company's market value is close to $950 billion. Companies posted their biggest one-day gain since the 1990s on Wednesday, according to FactSet data.

For short-term bearish investors, you can consider using the bear market spread strategy.

What is a Bear Call Spread Strategy?

A bear call spread is an options strategy in which options traders expect the price of the underlying asset to fall for some time to come, the trader wants to short the underlying and wants to limit trading to a certain risk range.

Specifically, the bear market call spread is achieved by buying a call option at a specific strike price while selling the same number of call options with the same expiration date at a lower strike price.

Specific cases of shorting Oracle

Take shorting Oracle Bone Inscriptions as an example. The current price of Oracle Bone Inscriptions is $328. Assuming that investors expect it to fall to around 300 on August 15th, investors can use the bear market spread strategy to short Oracle Bone Inscriptions at this time.

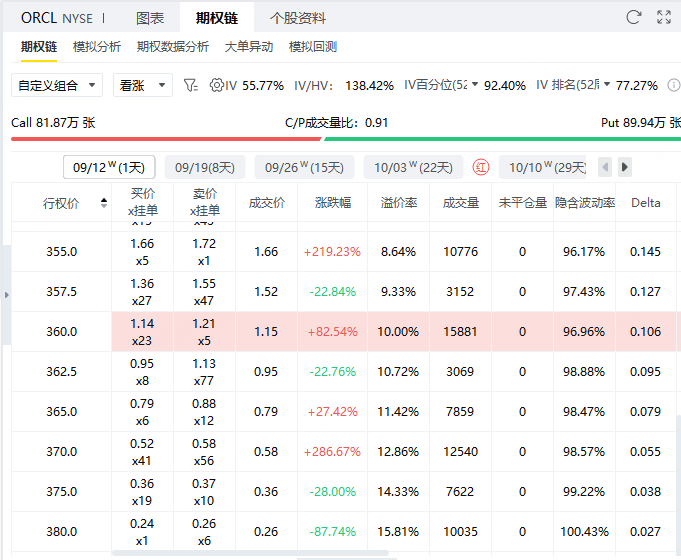

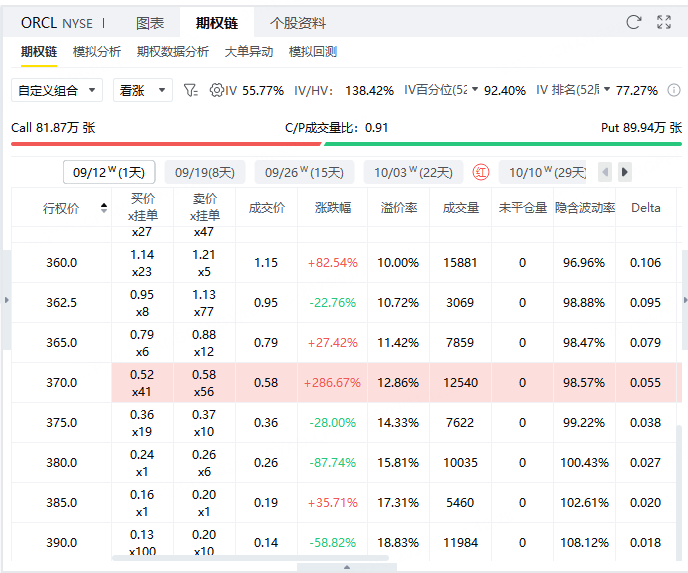

Step 1: Sell the call option with an exercise price of 360 expiring on September 12 and get a $115 premium.

Step 2: Buy a call option with the same expiration date and an exercise price of 370, which costs $58 premium, and the bear market spread is established.

STRATEGYTake shorting Oracle (symbol: ORCL) as an example, the current stock price is $328. Assuming that investors do not expect it to rise sharply before September 12, and may even fall back to around $300, they can consider using the Bear Call Spread strategy to establish a bearish position.

Strategy Building

Step 1: Sell a Call option (Call) with an exercise price of $360 expiring on September 12, 2024, and get premium $115

Step 2: Buy a Call option (Call) with the same expiration date and an exercise price of $370 and pay premium $58

Premium Net RevenueTotal income = Put option premium (115)-Call option premium (58) =$57

PROFIT AND LOSS

Maximum profit: If ORCL's stock price is below $360 at expiration, neither option is exercised, and the investor retains all premium income → Maximum profit = $57

Maximum loss: When the stock price is higher than $370 at expiration, both options are exercised, and the loss is the difference between the two strikes minus net income → Maximum loss = (370-360) × 100-57 = $943

Break-even point: When the stock price reaches $360 + (net income ÷ 100) at expiration → break-even point = 360 + (57 ÷ 100) =US $360.57

Strategy SummaryThis bear spread strategy is suitable for investors with a bearish or volatile bearish view on ORCL. If the stock price falls below $360 at expiration, the maximum gain can be $57; If the stock price rises above $370, the maximum loss is $943; The breakeven point is roughly around $360.57.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.