DocuSign Crushes Q2 Earnings! AI and IAM Fuel Growth

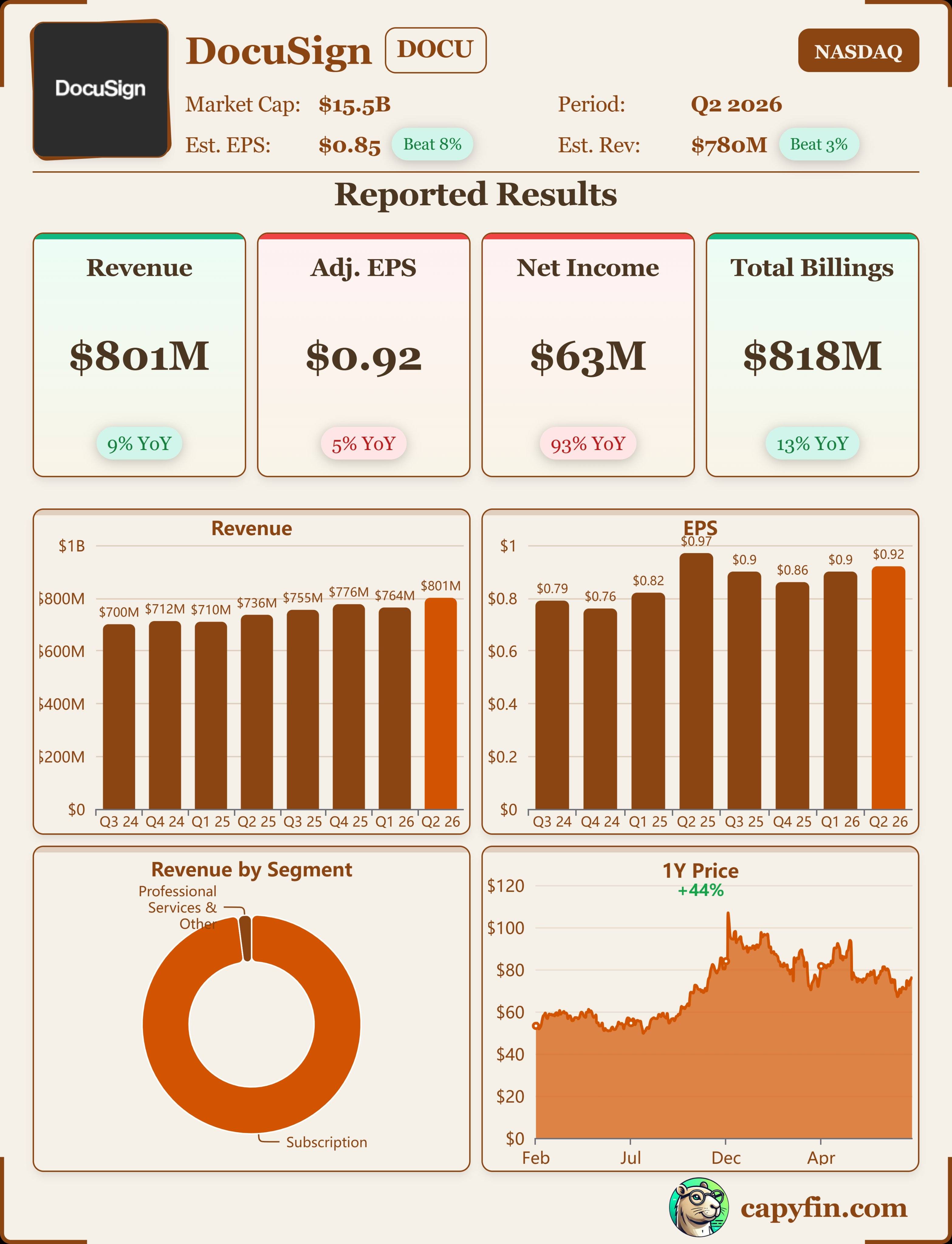

$Docusign(DOCU)$ delivered better-than-expected results for its second fiscal quarter of 2026. Both revenue and billings growth exceeded expectations (buy-side), while non-GAAP EPS also delivered solid performance. Particularly noteworthy were the IAM (Intelligent Agreement Management) business and AI product penetration, reflecting a strategic upgrade from a single electronic signature solution to a broader agreement management platform.

Profitability has continued to contract compared to the same period last year, indicating that expansion investments and competitive pressures persist.

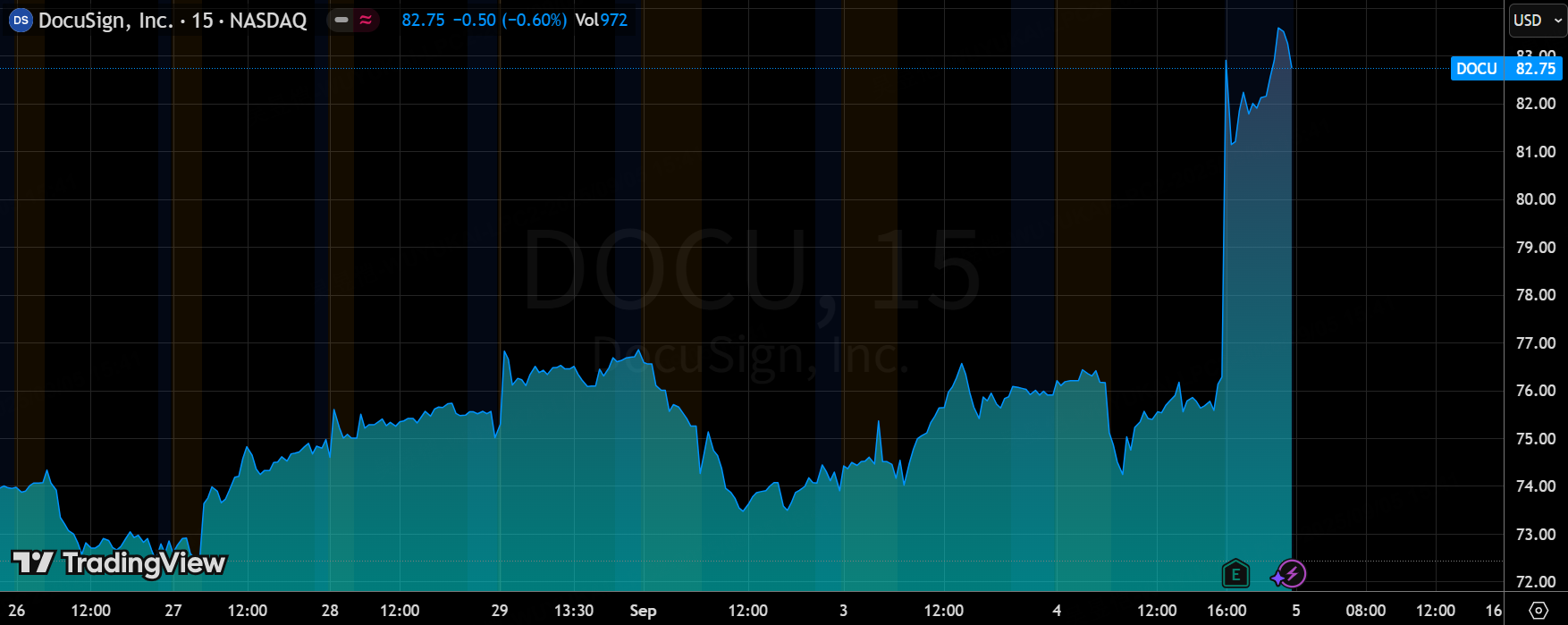

Following the earnings release, the stock rebounded 8% in after-hours trading, reflecting the market's positive response to the better-than-expected results and upward revision of full-year guidance. Overall assessment: This quarter's earnings performance was strong, representing a structural highlight characterized by "surpassing expectations, though profit quality warrants further observation."

Performance Status and Market Feedback

Revenue: Q2 reached $801 million, up approximately 9% year-over-year, exceeding market expectations of $790 million to $795 million. Growth was primarily driven by robust contributions from eSignature, along with incremental pull from CLM and IAM.

Billings: Reached $818 million, marking a 13% year-over-year increase and the strongest growth rate in several quarters. This leading indicator suggests that future revenue momentum is likely to persist.

Profitability: Non-GAAP EPS reached $0.92, exceeding market consensus estimates ($0.85–$0.86) but declining from $0.97 in the same period last year. This indicates that profit growth relies more on cost optimization than on structural improvements in profit margins.

Cash Flow: Free cash flow reached $218 million, marking a year-over-year increase, with operating cash flow continuing to improve. The company also repurchased approximately $200 million worth of shares during the quarter, demonstrating confidence in its valuation.

Market Reaction: Investors responded positively to the better-than-expected earnings and upward revision of full-year guidance, driving the stock price up 6–8% in after-hours trading. Short-term market sentiment remains optimistic.

Earnings Guidance

Q3 Outlook: The company expects revenue to reach $804 million to $808 million, representing a year-over-year growth rate of approximately 7%, continuing its steady growth trajectory.

Full-Year Outlook: Revenue for fiscal year 2026 is projected to reach $3.189–3.20 billion, exceeding the market's previous expectation of $3.16 billion.

Management emphasized: "IAM is the core driver of our year-over-year growth, and AI is a significant tailwind." This statement signals two key points: First, IAM is entering a phase of scaling up, becoming a new growth curve. Second, AI product features are not merely marketing gimmicks but are strategically positioned to enhance efficiency and drive incremental spending. The overall tone is optimistic.

Key Investment Considerations

First, the growth curve is shifting. While eSignature, as a mature business, is experiencing slower growth, IAM (Intelligent Agreement Management) has emerged as the true standout. Management noted that over half of the enterprise sales teams closed IAM-related deals during the quarter, with adoption levels far exceeding market expectations. If IAM can scale rapidly, DocuSign will transition from a "tool company" to a "platform company."

Second, AI serves as a strategic accelerator. Unlike other SaaS companies that merely highlight AI in marketing, DocuSign has embedded AI capabilities into its agreement lifecycle management, boosting efficiency and customer retention. Such AI applications inherently align with customer needs, creating stronger potential for commercialization.

Third, Profit Quality and Capital Returns. Although EPS declined year-over-year, the company maintains robust cash flow and continues to actively repurchase shares. This demonstrates its strategic choice to "return cash to shareholders while continuing to invest in new growth drivers." This balanced approach may imply short-term pressure on profit margins but enhances long-term growth potential.

The risk lies in the fact that the IAM market remains in its infancy, with high customer education costs. Simultaneously, whether AI can establish a lasting competitive barrier depends on product iteration speed and competitive dynamics. If market expectations for IAM/AI penetration prove overly optimistic, future volatility may ensue.

Valuation Summary

Overall, this quarter's earnings report demonstrates growth exceeding expectations, profitability under pressure but cash flow remaining robust. DocuSign's current P/E ratio stands at only around 14 times, representing a significant discount compared to the SaaS industry average. The market may still be "underestimating the platform potential of IAM+AI."

From a valuation perspective:

If IAM penetration rates continue to materialize, DocuSign is poised for valuation expansion.

If profitability cannot be restored, the market may continue to apply a discount to "value-oriented SaaS."

We believe that the current price level remains suitable for medium-to-long-term observation and positioning, particularly for investors who are optimistic about protocol management and the implementation of AI scenarios.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·09-22US mortgage refinance market is taking offLikeReport

- Mortimer Arthur·09-22this is going up due to refinance mortgage demand in USLikeReport

- poppii·09-11Exciting growth! 🚀LikeReport