Microsoft’s Dirty Secret: High Demand Is Crushing Its Data Centers (And Investors Love It)

$Microsoft(MSFT)$ FY2025 fourth quarter (25Q2) revenue of $76.4 billion, an increase of 17% year-on-year, a significant growth rate, reflecting the company's overall business vitality.Among them, Azure grew rapidly As a core cloud service, Azure revenue grew 39% year-on-year, far exceeding the overall revenue growth rate, and was an important engine driving Microsoft's growth, reflecting its strong competitiveness in the cloud services market.

The annual milestone exceeded $75 billion, and cloud business revenue even exceeded $168 billion for the first time, up 23% year-on-year

The market was previously concerned about Microsoft's ability to monetize its AI products.This quarter's earnings report shows rapid growth in Copilot and Fabric responding to this concern and market expectations may be revised upwards.This is a further indication of Azure growth sustainability, after the market questioned whether Azure growth was reliant on migration drivers.Addressing high capex raises gross margin concerns.Management emphasized on matching investment with $368 billion RPO and market acceptance.

Performance and market feedback

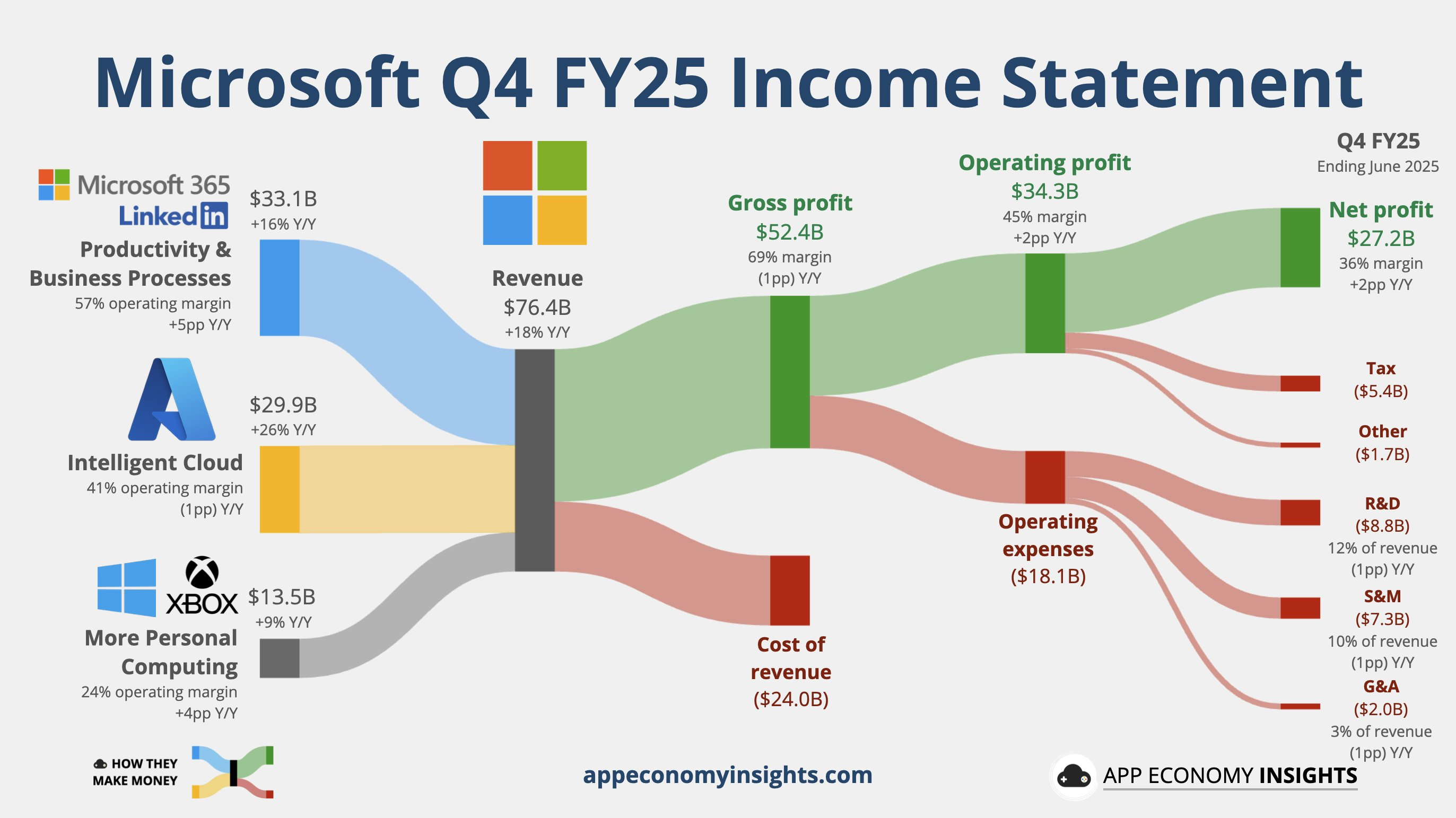

Revenue Exceeds Expectations: Microsoft's Q4 FY2025 total revenue of $76.4 billion was up 18% year-over-year (17% constant currency), exceeding market expectations of ~$75 billion.Microsoft cloud revenues of $46.7 billion, up 27% year-over-year, accounted for 61% of total revenues.

Bright EPS: Diluted EPS of $3.65, up 24% year-over-year (22% constant currency), above analysts' expectations of $3.50, reflecting synergies from cost containment and revenue growth.

Segment performance: $33.1 billion in Productivity & Business Processes revenue, up 16% year-over-year; $29.9 billion in Intelligent Cloud revenue, up 26% year-over-year; and $13.5 billion in More Personal Computing revenue, up 9% year-over-year.

Market reaction: Microsoft shares are expected to rise about 4% after hours following the earnings release, with a $555-$600 price target range, reflecting market optimism about AI and cloud growth.Analysts are high on execution, but concerned about AI startup competition and capex pressure.

Market confidence in Microsoft increased further compared to the previous quarter, with analysts more surprised by the scale of results and a more offensive tone from management.

Investment highlights

Cloud and AI-driven strategy turning point

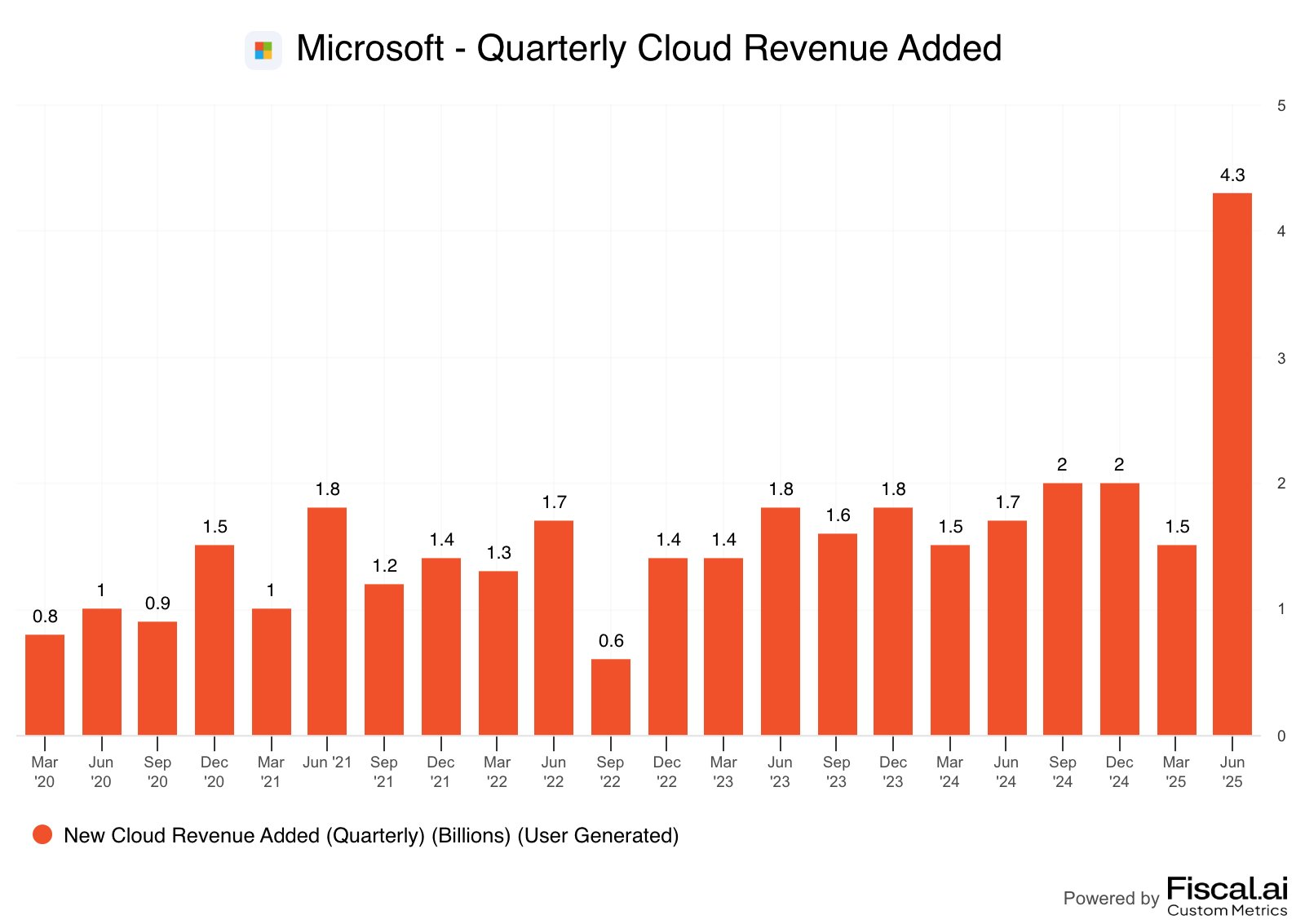

Cloud and AI strategy showed significant results this quarter.Overall cloud revenues were $46.7 billion, +27% year-over-year, with Azure and other cloud services growing 39%, further accelerating from 33% in the previous quarter, and the market was also generally expecting around 34%, and even the more aggressive buyers gold only thought it would be 36%, so this solid over-expansion came as a surprise to the market.

Management noted that Azure's growth came not only from traditional cloud migration, but also benefited from the rapid growth of AI workloads, such as the integration of Azure AI Foundry and OpenAI GPT-4.1 models.

Copilot apps surpassed 100 million monthly active users and AI-enabled monthly active users exceeded 800 million, demonstrating the broad penetration of AI offerings in the enterprise and among consumers.GitHub Copilot users reached 20 million, with 75% quarter-over-quarter growth in enterprise customers, demonstrating strong developer demand for AI tools.Microsoft Fabric revenues grew 55% year-over-year, withover 25,000 customers, making it the fastest-growing database product in the company's history.

Accelerating growth in AI and cloud could trigger a valuation repricing and the market may raise Microsoft's P/E estimate.

Commercial Remaining Performance Obligations (RPO) amounted to $368 billion, an increase of 37 percent year-over-year, of which 35 percent will be converted into revenue over the next 12 months.This metric reflects Microsoft's strong bargaining power and long-term contract stability in the enterprise market. the growth in RPO came primarily from long-term subscription contracts for Azure and Microsoft 365, demonstrating customers' continued reliance on Microsoft's cloud services.

High RPO provides Microsoft with robust revenue visibility and reduces market concerns about macroeconomic volatility (e.g., corporate IT budget compression), potentially supporting a higher valuation multiple.

Balance between capex and gross margins

Microsoft's Q4 capex was $24.2 billion, more than half of which was spent on long-term assets (e.g., datacenter construction) to support AI and cloud infrastructure expansion.Management expects capex growth to slow in FY2026, with an increased share of short-term assets, reflecting flexibility to adjust to demand signals.However, Microsoft cloud gross margin was 69%, down 1 percentage point year-over-year, primarily due to scaled investments in AI infrastructure.

High capex may depress gross margins in the short term, but AI and cloud infrastructure leadership will solidify Microsoft's competitive barriers in the long term.The market needs to weigh short-term margin pressure against long-term growth potential.

Capacity constraints and competitive risks

Management admits that demand for cloud and AI workloads continues to outpace supply, and capacity constraints are expected to continue through the first half of fiscal 2026.This could lead to delivery delays or customer churn risk.Additionally, analysts are concerned about the dual role of large AI startups (e.g., OpenAI) as customers and potential competitors.Nadella responded that Microsoft is responding to the competition through a platformization strategy (e.g., support for headline apps) and ecosystem building.

Capacity constraints may limit revenue growth potential in the short term, while competition from AI startups may erode some of Microsoft's market share.The market needs to keep a close eye on the sustainability of Microsoft's dominant position in the AI ecosystem.

Management Guidance and Market Expectations

Microsoft's guidance for FY2026 is optimistic, with double-digit revenue and operating profit growth expected and operating margins stable.Q1 guidance indicates that FX factors will add 2 percentage points to revenue growth, capex is over $30 billion, and Microsoft cloud gross margin is expected to be 67%.Management's confidence in AI and cloud demand, as well as investments in cutting-edge technologies such as quantum computing, reinforce Microsoft's image as a technology leader.

Optimistic guidance could push the market to further raise FY2026 estimates, but capacity constraints and declining gross margins could trigger caution among some investors.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-08-01MSFT从52周高点518美元跳空上涨,会再次触及该价位吗?有什么真相可以填补空白吗?LikeReport

- Venus Reade·2025-08-01$560 high back down to a $532 low ........why?LikeReport

- flixzy·2025-07-31Great growth! 🌟LikeReport