Techs-Review: Meme Stock Mania Hits 88% Bubble Gauge! Meta/MSFT Earnings Coming!

Market focus this week centers on macro policy events (e.g., Wednesday's FOMC resolution and Thursday's PCE data) as well as the intensive tech giant earnings season.

Overall, the market environment remains supportive, but seasonal pressures and valuation bubble risks should not be ignored.The AI supercycle continues to provide momentum, while investors need to be wary of a potential pullback triggered by the historically weak August period.The following analysis is based on reported data and presents core trends in an opinion-driven manner.

90-day tariff extension = reprieve?Three big numbers will rewrite the script!

The current market environment is generally favorable, driven by strong corporate earnings, moderate inflation (temporarily), and elevated policy certainty.A 15% tariff deal between the US and Europe has eased trade uncertainty, with liquidity supported by potential monetary easing from the Fed (M2 expansion expected.) The AI supercycle shows no signs of slowing down, driving continued leadership in the semiconductor and cloud computing sectors.Meanwhile, oil prices and bond yields remain low, the real estate market is showing early signs of a rebound, and a 90-day tariff extension further cushions external shocks.

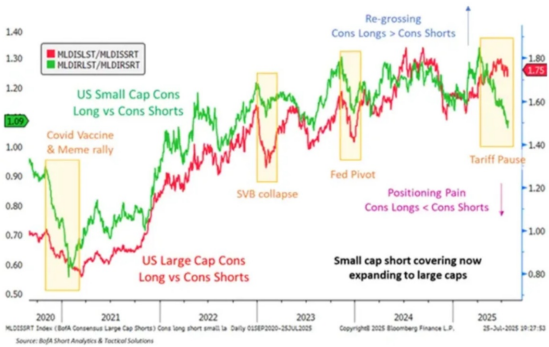

However, risk factors are building up: market valuations are at historically high levels, with signs of bubbles in areas such as meme stocks coming to the fore; and the transmission of tariffs to inflation has yet to fully emerge, potentially exacerbating the Fed's policy dilemma in the second half of the year.Key events this week include Wednesday's FOMC meeting (expected to leave rates unchanged, but watch for dovish signals), Thursday's June PCE data (a core inflation measure), and Friday's July nonfarm payrolls report, which will validate inflation control and economic resilience.Notably, small-cap stocks continue to lag large-cap performance, reflecting a divergence in risk appetite.This is visualized by the following charts showing the relative weakness of small caps:

Seasonal Risk - High probability of pullback during historically weak August period

Historical data strongly suggests that August could be a high-risk window for a market pullback.Since 1950, August returns have averaged just 0.02% and the probability of an August decline is significantly higher after hitting a 12-month high in July (past cases show 7 wins and 21 losses with an average decline of 0.84%).August performance during the President's second term is even worse: an average loss of 3.4% with no gains (cf. Eisenhower to Trump period data).The semiconductor sector is particularly vulnerable, with August-September being its traditional period of weakness, and the overlay of the EU semiconductor tariffs (Section 232) taking effect on August 1 is likely to exacerbate volatility.While the SOX is temporarily ignoring the impact, the tariff's impact on European semiconductors is beginning to be felt.The following charts capture the specific dynamics of this tariff impact:

Market Sentiment - Signs of Caution as the Bubble Heats Up

Market heat has entered the danger zone as speculative trading indicator shows currently at the historical 88% centile, much higher than normal.Volume share of Meme stocks has spiked, reflecting a surge in retail speculative activity, which could amplify short-term volatility.Meanwhile, the RSI indicator is showing negative divergence at higher levels, suggesting that upside momentum is weakening and risks of a pullback are accumulating.Goldman Sachs data highlights this bubble dynamic: the 88% tertile of the speculative trading component is not sufficient, suggesting that the bubble could inflate further.

The chart below quantifies speculative trading heat, combined with volume share data

Corporate Earnings Trends, Divergence at a High Bar

Last week's earnings season revealed a key trend: the market reacted highly harshly to earnings beaters, with 80% of companies opening lower on the first day after earnings, down an average of 3.6%.This suggests that investors are eager to take profits and that valuations are fully priced in.For example, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ shares are only marginally higher despite beating earnings estimates, and $Netflix(NFLX)$ s down 8% after solid numbers.The software and semiconductor sectors were particularly sensitive: $ServiceNow(NOW)$ and $IBM(IBM)$ sold off on margin issues, while semiconductors such as $STMicroelectronics NV(STM)$ and $Texas Instruments(TXN)$ tumbled after missing high expectations.This environment requires investors to prioritize position structure and market sentiment over pure earnings numbers.

With earnings reports galore this week, reactionary patterns are likely to continue, and lower single trade sizes are recommended to manage volatility risk.

This week's earnings focus: AI catalysts and risks for tech giants

This week's earnings reports will reshape the AI and cloud computing narrative with a focus on the following companies:

$Meta Platforms, Inc.(META)$ ( Wednesday after-hours): expects Q2 revenue of $45.5-46B (beating guidance), with AI ROI a key point to watch.Despite concerns about Zuckerberg's spending (e.g., AI team hiring), historical data shows that its opex is typically below guidance (6/7 years) and the potential for AI cost savings is huge (half of coding done by AI by 2026).If results are strong, it could drive a narrative shift to AI leader status.

$Amazon.com(AMZN)$ (Thursday after-hours): centers on whether AWS growth accelerates (17% expected in Q2), could boost shares if management signals "acceleration".Retail may beat expectations (3p data suggests 11% Q2 growth), but high valuation (11-15x EBITDA) requires perfect performance.

$Cloudflare, Inc.(NET)$ (Thursday's after-hours): as an AI inference pure-player, a $100M+ large order drove shares up 50% last quarter.Watch for another similar large order this week to support 30%+ revenue growth, but valuation is already at 17x sales and bubble risk is high.

$Reddit(RDDT)$ (Thursday's after-hours): ad revenue may beat estimates (Q2 bogey 450M+ vs. Street estimate of 425M), user growth is the bottleneck.If July data improves, AI overview to help the narrative could trigger short covering.

$PayPal(PYPL)$ Branded payments growth (Q2 expected 5-6%) could drive valuation repair (current 13x forward PE to 15-16x+) if it accelerates to HSD, benefiting from Braintree contract renegotiation ending.

Industry catalyst: accelerating AI infrastructure investment

AI super-cycle is still the core driver, Google, Meta and Oracle to increase data center investment (such as Meta's Prometheus project), the policy side also provides support (the U.S. "AI leadership" strategy, GPU depreciation reform).These investments will benefit semiconductor companies such as $NVIDIA(NVDA)$ (August earnings).Cloud demand recovery signals are also key: this week's earnings (e.g., META, $Microsoft(MSFT)$ ) will validate broad-based cloud growth if they show AWS or Azure acceleration. AI-native apps (e.g., Anthropic's 4B ARR) and model releases (ChatGPT 5, Grok 4) are further pushing the heat up, but the actual ROI numbers will need to be watched to avoid the bubble bursting.

Investment strategy advice: balance opportunities with seasonal defense

Short-term strategy should be cautious: seasonal risks overlaid with high valuations in August, suggest controlling positions and prioritizing post-earnings volatility opportunities (e.g., potential buy points in Meta and Amazon).Long-term mainstays remain focused on AI infrastructure (semiconductors, cloud computing) and advertising platforms (Meta, $Reddit(RDDT)$ ), utilizing pullbacks to add to core holdings.

Hedging options include defensive sectors ( $Consumer Staples Select Sector SPDR Fund(XLP)$ ) or $Cboe Volatility Index(VIX)$ related instruments for potential pullbacks.Overall, the market remains supportive, but investors need to "fasten their seatbelts" and stay tuned to this week's data and earnings guidance for dynamic adjustments.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- poppii·2025-07-28Great insights1Report