The interest rate cut cycle restarts! Time to Buy Gold?

As the market widely expects the Federal Reserve to restart the interest rate cut cycle in the coming months, the US Dollar Index continues to come under pressure, hitting a new low since February 2022, providing solid support for the interest-free asset gold. At the same time, the uncertainty surrounding US President Trump's tariff policy has also boosted risk aversion, further pushing gold prices to rebound from nearly a month's low.

For investors who are bullish on gold, they can use option strategies to go long on gold.

From a macro perspective, the latest PCE data released by the United States showed an unexpected decline in personal consumption in May, providing policy space for the Federal Reserve to further ease. According to Reuters, Trump intensively released hawkish remarks before the tariff assessment on July 9th, and did not rule out the possibility of raising some tariff rates from 10% to 50%; A White House spokesman said that if the countries concerned did not conduct "goodwill negotiations", Trump would negotiate with the trade team to raise the tax rate range. This series of news prompted the market's aversion to heat up, and gold was supported by capital inflows.

In addition, the expectation of easing fiscal policy also continues to put pressure on the dollar. The U.S. Senate passed the procedural vote of "a big and beautiful bill" by a narrow margin. If implemented, it will increase the federal deficit by about $3.3 trillion in the next decade, leaving the U.S. dollar in a passive defensive state.

From a medium-term perspective, the main driving logic of gold still lies in the continued fulfillment of expectations of double easing of U.S. monetary and fiscal policies. Analysts believe that if interest rates are cut as scheduled in September and the fiscal deficit pressure cannot be alleviated, the upward trend of gold will remain sustainable. From a cyclical perspective, gold may be brewing a new stage of upward trend channel, keeping the long-term preference unchanged in the medium and long term.

For investors who want to get involved in gold on dips, you can consider selling put options to go long gold

Options Strategy: Using Put Options to Go Long Gold

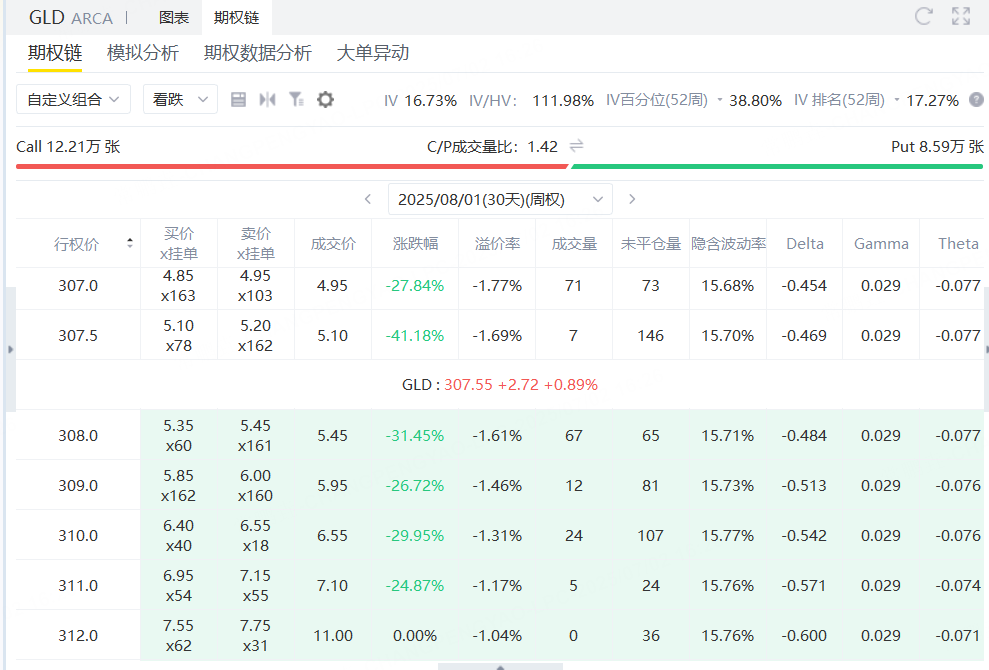

In the face of the strong trend of gold, we can use the option strategy to make efficient long trading. Current$SPDR Gold ETF (GLD) $The current price is 307dollar, we can sellExpires August 1, 2025, exercise price $308, premium $545Put Option to go long gold.

The current gold price is$307, we chose to go long gold by selling a Put Option with an exercise price of $308 and a premium of $545 expiring on August 1, 2025.

This is a typicalSell Put option (sell Put) strategy, used to earn premium gains in bullish or volatile markets, while indirectly establishing long positions at a lower cost.

Maximum benefit: If the gold price is higher than $308 at expiration, the option will not be exercised and the investor can retain all premium gains. →Maximum gain = premium revenue = $545

Break-even point: The breakeven point of this strategy at expiration is: →308-5.45 = $302.55As long as the gold price is higher thanUS $302.55, investors will receive positive returns.

Maximum loss: If the gold price falls to $0 on the expiration date, the maximum loss is the strike price minus premium revenue. →Maximum loss = 308-5.45 = $302.55 (per share)That is, the maximum loss per contractUS $30,255。

sum up

In the face of Trump's aggressive policies, the unstable global situation, and the overweight of central banks, gold has become a real safe haven tool. Using the options market, we can efficiently go long gold while controlling risks through the strategy of selling put options. This is not only a smart way of trading, but also a sound investment choice that conforms to market trends.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.