Broadcom's financial report is here, what should I do with options?

Broadcom will release its results for the second fiscal quarter of 2025 after the U.S. stock market closes on June 5, 2025, Eastern Time. According to general institutional forecasts, Broadcom will achieve operating income of US $14.975 billion in the second fiscal quarter of 2025, a year-on-year increase of 19.92%. Earnings per share are US $0.959, a year-on-year increase of 116.9%.

Since the beginning of this year, Broadcom's stock price has experienced a roller coaster ride. In April, affected by tariffs and other factors, the stock price once fell to US $138.1, and then started a strong rebound. It has risen by more than 70% in the past two months. Today, it rose by more than 2.5% to break through the previous high and set a record high!

Looking forward to this financial report, investors will focus on:

Will the growth momentum of the semiconductor business continue?;

Software Business (VMware) Integration and Subscription Transformation Results

In terms of overall performance, Citi has given its own guidance and logic:

Broadcom's sales in the second quarter of fiscal year 2025 are expected to exceed the market consensus and the bank's estimate of US $15 billion (a quarter-on-quarter increase of 1%), mainly due to the increase in AI sales;

Gross profit margin (including stock-based compensation costs) is expected to be 77.5%, slightly lower than the market consensus of 77.9%, due to the impact of product mix;

Earnings per share estimates (EPS) of $1.36 are slightly above the consensus of $1.33, helped by a lower tax burden.

What's happening with Broadcom in the options market

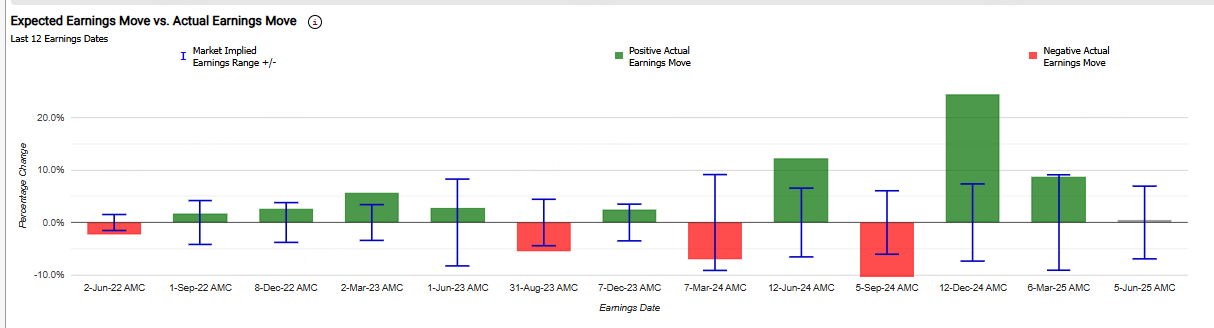

Currently, Broadcom's implied changes are±6.9%, indicating that the options market is betting on its single-day rise and fall after its performance6.9%。 The post-earnings gains and losses of AVGO in the last six quarters were-7%, 12.3%,-10.4%, 24.4%, and 8.6% respectively.

What is the Wide Straddle Strategy?

In long wide straddle options, investors buy both out-of-the-money call options and out-of-the-money put options. The strike price of a call option is higher than the current market price of the underlying asset, while the strike price of a put option is lower than the market price of the underlying asset. This strategy has significant profit potential because the call option theoretically has unlimited upside if the price of the underlying asset rises, while the put option can make a profit if the price of the underlying asset falls. The risk of the trade is limited to the premium paid for these two options.

An investor shorting a wide straddle sells an out-of-the-money put and an out-of-the-money call at the same time. This approach is a neutral strategy with limited profit potential. Shorting a wide straddle option is profitable when the underlying stock price is trading within a narrow range between break-even points. The maximum profit is equal to the premium obtained by selling two options minus the transaction cost.

AVGO Short Wide Straddle Strategy Case

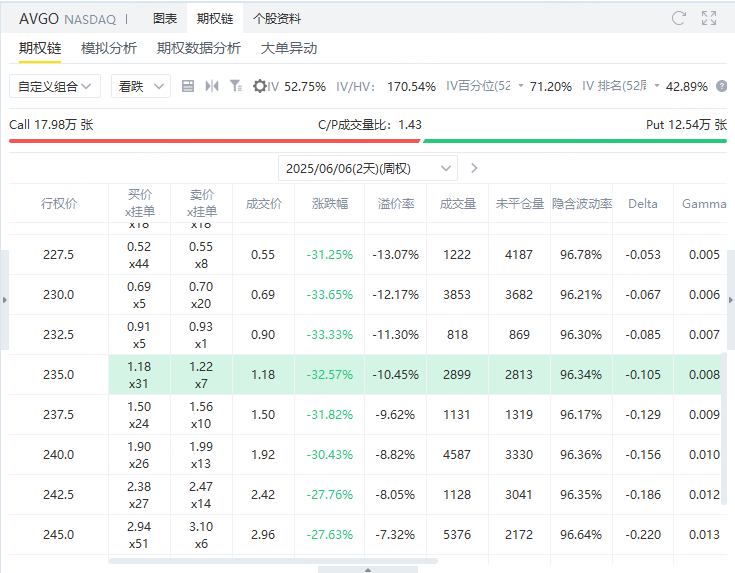

Stock AVGO is currently trading at around $261. Investors can implement the short wide straddle strategy by:

In the upside direction, investors can sell a call option with an exercise price of $290 expiring on June 6 and get a premium of $129.

In the downside direction, investors can sell a put option with an expiration on June 6 and an exercise price of $235, and get a premium of $118.

Currently, the market price of AVGO (Broadcom) stock is around $261. If investors believe that AVGO will not experience violent fluctuations in the short term, they can consider adopting a short wide straddle option strategy to earn premium income.

Policy Structure:

Upward direction: Sell one expiring on June 6, 2024, with an exercise price of$290Call option (Call), obtain premium$129。

Downward direction: Sell one expiring on June 6, 2024, with an exercise price of$235Put option (Put), obtain premium$118。

Total premium revenue:

$129 (Call) + $118 (Put) =$247

This part of premium constitutes the largest part of the strategyPotential benefits, when AVGO's stock price remains between $235 and $290 at expiration, both options expire and invalidate, allowing investors to retain all premium income.

Profit and loss analysis:

Maximum benefit: $247 Condition: AVGO was between $235 and $290 at the close of trading on June 6.

Break-even point:

Downside: $235-$2.47 ≈$232.53

Upside: $290 + $2.47 ≈$292.47

Loss area: If AVGO is lower than $232.53 or higher than $292.47 at expiration, investors will face unlimited losses (theoretically), because naked options are sold, and large fluctuations in stock prices will lead to large losses.

Policy applicable scenarios:

This strategy applies to investor expectationsLimited stock price volatility in the short termThe situation. For example, when volatility is expected to converge after the earnings report is released, or when the overall market sentiment is stable. Investors take directional risks in exchange for decaying returns on the time value of options.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.