ZETA: Post-Earnings Plunge? AdTech Revolution Trades at 9x 2028 EBITDA

$Zeta Global Holdings Corp.(ZETA)$ experienced huge volatility after Q4 earnings, from +20% to -12% at one point, and investors were deeply divided on it.

As one of the companies on the cusp of AI advertising services, its AI-driven efficiency improvement and scarcity of growth attribute support, the long-term logic has not changed, but the short-selling report brought about by the risk of data compliance and short-term market sentiment perturbation still need to be vigilant.The current low valuation or layout window.

Investment Highlights

Strong financial performance and growth resilience

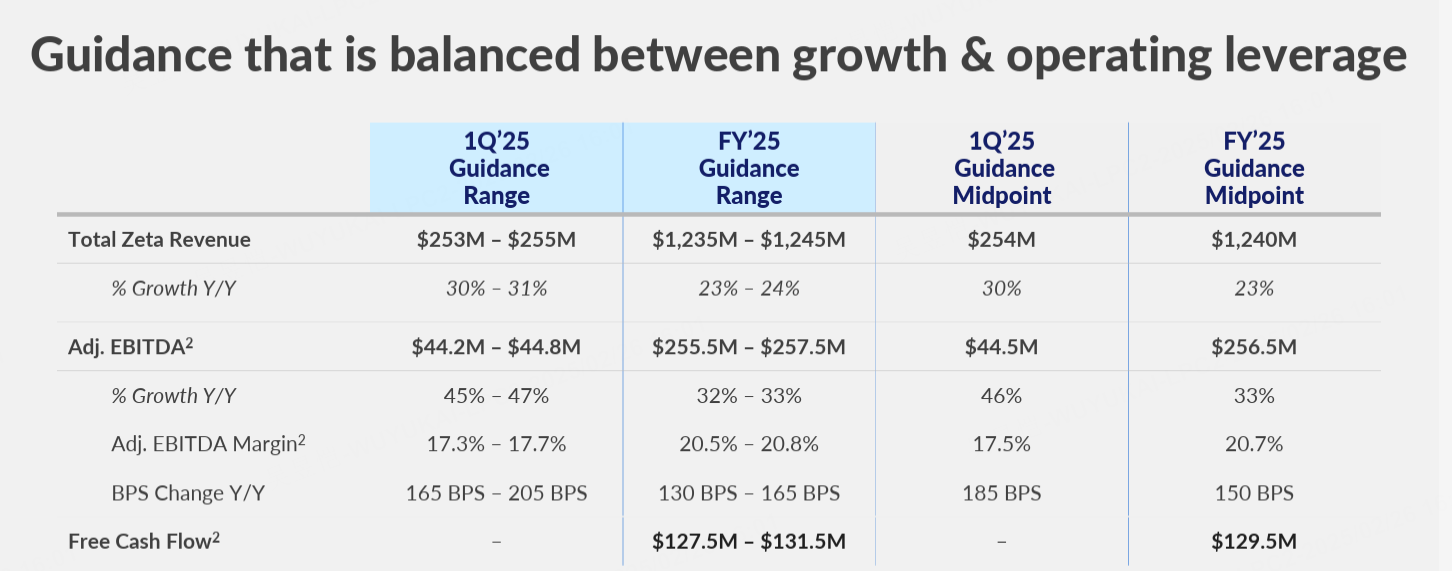

Revenue growth ahead of expectations: 4Q24 revenue growth of 50% y/y (7% ahead of guidance) and 31% growth excluding the impact of the election and acquisitions; 14 consecutive quarters of outperformance (Beat & Raise).

Profitability improvement: 4Q24 EBITDA margin of 22.4%, a small beat; 2028 EBITDA target of $525 million (25% margin), implied 3-year CAGR of 28%.

Long-term growth guidance is clear: 2025 revenue guidance of 23% year-over-year (21% organic growth) and 2028 target revenue of $2.1 billion (3-year CAGR 20%), significantly ahead of the market's previous expectations.

Buyback strategy and scarcity support valuation

Accelerated buybacks: 4Q24 buybacks of $31 million (3x of the previous three quarters), commitment to use more than 50% of future free cash flow for buybacks, saying "no better use of cash".

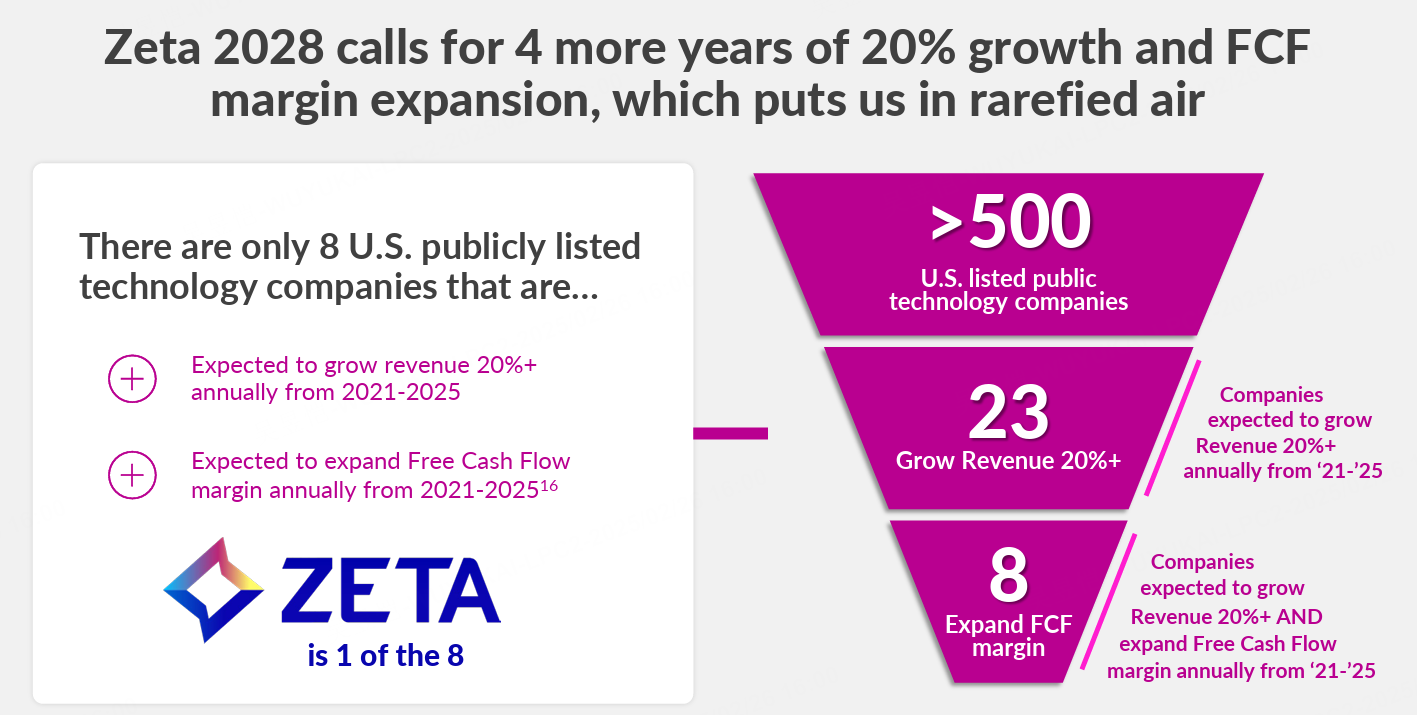

Scarce underlying attributes: the company emphasized that there are only 7 companies in the U.S. stock market that will achieve 20%+ growth in 2021-2025 consecutively and FCF margins continue to improve, and Zeta is one of them, and expects to continue this trend in 2026-2028.

AI strategy drives efficiency and revenue growth

Seven years of AI investment has entered the harvesting period: AI has been deeply embedded into the core functions of the platform, covering productivity improvement (automated marketing), personalized recommendation (precise audience insights) and precise interaction (conversational marketing tools).

Innovative AI agent applications, such as "Virtual Data Scientist" for automatic data alignment and "Creative Agent" for cross-channel content optimization, have boosted customer consumption by more than 40% year-on-year (accounting for more than half of revenue).

Advantageous business model: AI capabilities are not charged separately, but are realized through increased platform usage, forming a positive cycle of revenue and efficiency.

Management confidence and response to short-selling report

Refuted short-selling skepticism: Emphasized that no clients were lost due to short-selling report, as evidenced by 50% growth in 4Q; compliance costs increased by only $2 million (audit fees).

Conservative guidance: 1Q25 guidance up 20% excluding the election, management said it was "a continuation of the conservative style of the past", but full year and 2028 guidance were raised, demonstrating long term confidence.

Performance and Market Feedback

Share price volatility and market skepticism

Roller coaster ride: shares were up 20% after earnings, then retreated to -12%, reflecting the market's short-term disappointment with 1Q25 guidance (growth was flat YoY excluding the election).

Core points of concern:

Data compliance risk: Some investors remain concerned about the impact of the regulatory environment on the use of marketing data.

Management's expectation management: high-profile increase in holdings, accelerated buybacks, and early release of earnings before results, which has been questioned as "Sell the News".

Sector sentiment drag: Retail stocks (e.g., HIMS, NBIS) reported negative earnings results, affecting sector sentiment, while AdTech peers (APP, PLTR) also retreated.

Valuation Controversy and Opportunities

Current valuation: corresponds to 18x 2025 EBITDA and 9x 2028, significantly lower than similar Rule 40 (revenue growth + margins ≥40%) AdTech companies.

Focus of divergence: the market is more concerned about the flat 1Q25 growth rate in the short term, while underestimating the long-term AI-enabled platform effect and the potential of buybacks to enrich the value per share.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- M.Lwin·2025-02-27Thanks for reasonable information.LikeReport

- EraGrowth_Wealth·2025-02-26very insightful analysis[Miser]LikeReport

- JoBloor·2025-02-26激动人心的旅程LikeReport

- KevinKelly·2025-02-26LOAD UPLikeReport

- Tiger2023·2025-02-26Good analysisLikeReport