PLTR's High Valuation: A Recipe for Disaster?

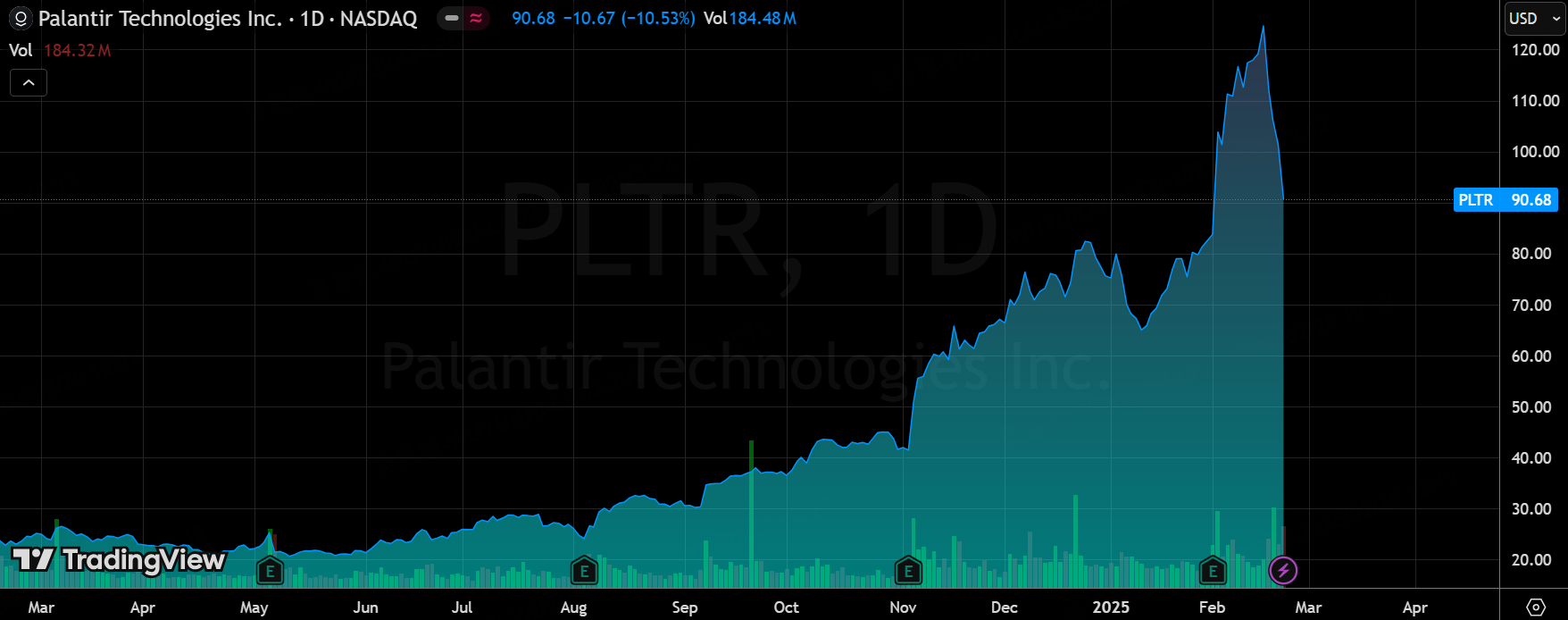

$Palantir Technologies Inc.(PLTR)$ plunged 27% in four trading days, which makes sense and is unexpected.

But what is unexpected is why it fell NOW?

A concerted sell-off/short-sale trade by investors who are pessimistic about their future share price due to high valuations, etc;

Unrelated to valuation, market trends are affected by the actions of influential investors;

Currently Palantir got both.

Valuation Estimates

Current valuation: market capitalization of $212.677 billion, FY24 revenue of $2.87 billion, and a TTM price-to-sales ratio of 74x, which compares favorably to peers, and is well above Bloomberg Peers' 10.6x and GICS' peer group's 12.8x;

The 2025 expected price-to-sales ratio of 63x remains well above the industry average of 11.75x;

P/E ratio: TTM PE reaches 223x, higher than the industry average of 43x; 2025 expected PE is 166x, higher than the industry average of 37x.

Growth

Expected 2025 quarterly revenue growth between 28-36%, of which the main increment is still in the U.S., about 3 pct higher than the overall, of which the growth rate of commercial orders between 32-37%, is also slightly higher than the average; However, it should be noted that these expectations were previously set by the investment bank in the U.S. Department of Defense to cut the budget before the "set".However, it should be noted that these expectations were previously set by investment banks before the "U.S. Department of Defense budget cuts" and did not take into account government factors such as the "end of the Russian-Ukrainian war" and the potential weakening of the "Israeli-Palestinian conflict", while the commercial side may be more important.

Profits have also leveled off, with adjusted EBIT margins in the 41-43% range, so profits may be growing faster.

Overall, the company has not achieved the kind of growth that would historically support a "high double-digit" price-to-sales ratio (at least a triple-digit growth rate) and a triple-digit price-to-earnings ratio.

At the same time, the company's executives have been reducing their holdings recently, with relatively high intensity and volume, and even Peter Thiel sold a lot of PLTR stock in September last year (although he may have sold out).

PLTR, on the other hand, is a DPO company with relatively ample liquidity overall, and the chips that should have been exchanged have pretty much been exchanged over the past four years.

Fundamental Trends

Department of Defense cut orders.Judging by Trump's desire to end Russia-Ukraine as soon as possible, as well as his strong treatment of the Palestinians, and the recent further boost of Elon Musk's DOGE, there is a great deal of potential for the growth of government orders, a trend that could continue for even four years;

Commercialization Competition.The core engine AIP in the LLM support is indeed for the commercialization of complex data analytics played a great promotion; the subsequent launch of the integration of ERP, MES, PLC and other systems of the Warp Speed platform, may face vertical industry SaaS companies stronger competition, including but not limited to the traditional ERP vendors (such as $SAP SE(SAP)$ $Oracle(ORCL)$ ), emerging companies (e.g. $C3.ai, Inc.(AI)$ )

Institutional Trends

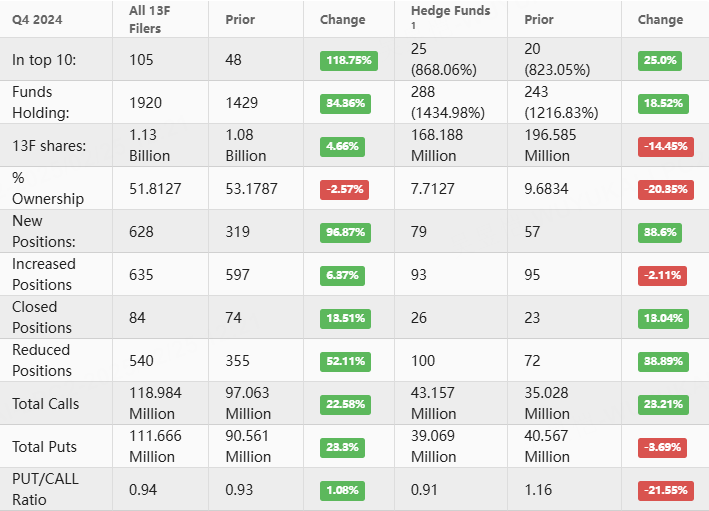

The most recent issue of the 13F shows some divergence in the positions of different institutions in PLTR.

Overall institutional holdings of PLTR increased by 34%, but the number of institutional positions increased by just 4%; with hedge fund HF's (more active) position increasing by 19% of institutions, but the number of positions -14%.The passive fund positions are more likely to come from Portfolio weighting shifts and (I'm guessing) an increase in demand for derivatives, and non-institutional retail orders;

The number of institutions opening new positions nearly doubled in Q4 (97%), with HF adding 39%; those adding positions grew by 6% (HF -2%), while those subtracting positions grew by 52% (HF +39%), suggesting considerable divergence among institutions as well;

In terms of options, the overall PUT/CALL Ratio of institutions did not change much (0.94), but the PUT/CALL Ratio of HF dropped to 0.91 from 1.16 in the previous quarter, with a lower need for position adjustment and hedging.

The Top 10 PLTR institutional positions even featured quantitative institutions with very fast position changes (SIG, etc.), i.e., not LongOnly money making further speculation.

Individual Sentiment

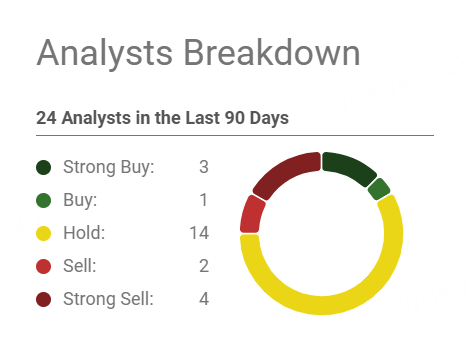

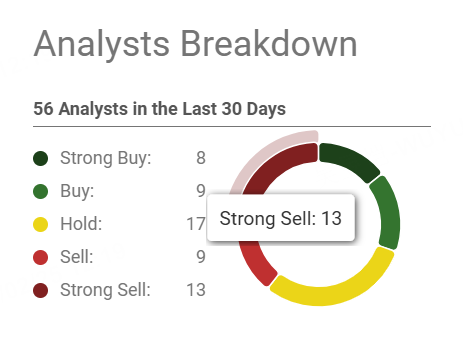

SA's Analysts are a bit more pessimistic than Wall Street as a whole, but Wall Street as a whole is also mostly "Hold", which is really not friendly to it at current valuations and market sentiment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Enid Bertha·2025-02-25Time to buy more. This technology is the best in it's class. ^0% commercial and 40 federal and all departments of the government need upgrades to their technologyLikeReport

- Merle Ted·2025-02-25We could see a re-trace to around 50-60 and then personally I'll be loading up as this company is going to be the winner in AI military defense.LikeReport

- kookiz·2025-02-25High risk hereLikeReport