Squid Game 2 Boosts Netflix: 2025 Forecast to Skyrocket!

Summary

Two important "beat" factors behind $Netflix(NFLX)$ earnings beat

Bigger-than-expected subscriber numbers.Nifty, which last announced this figure, fully surprised investors by exceeding expectations by 107%, which is equivalent to a doubling of the market consensus underestimation, with the greatest degree of underestimation in North America and Latin America.There may also be Q3 results after the announcement to be in North America and Latin America to increase the factor.In addition, the market underestimated the global popularity of The Squid Game 2, a commercialized series that "makes money" and is not necessarily an award-winning show, despite the fact that the show is not yet finished and has been conservatively criticized and not highly rated.

Management's thinking is clear, and its long-term goals are well defined.The company has successfully spread from the previous "subscription growth" streaming story to the entire pan-entertainment business, including advertising, sports, games, etc. The TAM of this segment could reach $650 billion.This part of the TAM can reach 650 billion dollars.The current implementation of the advertising business shows good results.

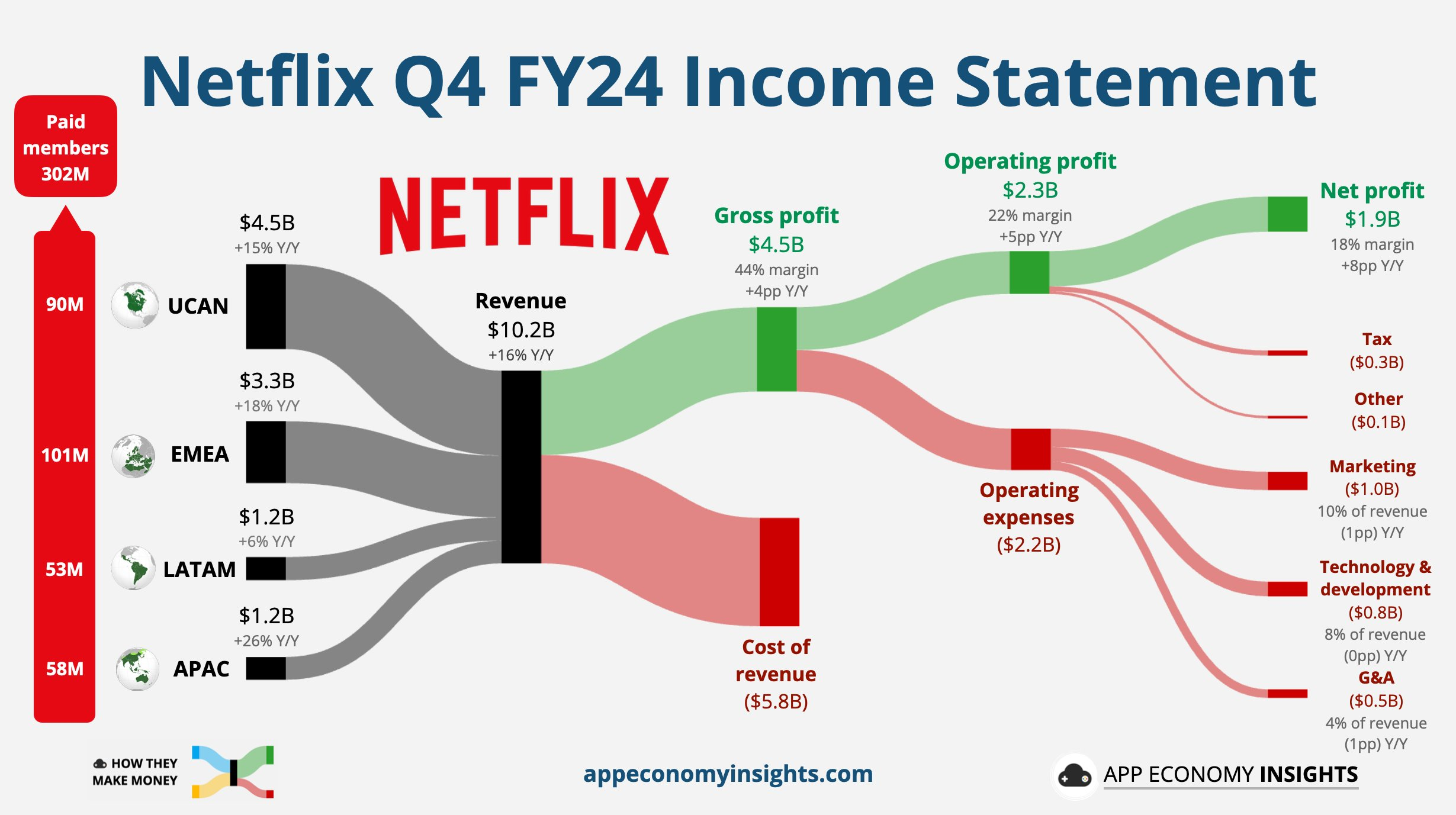

Q4 Performance Highlights

Strong subscriber growth: in Q4 2024, Netflix added 18.91 million net subscribers, well ahead of market expectations of 9.18 million.Thanks to the pull of popular content such as "Squid Game 2" and NFL games.Starting from 2025, Netflix will no longer announce the number of subscribers with ARM. given the continuation of popular content in Q4 and the content reserve in Q1, it is expected that there will still be around 6 million subscribers added in Q1.

The incremental advertising business shows

Netflix officially launched its advertising business in 2024, with impressive results on the much-anticipated ad revenue monetization metrics.Ad-containing packages accounted for more than 55% of subscriber registrations in the countries and regions where the relevant services are already available, and the number of members of the Q4 advertising program grew by nearly 30% YoY .The business is expected to reach a large enough subscriber base in all countries with open ad packages by 2025.

To further boost advertising revenue, Netflix has launched its 1P advertising platform in Canada and plans to accelerate the rollout process in other regions in 2025, with the U.S. region going live in April.With the expansion of subscriber scale and the promotion of the ad technology platform, it is expected that the proportion of ad revenue will increase significantly in 2025, and the profit margin is also expected to be further improved.

In terms of new business expansion, Netflix indicated that it will further develop new programs such as live shows and games.

In addition to continuing to expand live sports events, it will focus on the key categories of immersive narrative games based on original IPs (e.g., Squid Games), social party games, children's games, and mainstream mature games like Grand Theft Auto.

In 2025, we will also continue to test and expand our cloud gaming offerings for TV as a way to enrich our business ecosystem and tap more growth potential.

Free cash flow exceeded expectations.

Q4 saw free cash flow significantly beat expectations at $7bn for the year while content investment was on track.In 2025, content investment will increase to $18bn (+10% y/y), but management expects free cash flow to improve to $8bn given the high ROI investment strategy.

Also as a result, management added $15bn in new buybacks this quarter, which isn't much compared to Mag6 (ex-AMZN), but it's pretty good for Netflix, where content spending is already huge.

Margin improvement exceeded expectations.

Q4 operating profit of 2.27 billion, an increase of 52% year-on-year, the same growth rate as Q3.Double-digit revenue growth of 16% was accompanied by effective control of costs and expenses;

Record operating profit for the year, exceeding the $10 billion mark for the first time, with operating margin up 6 percentage points to 27 percent

2025 Expected Highlights

Earnings Guidance

Revenue: in Q1 2025, Netflix revenue is expected to grow 11% year-over-year to $10.42 billion; 14% when currency-neutral, though this is slightly below market expectations of $10.48 billion.Full-year revenue is expected to grow 12%-14% year-over-year and 14%-17% when currency-neutral, and full-year advertising revenue is expected to double.

Of note, the company expects 2025 revenues to be in the range of $43.5-44.5 billion, which is $500 million more than the upper and lower bounds of its previous guidance even with the stronger dollar, indicating accelerated growth in 2025.

Profit: Operating margin is expected to be 29 percent in 2025, above analysts' expectations of 28.4 percent, 1 percentage point above the company's previous guidance and 2 percentage points above 2024 .

Other: Free cash flow is expected to be approximately $8 billion in 2025 in the absence of significant foreign exchange fluctuations, and content cash expenditures are expected to be approximately $18 billion.

Price Increase Expectations

Netflix will only increase prices in some regions (mainly Europe) in 2024, mostly by removing Basic packages to drive low-paying subscribers to ad packages.At the pace of previous price increases, a new round of price hikes is expected in core regions in 2025.

Previously the company announced prices for most subscription packages in the US, Canada, Portugal and Argentina, but these have been factored into the New Year's earnings guidance provided in Q3 2024, so investors have Price-in quite a few

Margin upgrades.Operating margins are expected to be 29% in 2025, higher than analysts' expectations of 28.4%, and also 1 percentage point above the company's previous guidance and 2 percentage points above 2024.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.