Pelosi: How to Sell Deep ITM Calls like a Pro? (With new position)

Old Demoness Pelosi announced new positions the day before Trump's inauguration (probably coincidentally), most of which are similar in style to the previous ones, with the main layout still in AI, but with some stylistic changes:

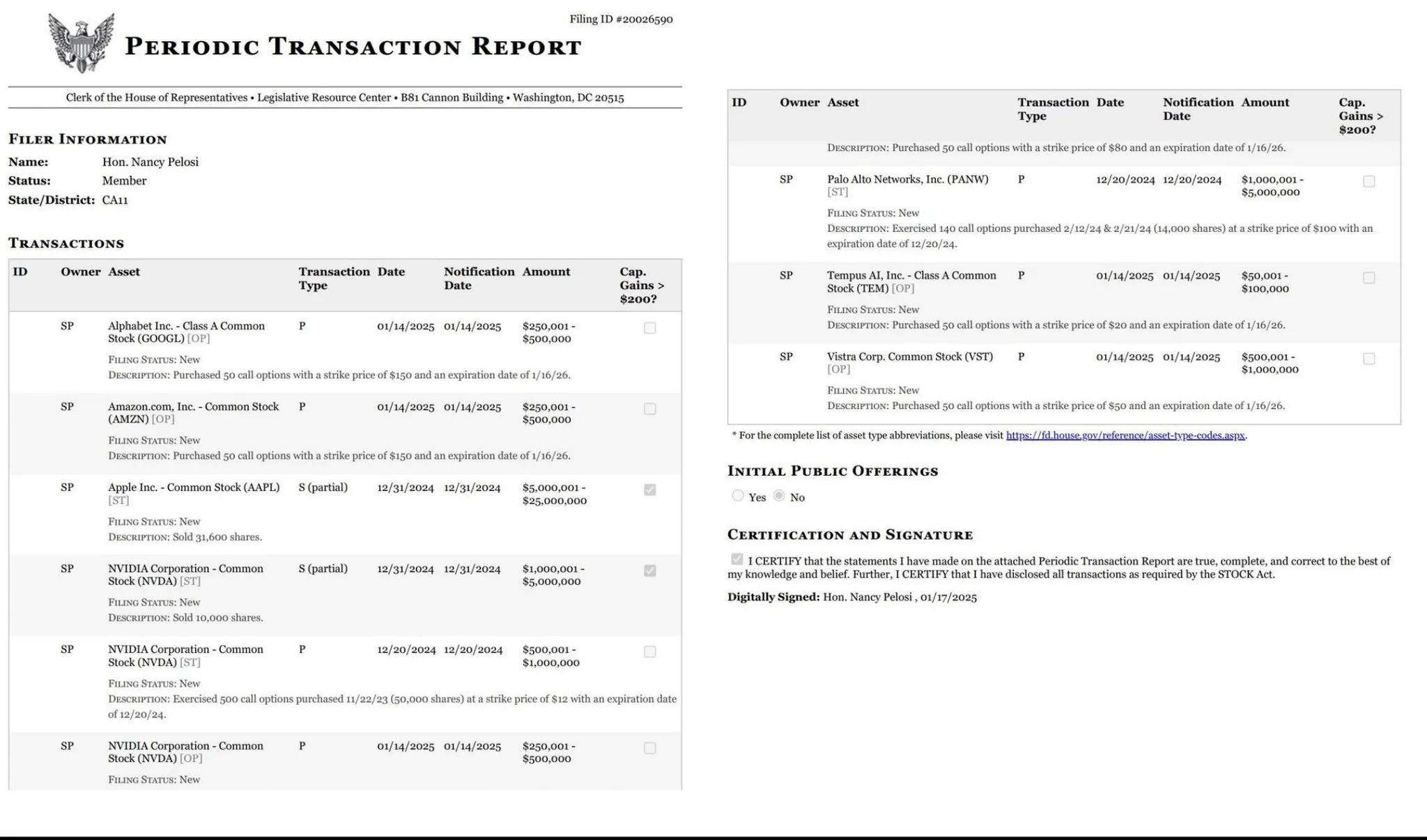

Added AI application layer positions:

Added $Alphabet(GOOGL)$ and $Amazon.com(AMZN)$ $Palo Alto Networks(PANW)$

Opened a small position in Medical AI company $Tempus AI(TEM)$

Lowered hardware position by a small amount:

Lowered position in $Apple(AAPL)$ (sold 31,600 shares)

Maintained position in $NVIDIA(NVDA)$ (sold 10,000 shares while buying 500,000 in options)

Increased AI utility position: added to already ATM stock $Vistra Energy Corp.(VST)$

One of the main concerns is the position in NVDA, where new options were purchased at the same time as the strike.Most of her options positions remain in-the-money, also with the goal of exercising, so they can be described as "holding positions".

However, it is important to note that the options themselves are asymmetric underlyings with limited losses in the event of a major decline;

In addition, why did she use "sell after exercise" instead of "sell the option directly" to take profit?There may be two reasons, which are also worthwhile for a Leap Call trader to consider:

Tax avoidance. To a certain extent, it can reduce costs and Capital Gain Tax

Lower friction costs .Deep in-the-money options are less liquid, and it is difficult for the market to pick up such a large number of positions, and even if market makers force them, they may incur large spreads, resulting in significant friction costs.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Twelve_E·01-21will it be a bad news for $NVIDIA(NVDA)$LikeReport

- fizzik·01-21Wow, this is an insightful analysis!

![[Wow]](https://c1.itigergrowtha.com/community/assets/media/emoji_027_wasai.bc2354fb.png) LikeReport

LikeReport