Long US Bonds, Short US Dollar!

U.S. bonds rallied at the limit last week, but are still at relatively high levels in anticipation of Trump's inauguration. $US10Y(US10Y.BOND)$ yield fell back after hitting 4.8%.The current position may be a better opportunity for right side investors to enter the market.

Before the September rate cut, the 10-year Treasury rate was at its lowest at 3.62%.Since then, the 10-year bond rate has risen all the way to a high of 4.8% on January 14th.That's a total increase of 118 basis points (bps).

During this period, the 3-month Treasury rate fell about 55 basis points because the Fed cut rates.During the same time period, the term premium between the 10-year and the 3-month Treasury rose by 173 basis points.You see, 173 basis points minus 55 basis points is exactly 118 basis points.This suggests that the main reason for the rapid climb in the 10-year Treasury rate since September is the rising term premium.

Therefore, when Trump is officially inaugurated, the market will start trading the "realization" of his policy uncertainty.

The big banks have a similar view:

$Morgan Stanley(MS)$ s view: expect 2025 Fed to cut rates for the first time in March (25 bps) and again in June or so.

Inflation downtrend: Core PCE inflation growth is expected to fall to 2.6% y/y in January from 2.8% in December.On the one hand, Federal Reserve officials have increased confidence in the downward trend of inflation, and a number of officials have stated that inflation will continue to decline.On the other hand, U.S. inflation continued to slow in November and December, with rents and other related data falling, and CPI inflation and PPI data cooling further in December.In addition, financial services inflation is expected to increase less in January 2025 than in January 2024, as the acceleration in financial services inflation over the same period in 2024 was correlated with U.S. equity returns, which averaged lower monthly returns in November-December 2024 than in the same period in 2023.

Risk factors: There are also risk factors between now and the March Fed meeting.If the U.S. government raises tariffs ahead of schedule, prices could rise; tighter immigration policies could keep the Fed's interest rates high for longer; and continued wildfires in California could push up core prices.However, DAMO believes that the market has considered these uncertainties, and policy adjustments will not be made overnight, March rate cuts are still more likely.

$Bank of America(BAC)$ also holds the same view:

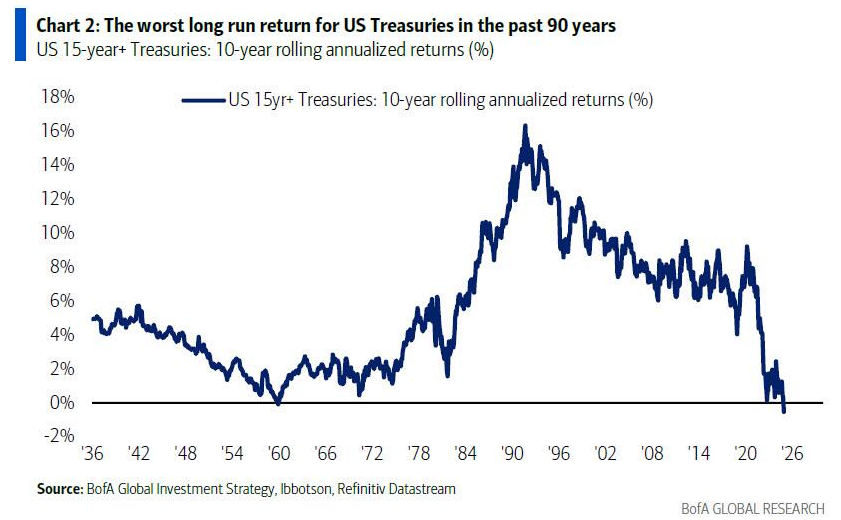

Trump's cost-cutting: the Trump administration's "inability to tolerate greater debt and deficits" could be a key factor in the end of the bond sell-off.The U.S. government is now $7.3 trillion, equivalent to the world's third-largest economy.

Trump's pursuit of "small government" may mean that U.S. bond yields will reach the "double top", that is, 5% bond yields will not rise further.

Based on the above, the logic of investing in U.S. bonds has been relatively clear, and the market is just beginning to reverse the stage:

Technical signals: Technically, US bond yields rose to highs last week, but the Moving Average Convergence / Divergence (MACD) indicator did not make new highs, and the two diverged, which is a favorable signal for bond investments.

Duration Premium: Market prices already include a large duration premium.The current minimum market expectation of future policy rates is close to the current policy rate and well above the median long-term rate that Federal Reserve officials consider appropriate.The difference of about 100 basis points can be regarded as a term premium, which is now closer to the highest value in the past year.

Dollar liquidity is back, sell the overly strong dollar: this is the right time to short the dollar, the dollar index has topped out, at least tactically.The favorable factors that drove long dollar positions have been fully digested by the market.And investors are expecting too much from US tariffs and fiscal expansionary policies

Short-term sell -off: The U.S. dollar could face a tactical sell-off in the short-term and the risk of weakness outweighs the risk of strength.

Equity Sector Allocation: Increase allocations to bond duration and interest rate sensitive assets such as $SPDR S&P Homebuilders ETF(XHB)$ $Utilities Select Sector SPDR Fund(XLU)$ $Spdr S&P Biotech Etf(XBI)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.