Summary

Elliott Investment Management, known for activist investing, increased its stake in $Match(MTCH)$ , urging proactive measures to boost stock value. Match, the parent company of Tinder and Hinge, faces scrutiny due to slowing Tinder growth and executive turnover.

Facts

💼 Elliott Investment Management revealed a 3.30% stake in Match, pushing for performance changes, with specific demands undisclosed.

💰 Match's market value sits around $10 billion, with its stock closing at $37.89 per share.

📉 Pandemic-driven peak valued Match over $400 billion, but subsequent user decline led to stock depreciation.

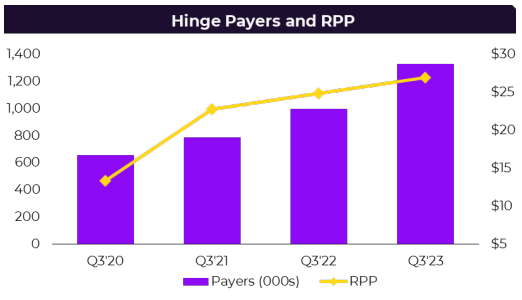

🌐 Tinder dominates with the most users globally, generating $1.8 billion in 2022, while Hinge soared with a 44% revenue growth.

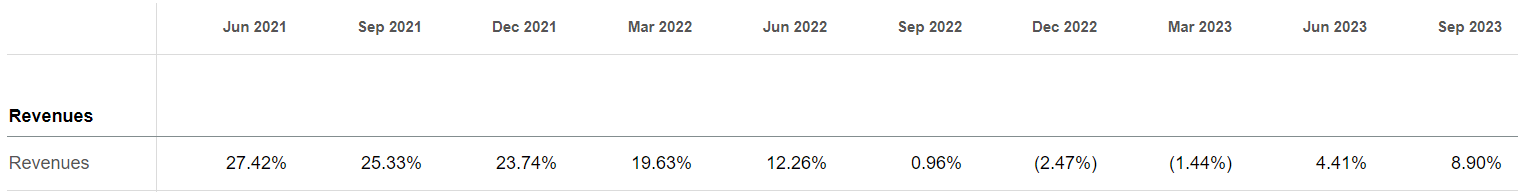

🔄 Concerns arise over Tinder's slowed growth, earlier and more severe than anticipated, prompting managerial changes, including appointing Bernard Kim as CEO.

🔍 Match reported a continuous decline in Tinder's paying users, expecting a more pronounced decline due to price hikes.

📊 Analysts project Hinge's business to hit $1 billion in revenue within the next four years.

What is Activist Investing?

🔔 Activist investing transcends passive financial involvement, often engaging in shareholder resolutions, media campaigns, seeking board representation, or proxy fights for change.

🤝 Elliott's known for intervening in tech and other firms, pressuring reforms including sales. It previously intervened with Salesforce and Pinterest and recently succeeded in a fiber optic business review with Crown Castle.

Comments