騰訊控股,調整結束了?

文章首發-公衆號:鑽石研報。

騰訊控股的基本面,有太多專家和大V分析的很透徹。

今天,簡單粗暴的看一下技術面。

1、長線趨勢,月K線。

時間和空間都調整的很夠意思了,具備長線建倉的好機會。

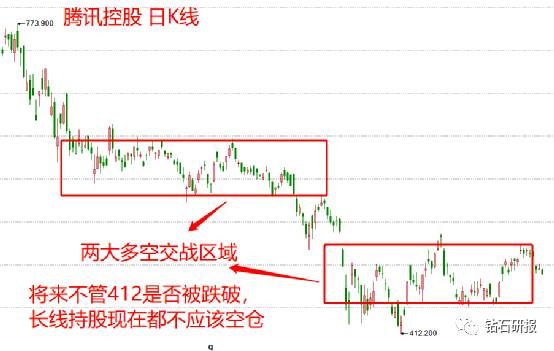

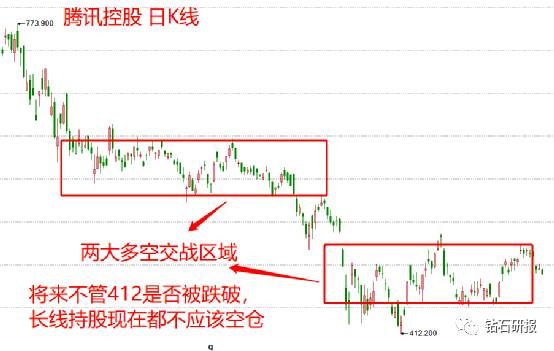

2、日K線,短線繼續震盪中,震盪區間爲445-514。

不管將來是跌破412還是向上突破520,現在都應該持倉一部分長線籌碼。

3、分享文章:一種簡單的長線建倉方法。

適合:沒有固定方法,賣買容易衝動還拿不住票的長線投資者。

長線十八字法則:

精選票,跟大勢;

不抄底,不逃頂;

買組合,分倉幹!

附:買入的底層邏輯:所有的買入都是抄底。

我們認爲所有的買入都是抄底,不同的是“抄底”的週期不同,短線買入可以理解爲抄的是5分鐘-30分鐘週期的底;中線買入可以理解爲抄的是日線的底;長線買入可以理解爲抄的是周線或者月線週期的底;做T可以理解爲抄的是5秒鐘-1分鐘週期的底;留給孫子的股票可以理解爲買的是月線或者季線週期的底。

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments