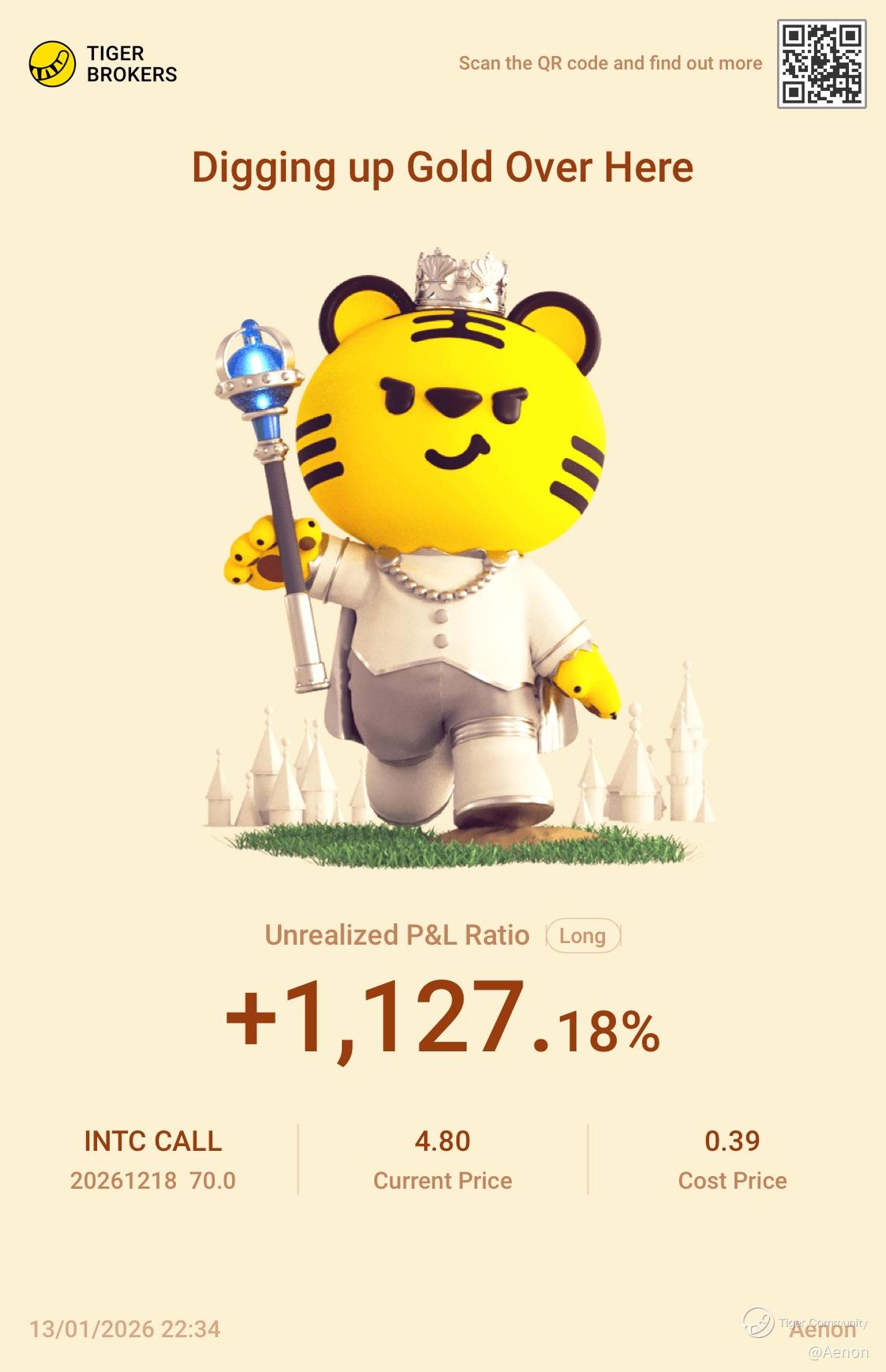

$INTC 20261218 70.0 CALL$

Been a while since I post. This probs make up for the mistakes I made on the baba options and baidu options.... when I didn't sell early enough. Coz baba and baidu took a while to materialize than expected. So broke even on them overall.

Now with Intel.... Got some left to let the bullets fly abit. .... see how far it can go. 🚀

This is only the beginning. But once it reaches will likely wing it. This is like a corporation behaving like startup. And imagine if PE is 30. And post some good profits.

Praise the Lord. Amen 🙏

This is not AI post... 🍀😎

*Not financial advice. Do you own research .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments