These 3 dividend stocks are worth looking at as they look pretty cheap now. Investors may want to study them as their dividends look secure - the companies' earnings more than cover the dividend payments.

Moreover, the companies are growing earnings and they produce positive free cash flow (FCF). That allows them to pay their dividends and buy back stock. That will also help push up the stock.

Lowe's Companies

This home building and supplies retailer just raised its dividend by 31.25% from 80 cents per quarter to $1 in May, putting it on a forward dividend yield of 2.35%. Lowe's said it was due to the strength of its cash flow.

For example, in the last year, its free cash flow (FCF) was $6.835 billion, or 7.2% of its $95.5 billion in sales for the past year to the first quarter of 2022. That was more than enough to pay for the $2 billion costs of its dividends.

Moreover, according to its earnings release, it spent $4.1 billion on buybacks in Q1 and expects to do $12 billion for the full year. That represents 10.6% of its market value now. It will act as a catalyst on the stock price and spur growth in the dividend per share.

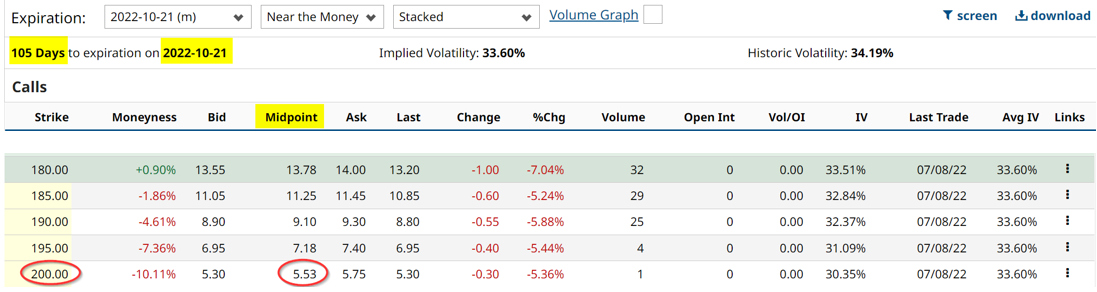

LOW stock is cheap at just 13.3 times this year’s forecast earnings and 12.1 times next year’s. That makes investing in its out-of-the-money calls worth looking at now.

Cigna Corp

After 17 years of paying minimal dividends, in 2021 Cigna Corp started paying a substantial dividend. It raised the dividend per share (DPS) by 12% beginning in 2022, giving it a yield of 1.65%.

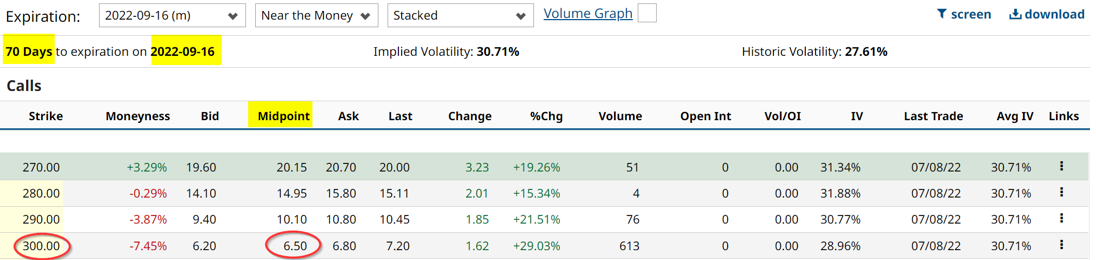

The company has sold off its international operations and expects to produce $8.25 billion in free cash flow (or FCF) this year alone. It also is buying back large amounts of its shares - to the tune of $5.4 billion annually. Its future dividends and buybacks make this one of the cheap dividend stocks.

Here is an out-of-the-money covered call worth looking at.

Oracle Corp

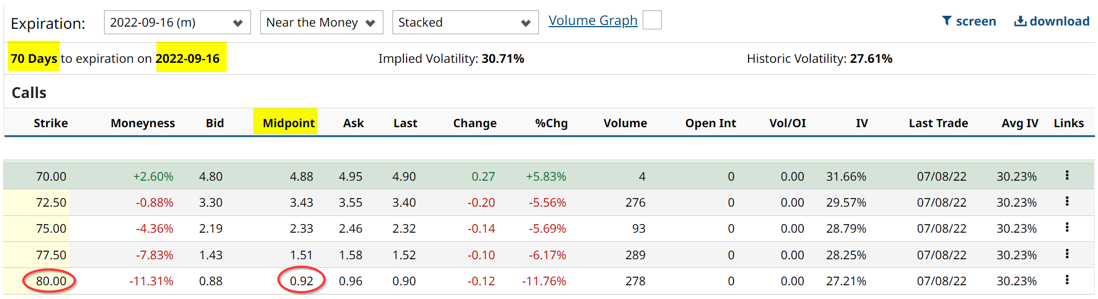

Oracle is due to increase its dividend sometime in the next several quarters. Its free cash flow is still strong enough to allow the company to buy back $2.4 billion of its shares annually. That gives the stock a total yield of over 3.0%, including its 1.79% dividend yield, and 1.27% buyback yield.

Comments