The broader semiconductor industry has been one of the market’s worst performing peer groups this year, with the Philadelphia Semiconductor Index down by close to a quarter this year. AMD (NASDAQ:AMD) has largely underperformed its industry benchmark, as well as broad-market indexes like the tech-heavy Nasdaq 100 (-21% YTD) and S&P 500 (-13% YTD), with year-to-date declines nearing 40%. AMD, alongside its industry peers' latest selloff comes as a result of mounting investor concerns over dampening consumer sentiment ahead of soaring inflation, as well as increasing risks of an economic downturn on the Fed's aggressive trajectory towards monetary policy tightening.

But AMD CEO Dr. Lisa Su’s allusion of the company’s first quarter outperformance to a “significant inflection point” pretty much sums up its continued rapid ascension in market leadership within the semiconductor industry. The chipmaker’s beat and raise for the first quarter has largely assuaged investors’ previous concerns that looming macro headwinds might be increasing risks for a broader industry slowdown after three years of rapid gains. This was further corroborated by the stock’s rally of more than 6% in pre-market trading, underscoring the return of investors’ confidence.

With the completion of the Xilinx acquisition, and the impending close of AMD’s acquisition of Pensando later in the current quarter, the chipmaker stands to bolster its market appeal and fundamental prospects with an increasingly comprehensive product and technology roadmap, enabling greater market share gains ahead. Although the stock has lost a significant chunk of its value this year due to broad-based multiple compression across the market and its peer group, AMD’s latest achievements substantiate continued prospects for robust fundamental outperformance, which is expected to rise above the macro headwinds currently weighing on the stock over the longer-term.

Brief Overview Of AMD’s 1Q22 Performance

AMD reported 1Q22 revenue and earnings that beat consensus estimates by wide margins. First quarter revenues set a new record at $5.9 billion (+71% y/y; +22% q/q), beating the average analyst estimate of $5.3 billion (+54% y/y; +1-% q/q). Excluding revenues totalling $559 million attributable to the consolidation of Xilinx results in the six weeks following completion of the acquisition in mid-February, AMD reported organic sales growth of 55% from the same period last year (+10% q/q).

First quarter earnings per share came in at $1.13 a share, topping consensus estimates averaging 92 cents. The results were driven by non-GAAP gross margin expansion of 7 percentage points year-on-year to 53% (GAAP: 48%), enabled by higher-margin server processor and Xilinx-related sales. On an organic basis, gross margin expansion ex-Xilinx totalled 5 percentage points to 51%.

AMD’s latest achievements have largely defied the “macro factors that work against [its business]”, including Russia’s invasion of Ukraine and ensuing sanctions that are adding pressure to already-fragile chip supplies, which makes it all-the-more impressive. For the current quarter, AMD has guided annual revenues of $26.3 billion (+60% y/y), topping consensus estimates of $24.1 billion (+47% y/y). The revised guidance is inclusive of Xilinx, and builds-in a raise of management’s previous projections provided earlier in the year on AMD’s organic growth from 31% to the mid-30% range as a result of robust demand for its server and semi-customer processors, offset by expectations for a softer PC market.

Expanding TAM With Xilinx

The completion of AMD’s Xilinx acquisition in mid-February has enabled further expansion of AMD’s technology and product portfolio in the first quarter, a key strategy in acquiring market share. Xilinx has allowed AMD to make inroads into markets that it had little to no presence in before. As the current market leader in field-programmable gate arrays (“FGPA”) and adaptive system-on-chips (“SoCs”), which are widely used in high-demand technologies like cloud data center and communication infrastructure applications, Xilinx accommodates AMD’s continued acceleration. In addition to “strengthening and diversifying” AMD’s business, the consolidation of Xilinx’s prowess in FGPA and adaptive SoCs also broadens AMD’s “portfolio of leadership compute engines and expanded solutions capabilities”, bolstering the rapid ascension of its prominence within the semiconductor industry.

Early integration of Xilinx into AMD’s day-to-day operations has already started delivering on synergies previously expected from the transaction. As discussed in our previous coverage, FGPAs are widely used in emerging technologies like cloud data center and communications infrastructure applications considering its adaptive nature and ability in enabling low-latency AI acceleration. And the consolidation of Xilinx has enabled AMD to achieve just that. During the first quarter, AMD saw expanded sales related to the provision of “FGPA from Xilinx as a service and smartNIC deployments at Tier 1 hyperscalers, as well as low-latency network solutions with fintech companies”.

The company also saw robust demand from telcos and related infrastructure providers as 5G deployments continue to “ramp in multiple regions”. With the help of Xilinx, AMD has also rung into its foray in communications infrastructure with a “strategic design win with a Tier 1 communications equipment provider to power their next-gen baseband solutions with the Versal ACAP solution”. Versal ACAP (Adaptive Compute Acceleration Platform) is a legacy Xilinx product that can be “easily programmed by software developers and hardware programmers” to accommodate a wide range of use cases and workloads, which further highlights the subsidiary’s prowess in programmable solutions.

In embedded markets, Xilinx has also paved the way for AMD to penetrate new opportunities stemming from a wide range of burgeoning end markets that include automotive, industrial, and healthcare. Continued integration of Xilinx’s industry-leading technological capabilities is expected to further AMD’s total addressable market (“TAM”), underscoring the company’s massive growth runway as its technology portfolio continues to expand. For instance, the integration of Xilinx’s “differentiated AI engine” across AMD’s CPU product portfolio is expected to “enable industry-leading inference capabilities”, with the first related products scheduled for launch in 2023. Other growth synergies include the ability to gain further market share through cross- and up-selling to some of AMD’s existing customer base. Its continuously expanding product and technology portfolio with the integration of Xilinx now creates a way for the AMD to “address a larger portion of [customers’] compute needs” better and faster.

Based on management’s brief overview of Xilinx-related achievements to date and longer-term integration plans, we are expecting AMD to add $3.8 billion (inclusive of $559 million recognized in 1Q22) in Xilinx sales on top of organic AMD growth estimates. The forecast considers Xilinx’s performance trends in recent quarters, as well as management’s observations of growth in the low-20% range based on a full-year compare to CY/2021. And over the longer-term, our forecast estimates Xilinx sales to expand at a five-year compounded annual growth rate (“CAGR”) of 6% towards $5.1 billion by 2026. The growth assumption applied is consistent with current demand trends and opportunities observed in the global FGPA market, as well as longer-term synergies pertaining to AMD’s strategic leverage of Xilinx technologies on expanding its product portfolio for greater capitalization of market share.

AMD Will Hurt Less From Softening PC Demand

Softening PC demand has been considered by investors a sore spot within the industry. Consumer PC demand has already showed signs of normalization, with shipment levels now on polar opposites from trends observed during peak pandemic-era when individuals across all demographics were scrambling for a computing device to accommodate remote working and learning needs. Perhaps, “old-times industry leader” Intel could provide some “intel” on what the consumer PC market looks like today – the company’s PC chip sales, which represent its largest revenue source, slumped in the first quarter after some customers “cut orders to reduce unsold inventory and consumers bought fewer devices for education purposes, …escalating concern that overall demand for consumer PCs is sputtering following a boom fuelled by pandemic-related working and studying needs”.

AMD has also observed similar trends. But instead of lost demand, AMD sees the current PC market shifting to “higher end [and] more premium segments”, buoyed by corporate purchases to accommodate the idea that “hybrid and remote work is the new reality”. Digital transformation trends have enabled many corporate environments to adopt a “location-agnostic” work arrangement, giving employees full autonomy on deciding where they want to work. Although AMD has opted to stay on the conservative side with regards to PC opportunities for the year, guiding a year-on-year decrease in “negative high single digits” for related sales, the company is expected to recoup some market share by selling its premium, more expensive models.

Recognizing that it is currently “underrepresented in the commercial [PC] market”, AMD’s recent launch of “premium segment products” such as the “Ryzen 6000 Series” processors that boast best-in-class battery life and performance, as well as leadership in “modern security and manageability features” puts it in a competitive spot for acceleration in commercial notebooks. The company also has a “number of commercial systems” in the pipeline that are scheduled for launch later in the year, which underpins solid PC performance for 2022 despite a broad slowdown in the market. Paired with seasonal demand in the second half of the year from back-to-school and holiday purchased, AMD remains on a positive track for further PC market share gains.

Data Center Demand Acceleration

Accelerating demand for data center processors is also expected to cushion some of the PC-related risks for AMD. As discussed in earlier sections, added strength in product portfolio build-out with the addition of Xilinx’s technological capabilities are enabling better capitalization of rapidly expanding market demand for AMD. Global demand for data center processors will remain elevated in coming years, as cloud computing remains a critical need in the corporate sector with no signs of slowing in adoption. Despite the current array of macroeconomic risks that span from tightening monetary policy and financial conditions to the resurgence of COVID in China and the Russia-Ukraine war, businesses have continued to migrate their workloads to the cloud, in which data center processors remain the backbone of.

With only 11% of the corporate landscape feeling confident that their legacy business models will be "economically viable through 2023" and another 64% raising the need to step up on digitization plans, corporate spending on digital transformation is fast approaching an inflection point. More than half of corporates are expecting cloud adoption to account for a significant portion of investments in the next two years, driving the global cloud-computing market towards a market value of more than $800 billion by 2025.

These statistics continue to support a robust demand environment for both cloud service providers and chipmakers like AMD, even under a potentially tightening economic environment in the near term. More than half of the corporate scene have expressed that they would rather "tighten the belt" in other parts of the business than to miss out on digital transformation, which is considered a strategic investment in differentiating themselves from competitors, while also enabling cost efficiencies.

And AMD’s continued commitment to bettering the performance of its flagship EPYC server processors makes it well-positioned for related growth opportunities ahead. The upcoming launch of the “Genoa” fourth-generation EPYC server processor in the second half of the year is expected to complement AMD’s continued ramp of the upgraded “Milan-X” third generation EPYC server processors, and draw greater demand by enabling more optimization for handling increasingly complex workloads. The Genoa EPYC processors are expected to be “the industry’s highest performance general purpose server CPU”, capturing best-in-class performance, energy efficiency and ownership cost advantages. The next-generation server processor has already garnered positive reception during “customer and partnering sampling” in the first quarter, and is expected to bolster “AMD’s share gain trajectory based on expanding cloud, enterprise and [high performance computing] customer adoption” once launched in the second half.

The company is also working to launch a “cloud-optimized” version of the fourth-generation EPYC processor, “Bergamo”, in the first half of 2023. Bergamo will feature up to 128 Zen 4c cores for cloud-optimized applications. Built on the same technology as the Zen 4 cores, the Zen 4c cores enable improved power efficiency without compromising on performance for cloud-specific workloads.

In addition to data center CPUs, AMD has also recently dipped into rival Nvidia’s (NVDA) turf in data center GPU processors. The all-new “AMD Instinct MI210”data center GPU is powered by its "CDNA 2" architecture and "ROCm 5" open software platform, and is designed for “exoscale-class, high performance computing (“HPC”), and AI applications”. As mentioned in one of our previous coverages on the stock, AMD has drawn increased prominence within the HPC realm in recent years - its processors can now be found in 73 supercomputers on the latest TOP500 list and holds 70 HPC world records. The latest improvements to AMD’s data center CPU/GPU portfolio, paired with added technological strength from Xilinx’s FPGA deployments for hyperscalers are expected to further fuel its reputation across HPC and AI applications, underpinning greater market share gains ahead.

Market Share Expansion With Pensando

Similar to the recent Xilinx transaction, AMD’s pending acquisition of Pensando will build on its strategy to grow market share by expanding its product portfolio, and inadvertently its TAM. With customers including high-profile names like Goldman Sachs (GS), Microsoft’s Azure (MSFT), HPE (HPE), and Oracle’s cloud unit (ORCL), Pensando boasts its strength in “high-performance, fully programmable [data] packet processors and [a] comprehensive software stack that accelerates networking, security, storage and other services for cloud, enterprise and edge applications”.

Taking a page from Nvidia’s corporate strategy that typically combines hardware offerings with an accompanying software stack to enable end-to-end solutions, AMD has been focused on “investments in software stack and working with cloud talent to optimize software capabilities” in recent years. The acquisition of Pensando will complement Xilinx’s “strong software stack” and AMD’s hardware engines, and accelerate efforts in creating full-stack, hardware-software solutions that aim at “[unifying its] overall product roadmap going forward”. For instance, Pensando’s “highly scalable distributed services platform” combines its programmable package processors with its software stack to enable unprecedented performance with less power. The Pensando transaction is expected to further AMD’s exposure to a “larger customer base across more markets”, driving further strength from both a fundamental and valuations standpoint over the longer-term.

Fundamental Estimates Update

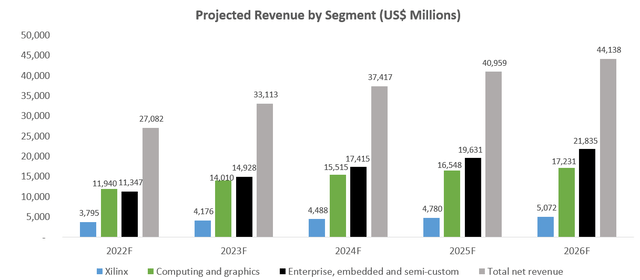

AMD’s upbeat performance and outlook continues to support the growth assumptions we had previously analyzed. Updating our forecast for the company’s actual first quarter results, with the addition of expectations pertaining to Xilinx-related sales, AMD is projected to grow its topline by 65% to $27.1 billion by the end of the current year. The year-on-year growth assumption slightly exceeds management’s guidance of +60% for the year, which we consider reasonable given seasonality demand that is expected to be bolstered by new product launches in the latter half, as well as AMD’s consistent track record of outperformance.

Looking ahead, annual total revenues are expected to further expand at a CAGR of about 10.3% towards $44.1 billion by 2026. Much of the growth will continue to be driven by rising demand for data center processors ahead of continued ramp in “cloud, enterprise and HPC customer adoption”. AMD is also well-positioned to benefit from an enlarged TAM with accelerated expansion of its product portfolio and offerings through consolidation of various best-in-class technology providers that include Xilinx and Pensando this year.

AMD Revenue Projections (Author)

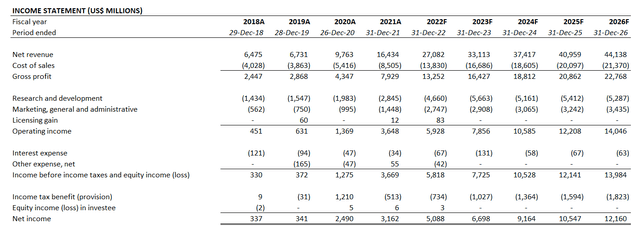

Combined with AMD’s projected cost structure, which takes into consideration the company’s continued strength in scaling new product launches as well as an increasing mix of higher-margin data center and Xilinx-related sales, the company is expected to generate net income of $5.1 billion in the current year with further growth towards $12.2 billion by 2026.

AMD Financial Forecast (Author)

AMD_-_Forecasted_Financial_Information.pdf

Valuation Considerations

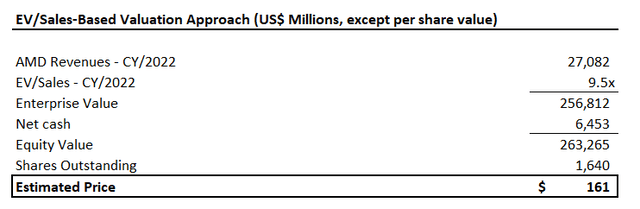

We are maintaining our price target for AMD at $160, which represents upside potential of more than 60% based on the stock’s last traded share price of $99.42 (May 4th). The valuation reflects AMD’s anticipated strength in maintaining market-leading growth that includes support from acquisition-related synergies. But near-term macro headwinds, as well as the consolidation of a higher debt balance from Xilinx operations will increase AMD’s exposure to rising borrowing costs ahead and slightly weigh on its valuations outlook.

AMD Valuation Analysis (Author)

AMD Valuation Analysis (Author)

Our valuation approach considers an equal weighting of results from the discounted cash flows (“DCF”) and multiple-based method. For the DCF analysis, we have applied an exit multiple of 25.3x, which bumps AMD back in line with its peer group. The company is currently trading at a discount to peers despite boasting leading growth prospects and a technological advantage. As such, we believe a slight premium multiple is reasonable given AMD’s rising exposure to high-demand segments like cloud, AI and HPC, buoyed by continued expansion of its technology roadmap.

AMD DCF Analysis (Author)

For the multiple-based analysis, we have applied a forward EV/sales multiple of 9.5x, which is derived with the same intention as our DCF analysis to gauge the company’s valuation prospects if traded more in line with peers:

AMD Peer Comp (Author)

AMD EV/Sales-Based Valuation (Author)

Other Downside Risks To Consider

In addition to a slowing PC market, the broader semiconductor industry still faces strong headwinds from global supply chain instability that should not be entirely overlooked. While the peer group has previously downplayed the potential adverse impacts to near-term fundamentals resulting from intensifying Russia-Ukraine conflicts and ensuing sanctions from both a supply and demand perspective, there have been some downstream risks emerging that could threaten uptake rates in the near-term.

In AMD’s case, while the chipmaker has not experienced any significant impacts to its shipments or supply chains as a result of recent geopolitical headwinds, it has started to see some “customer build delays” whereby COVID-related work suspensions and/or logistics and labour constraints have slowed outflow of chip inventory and inadvertently impacted uptake from AMD. For now, management noted that related impacts have already been considered in the second quarter guidance. But considering the stellar forecast for close to 70% year-on-year growth in the current period, the impacts are not expected to be blown out of proportion as challenges in curbing infection rates in manufacturing hubs across China start to ease in coming months.

The company’s reliance on third-party foundries to make its chips also increases exposure to constrained supplies. For instance, AMD’s key chip-producing partner TSMC (TSM), in which it relies on for better technology for improving the way “chips process data and how much information they store”, has continued to reel from supply chain constraints. The world’s largest semiconductor foundry cited during its first quarter earnings call that the ongoing chip supply shortage has yet to ease, with observations on “wait times for semiconductor delivery [up] again in March due to China’s COVID lockdowns and a Japan earthquake that hit production”, as well as supply uncertainties pertaining to “key materials such as silicon wafers and industrial gases [due to] rising geopolitical tension and low global wafer capacity gains”. But with AMD’s products representing “some of the most expensive items coming out of [TSMC’s production lines]”, the chipmaker is expected to benefit from a safer position for supplies over others, which provides some insulation from exposure to ongoing volatility in availability and costs to materials needed to address accelerating demand.

Conclusion

The AMD stock currently trades at about 5.8x EV/’22 sales, which is a significant discount to its peer group. Reasons for the discount include broad-based multiple compression due to tightening market conditions stemming from a blight of macroeconomic headwinds, which have particularly weighed on growth stocks like AMD that were previously trading at lofty valuations.

But considering AMD’s increasingly diversified product portfolio which bolsters additional market share gains over the longer-term, the company is well-positioned for accretive fundamental growth that complements further valuation upsides ahead. AMD remains the backbone of critical next-generation technologies for an array of applications ranging from our day-to-day personal computing needs to complex AI workloads.

With AMD’s recent outperformance dispelling concerns of a slowing cycle, and the Fed’s recent rate decision providing further clarity on policy tightening plans ahead, the stock will likely trade closer to a valuation that better aligns with its fundamental strength in the near-term. This means the current discount will not last for long, as the stock regains momentum on returning investors’ confidence over coming months.

Comments