'This means we will become the first publicly traded company to hold Ethereum, Proof of Stake assets, [decentralized finance] tokens, and many other crypto assets,' says CFO Haas

Coinbase CEO Brian Armstrong on Thursday said that the U.S.'s largest digital-asset exchange received board authorization to add $500 million in crypto to its balance sheet.

In a tweet, Armstrong, co-founder and head of the platform, said Coinbase would also be investing 10% of all profits in crypto.

In a late-Thursday blog from Coinbase , CFO Alesia Haas expanded on Armstrong's tweets.

"We believe in the cryptoeconomy, a future where economic transactions--buying, selling, spending, earning--will be based on crypto assets," she wrote.

"This means we will become the first publicly traded company to hold Ethereum, Proof of Stake assets, [decentralized finance] tokens, and many other crypto assets supported for trading on our platform, in addition to bitcoin, on our balance sheet," Haas wrote.

Coinbase $(COIN)$, as of Dec. 30, held on its balance sheet $48.9 million in a stablecoin, intended to be pegged to the dollar; $130.1 million of bitcoin ; $23.8 million of Ethereum's Ether , the second-largest crypto by market value; and $34 million of other crypto assets, according to public filings .

Some of the largest publicly traded companies now include digital assets on their balance sheet, a growing trend in 2021, include MicroStrategy $(MSTR)$, which holds bitcoin valued at nearly $5 billion, as well as Tesla Inc. $(TSLA)$, which owns some $2 billion in bitcoin. Galaxy Digital Holdings holds nearly $800 million in bitcoin.

Recently, Coinbase said that it had built a $4 billion cash in Congress.

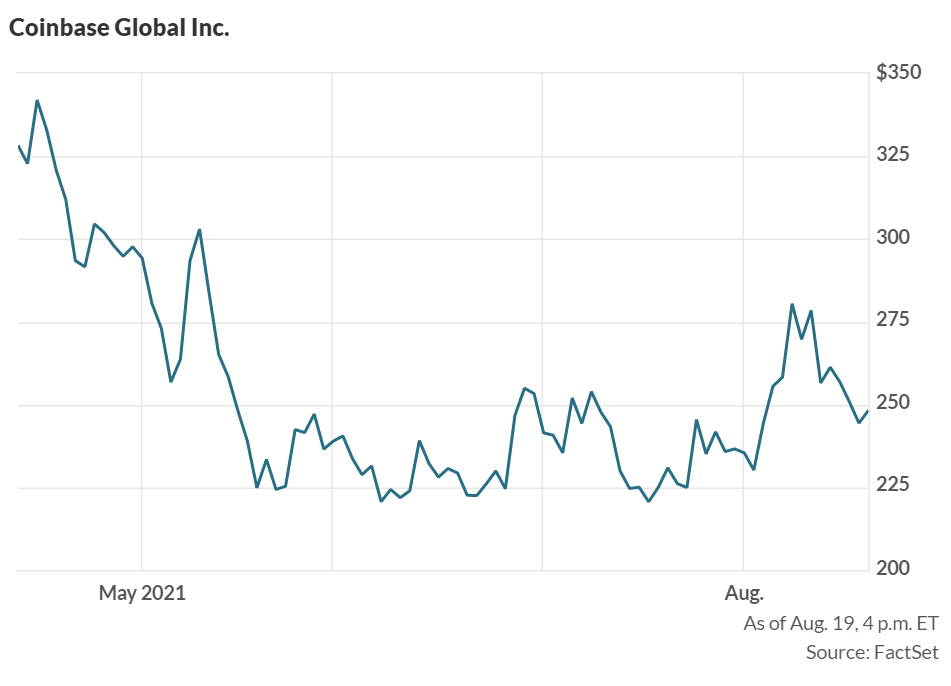

The exchange platform listed on the Nasdaq in mid-April and is roughly flat based on its $250 reference price established before its first trade and its $342 closing peak on April 16.

Coinbase held a direct listing instead of a standard initial public offering, meaning that the company didn't raise money through the process of going public and doesn't have a traditional IPO price against which to measure the stock's first-day rally.

Earlier this month, Coinbase posted net revenue of $2 billion in the second quarter, up from $178 million a year earlier and $1.6 billion in the first quarter. Coinbase had $1.9 billion in transaction revenue, surpassing consensus expectations for $1.8 billion.

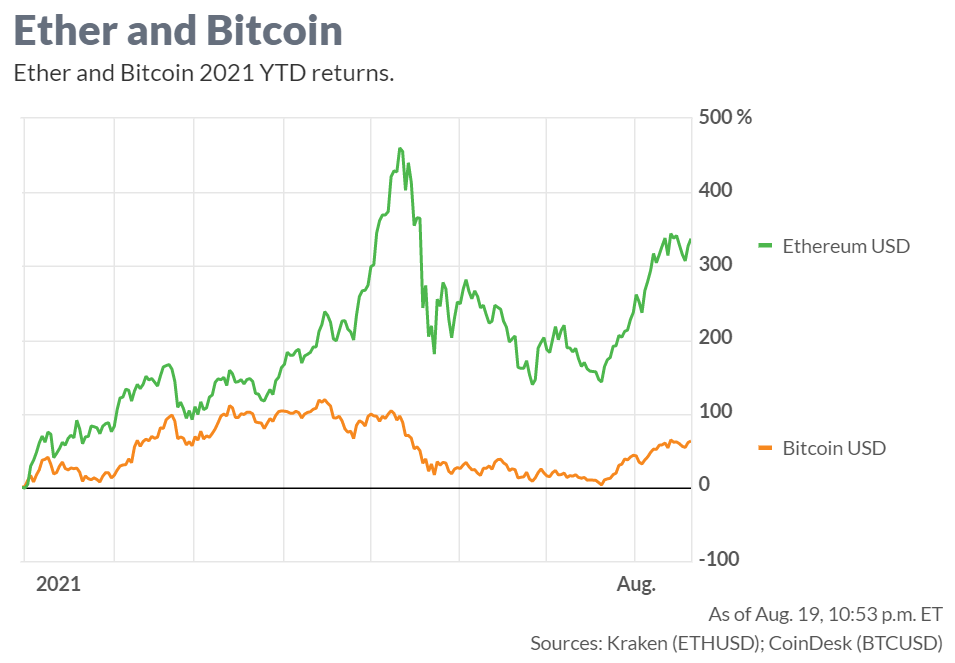

About 50% of the company's business is still based on bitcoin and Ether trading and those assets have been volatile falling substantially from peaks hit during the spring, though digital assets are attempting a rebound, with the total crypto market hitting $2 billion in value for the first time since May.

Ether prices have been on the rise as the crypto is in the process of a multistep upgrade to the Ethereum network , which includes a shift from a proof-of-work protocol to a proof-of-stake and increased storage capacity and processing power for smart contracts.

Comments