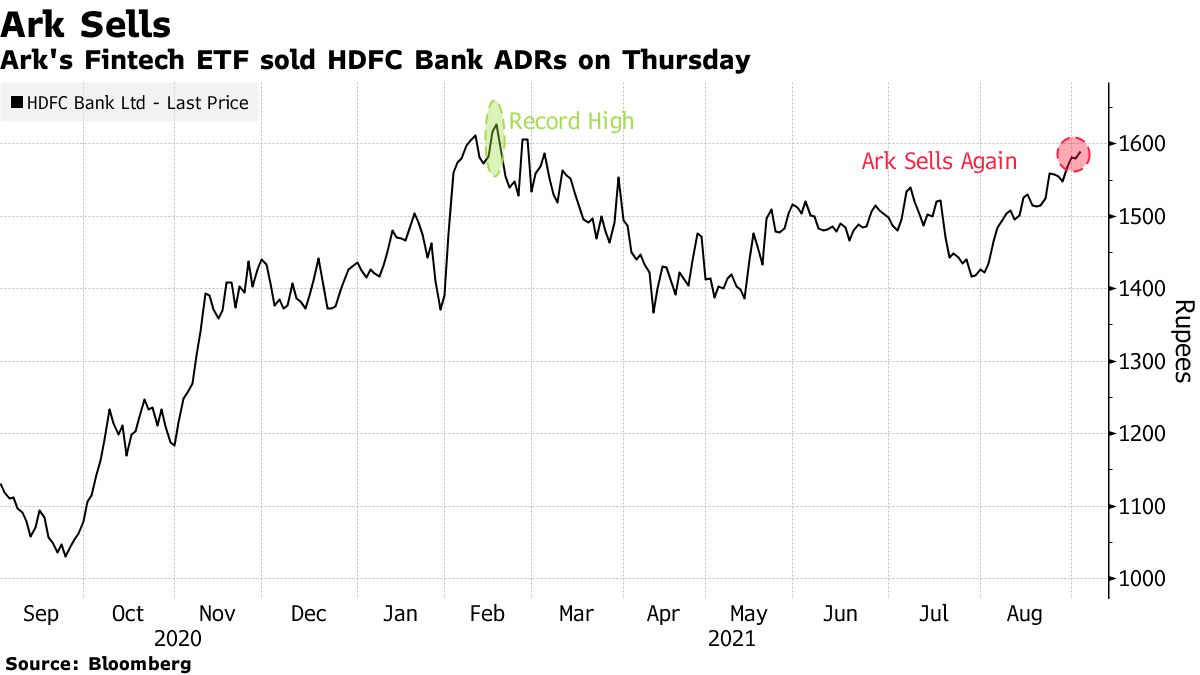

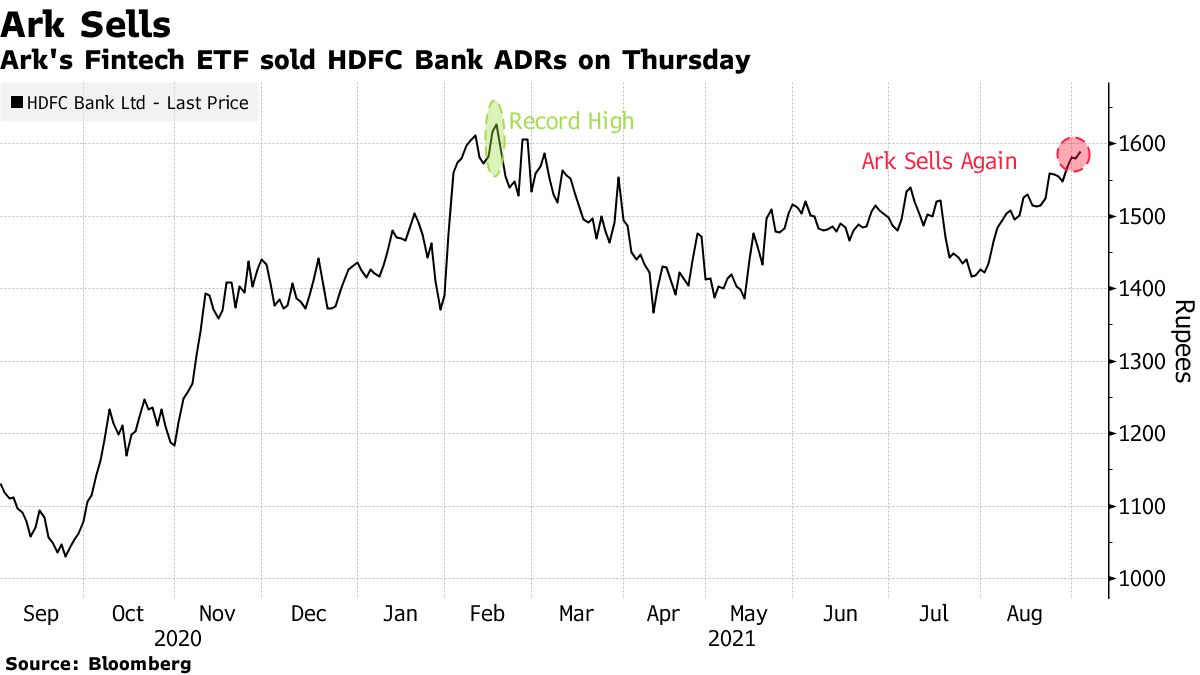

Cathie Wood’s fintech fund has sold a stake in HDFC Bank Ltd, India’s largest by market value, for the first time in nearly four months. The move comes at a time when the lender’s main stock listing is less than 3% away from a record high.

Wood’sArk Fintech Innovation ETF(ARKF) sold 127,637 American depository receipts of the lender on Thursday for the first time since May 6, according toArk Investment Management’s daily trading data compiled by Bloomberg. It now hold ADRs worth $19 million, Ark’swebsiteshows.

HDFC Bank ranks among the world’s most priciest mega banks, trading at a 12-month forward price-to-book value ratio of 3.5 times, according to data compiled by Bloomberg.

HDFC Bank ranks among the world’s most priciest mega banks, trading at a 12-month forward price-to-book value ratio of 3.5 times, according to data compiled by Bloomberg.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments