Big-cap tech stocksin the S&P 500 are back. But analysts insist still you've got time to make significant gains on them.

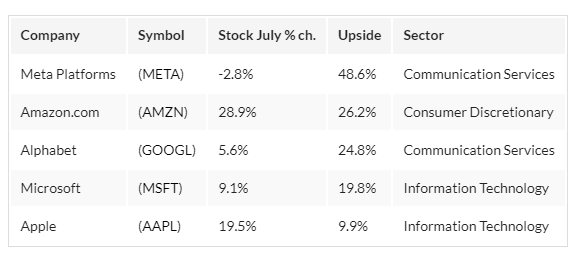

All five of the biggest-cap tech and tech-related stocks in the S&P 500, includingApple(AAPL),Amazon.com(AMZN) andMeta Platforms(META), stand to gain roughly 10%, or more, within the next 12 months, according to an Investor's Business Daily analysis of data from S&P Global Market Intelligence andMarketSmith.

And that's a welcome sight for investors. Why? Just these five stocks account for roughly 20% of the S&P 500. Even so, "Investors should be selective when picking stocks within the tech sector," said David Trainer, CEO of research firm New Constructs.

The S&P 500 Megacap Tech Rally

Tech stocks, the bedrock for much of the most recent bull, are starting to perk up again.

The Technology Select Sector SPDR ETF (XLK) is up 12% in just the past month. That ranks it only behind the Consumer Discretionary Select Sector (XLY) ETF during that period. And the gain in tech stocks is all the more important. Tech stocks account for 28% ofthe S&P 500, which is more than any other sector. Consumer discretionary only makes up 11% of the index.

It's also important to note that tech's influence on the S&P 500 spans beyond just the confines of its sector. Amazon.com, which many people think of as a technology stock, actually accounts for nearly a quarter of the consumer discretionary sector. Amazon shares are up nearly 29% in a month.

Gains in the megacap tech and tech-related firms is impressive. Shares of pure tech giants Apple(AAPL) and Microsoft(MSFT) are up 19.5% and 9.1%, respectively in the month of July. In communication services, Alphabet(GOOGL) is up 5.6% in a month. Meta Platforms(META) is the only megacap tech-related stock to fall in July. And only by 3%.

Analysts Pick Their Favorite Megacap Techs

A decisive second-quarter earnings season largely separated the winners from the losers. But analysts still like all their options.

Amazon is the tech-related stock analysts think has the second-highest upside. Meta is the one they think has the highest upside potential. Shares of Amazon, up nearly 29% in just a month, gained more than any other stock in the group. Interestingly, the company's loss of 20 cents a share, reported July 28, missed views calling for an adjusted profit of 12 cents a share. Revenue topped views, though. Analysts still think the stock should be worth 172.83 a share in 12 months, implying a nearly 26% upside.

Also on the plus side,Apple on July 28 reporteda quarterly profit that was 3% more than analysts' expectations. And that was despite revenue of nearly $83 billion, roughly in line with views. Such strength is prompting analysts to think Apple's stock should still be worth 179.55 in 12 months. That would mark nearly 10% upside.

It's time for investors to analyze all these megacap techs not as a group, but individually, Trainer says. For instance, analysts are most bullish on Meta, despite it being the only megacap tech-related stock to fall in July. "(Many of these stocks are) trading in the same direction, (which) reflects the inefficiency of the stock market over the last several years," he said.

Comments