Americans are saving less, a potentially troublesome sign for theU.S. economy.

The personal savings rate, as a percentage of disposable income, fell to 4.4% in April, the lowest level since 2008 according to the Commerce Department. Total savings slipped to $815 billion. For some, the decline is a red flag for consumer spending, which accounts for 70% of gross domestic product (GDP).

"We're starting to dip into savings because what generally happens in periods of inflation is you see demand destruction because prices just get too high and people just stop consuming whatever it is," said Mitch Roschelle, Macro Trends Advisors LLC founding partner. "While we haven't truly seen demand destruction yet, the first thing that happens is people start dipping into savings because they're not willing to slow down consumption."

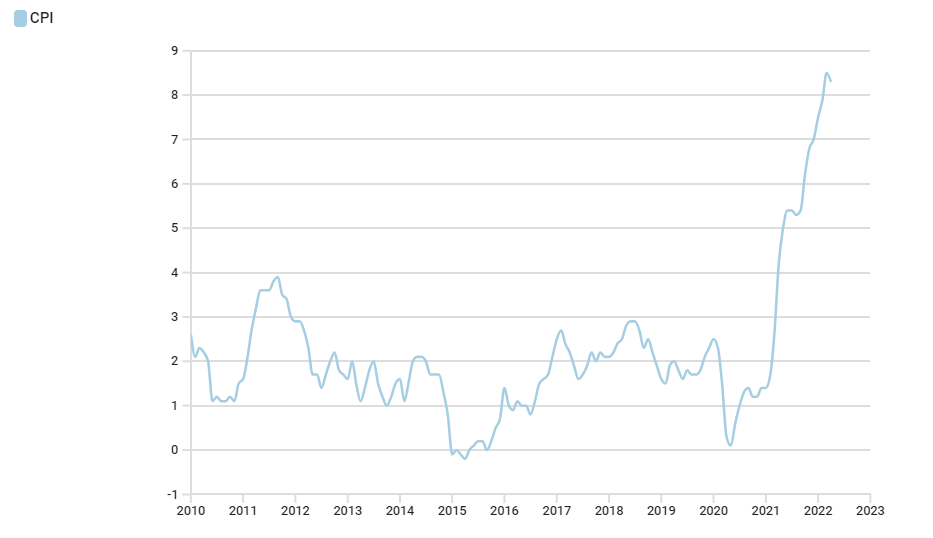

With consumer inflation at a 40-year-high, costs are rising for everything from fuel to food, chipping away at personal balance sheets.

INFLATION HITS 8.3% IN APRIL

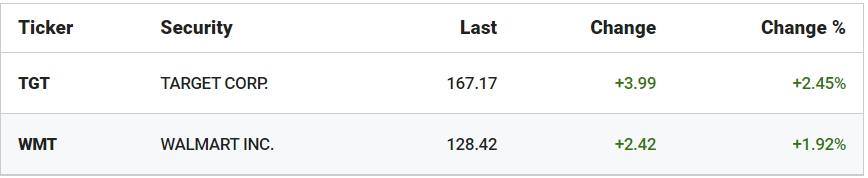

While consumers are still spending, dollars are not going as far. Walmart and Target both reported a slowdown in sales and profits during their recent quarterly earnings reports because of inflation.

"On the food side, we're seeing double-digit inflation, and I'm concerned that, that inflation may continue to increase," he said in response to a question on the retailer’s earnings call.

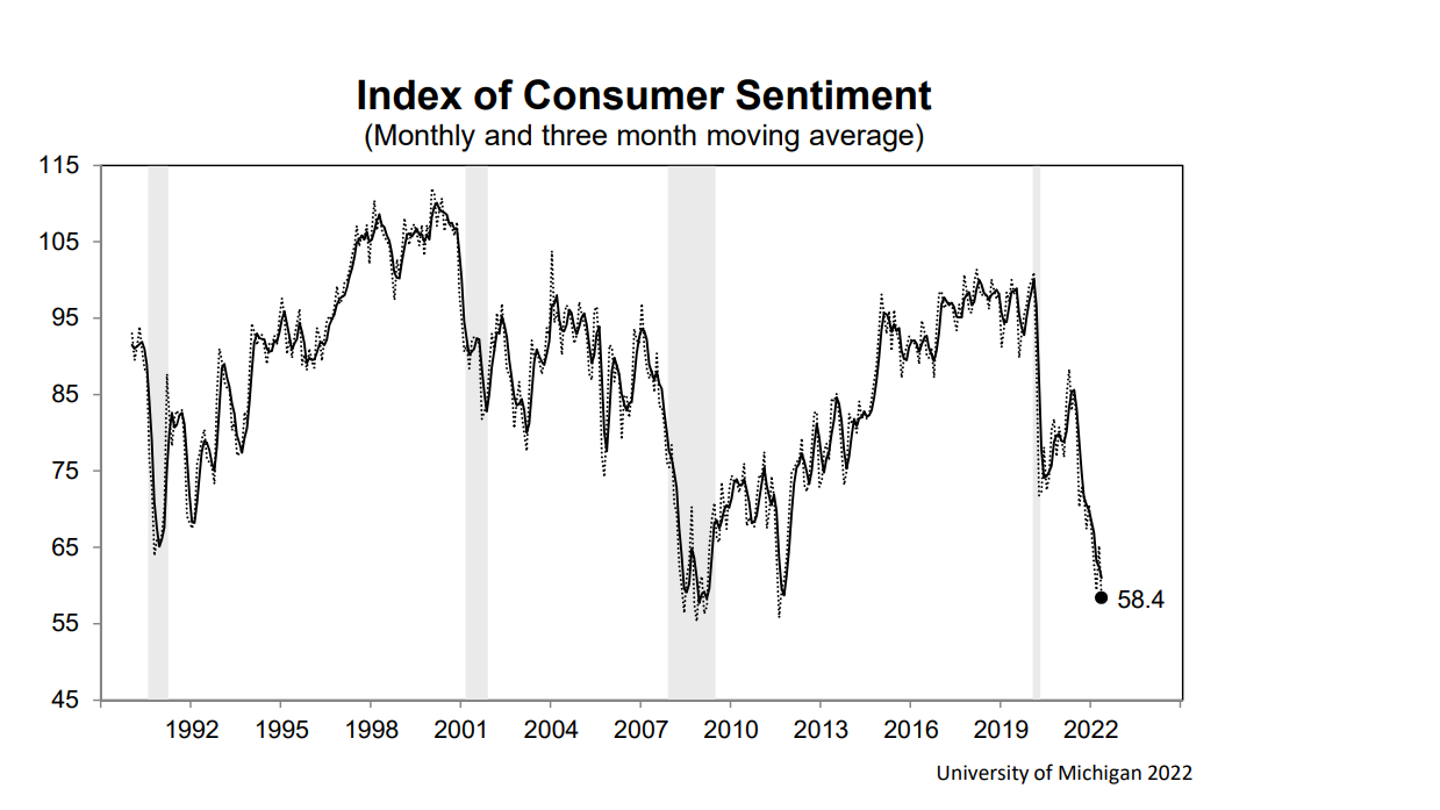

"The consumer is really pessimistic, the Michigan survey came out and told us that people are as pessimistic about consumption as they’ve been going all the way back financial crisis and one way you can see that is the savings rate has dipped to below 5% which is the lowest it’s been since the September of the Lehman [Brothers] crash. So the consumer is seeing all this price news and thinking, ‘Whoa, I got to take it easy,'" said Kevin Hassett, former chairman of the Council of Economic Advisors for the Trump administration, during an interview on "Cavuto: Coast to Coast."

Comments