S&P 500 futures point to a second day of recovery, but the index is still on track for its worst weekly performance in a month

U.S. stock futures ticked up and government bonds extended their selloff as investors assessed the latest signals about Federal Reserve policy and the war in Ukraine.

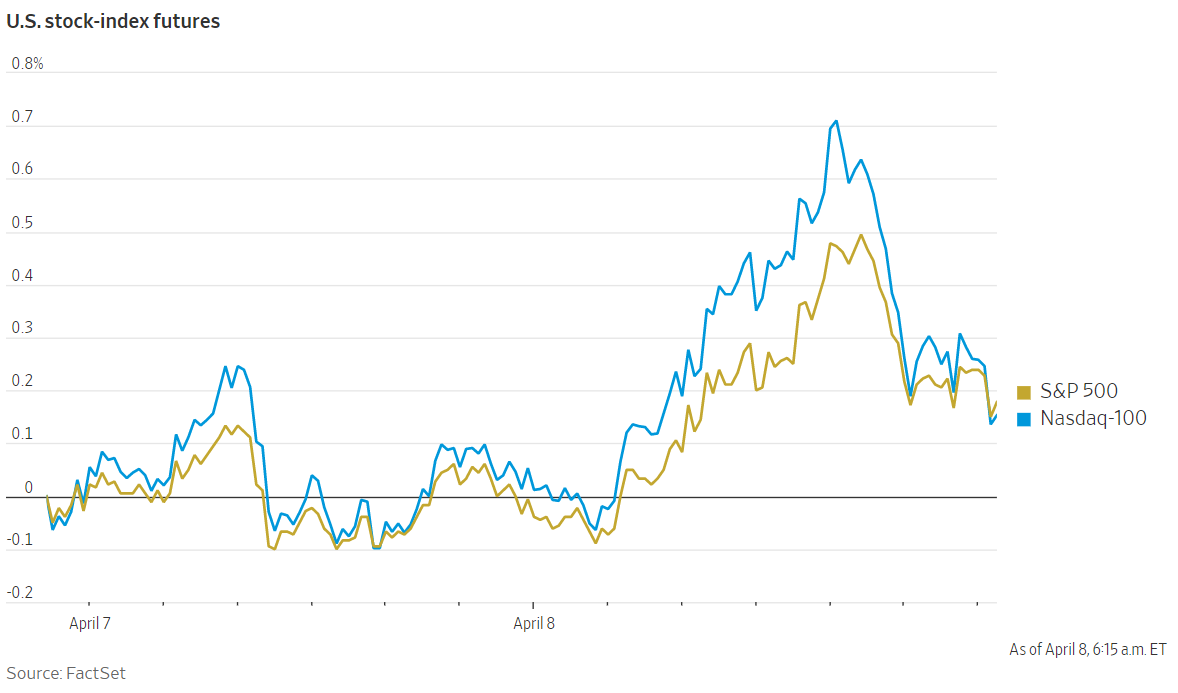

Futures tied to the S&P 500 added 0.1%, pointing to the broad-market index extending gains after it closed up 0.4% on Thursday. Nasdaq-100 futures climbed 0.1%, pointing to similar moves for technology stocks after the opening bell.

VIX fell 0.1% while VIXmain rose 0.4% separately.

Gold fell 0.05% to $1936.9.

The yield on the benchmark 10-year Treasury note rose for the sixth consecutive day, climbing to 2.689% from 2.654% on Thursday and notching a new three-year high. Yields rise when prices fall. Shorter-dated bond yields also advanced, with the 2-year yield rising to 2.514%.

Stocks have swung and bonds have sold off this week as investors’ concerns about aggressive Federal Reserve policy weighed on markets.Minutes showed that policy makers had considered raising interest rates and unwinding its balance sheet faster.

Federal Reserve Bank of St. Louis President James Bullard said Thursday that the central bank is behind on its mission to tame inflation and will likely have to act fairly forcefully to get price pressures under control.

“The Fed has been the number one story and that continues,” said James Athey, an investment manager at Abrdn.“The effect of the sort of tightening that has been discussed, that has a history of being very destabilizing.”

The S&P 500 reversed direction on Thursday after two days of losses, but is still on track for the worst weekly performance in a month. It is down 1% so far.

“There’s more headwinds for the equity market yet it continues to grind out gains. After a couple of days of weakness, buying the dip is a learned behavior,” Mr. Athey added.

The war in Ukraine also continued to worry investors. Russian triggered a new round of sanctions from the U.S. and the European Union this week. The United Nations General Assemblyvoted to suspend Russiafrom its Human Rights Council.

Oil prices climbed. Global benchmark Brent crude rose 0.7% to trade at $101.26 a barrel, as traders assessed the impact of sanctions and self-sanctioning measures by energy companies on Russian oil output.

In premarket trading,CrowdStrike shares rose 4% after the cybersecurity software developer said it received a key authorization to work with the Department of Defense.

Overseas, the pan-continental Stoxx Europe 600 rose 1.2%.Banco BPM jumped 14% after Crédit Agricole said it took a 9.2% stake in the Italian lender. Shares of Crédit Agricole rose 1.4%.

The ruble weakened 1.7% against the dollar, trading at around 80 rubles to $1. Russian stocks declined 0.7%. The country’s benchmark MOEX stock index has lost over 5% this week.

In Asia, most major benchmarks closed up. The Shanghai Composite Index added 0.5% while Hong Kong’s Hang Seng Index rose 0.3%. Japan’s Nikkei 225 ticked up 0.4%.

Comments