YouTube TV is probably an underappreciated, underrated revenue generator within Alphabet’s portfolio. MavenFlix explains why.

The so-called “streaming wars” have become a popular topic of discussion. With big players like Disney and Amazon. Report clashing with Netflix for market share, video streaming is expected to grow quickly over the next few years. So, who will win this race?

Among the top names in the space, one that is often overlooked but that we believe should be tracked closely is YouTube TV. Today, MavenFlix looks a bit more closely at parent company Alphabet and its streaming service.

How YouTube TV works

Unlike TV channels or specialty networks that offer one type of content, YouTube TV is more of a portfolio of show and movies that cater to a broader audience. Content can be watched live, as is the case of cable TV, or on demand, a model that resembles streaming platforms.

The main source of revenue for YouTube TV’s service is monthly subscription. However, the platform does not dependent exclusively on service fees, as ads can also be displayed within the app, creating a hybrid model.

An “infinite” library

YouTube TV’s library is a great asset to the company. Users can save content that is distributed through more than 85 channels available on the platform – a compelling feature that helps customers build a very large library of content that caters to them.

Within its portfolio of channels, YouTube TV offers anything from news to entertainment, including sports and reality shows. Worth noting, YouTube TV's original content costs are low, as the platform leverages the product of third-party content producers.

In addition, YouTube TV is not totally separate from the more popular YouTube platform. Some channels, most of which run and operated by independent contributors, can be viewed within the paid service, making the library even larger.

YouTube and YouTube TV work together

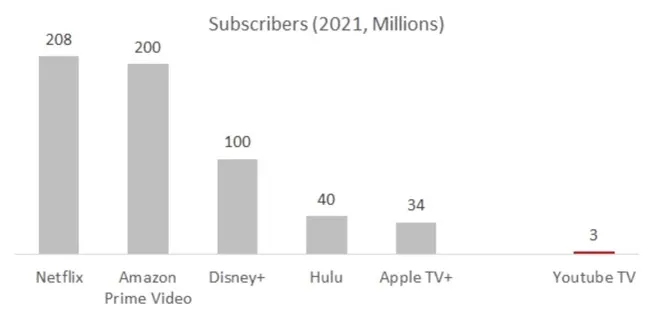

The number of YouTube TV subscribers pale in comparison to those of Alphabet’s main competitors (see chart below). However, while the platform has no more than 3 million paying users, YouTube proper has over 2 billion active users.

Across the world, YouTube has over 1 billion hours of videos viewed daily. Therefore, YouTube TV’s opportunity to use YouTube as a funnel to turn new users into paying subscribers should not be taken for granted.

Assuming a conversion rate of 10% of standard users into paying users, Alphabet could become one of the top three streaming companies by number of subscribers – if not the main player, even ahead of Netflix.

Our view

YouTube proper generated revenues of over $19 billion in 2020. But YouTube TV could very well become an important engine of revenue growth. Therefore, we think that the investment opportunity in GOOG stock should be considered with streaming services in mind.

Comments