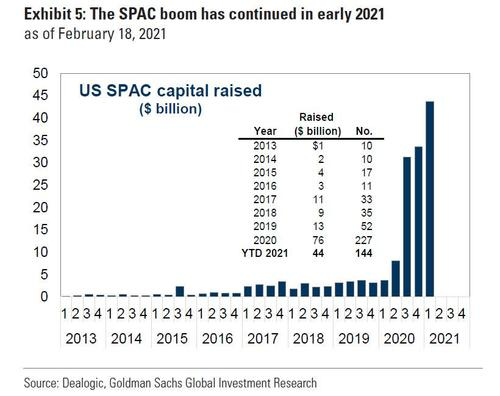

"3 SPAC IPOs this week after 2 last week after 276 in Q1 (vs 228 all of last yr vs 170 from 2013 – 2019 combined)" - Goldman Sachs trader John Flood, April 7, 2021

As Bloomberg's Drew Singer writes, the days of special purpose acquisition companies debuting by the dozens on public exchanges appear to have come and gone, "spelling trouble for the broader market for initial public offerings."

After fueling a record first quarter for IPOs, SPACs have suddenly stopped going public at anything close to the same scale, as if they hit a brick wall in the second quarter.

Worse, according to Bloomberg data, public SPAC offerings are poised for their slowest two-week stretch since the end of 2020. While a reversal remains possible as we get further from Easter weekend,investors have been signaling a growing distaste for these deals.More than 100 or about a third of SPACs that went public this year are trading below their IPO price as investors wait for news of an acquisition. In all, 2021’s SPACs are trading 0.8% above their debut levels, compared with an average 6.0% gain by the year’s traditional IPOs.

The trouble in SPACs comes alongside other signs of weakness in the global IPO market even as the S&P 500 continues to trade near record highs. Stocks rose on Wednesday amid a surge in the Nasdaq 100.

Postmarket launches of U.S. secondary offerings:

Academy Sports (ASO)

- Bookrunners: JPMorgan

- Shares -3.5% postmarket

- Seller unknown

Identiv (INVE)

- Bookrunners: B. Riley, Lake Street, Northland

- Shares -2.2% postmarket

- Seller: Company

Otonomy (OTIC)

- Bookrunners: Cowen, Piper Sandler

- Shares -9.8% postmarket

- Seller: Company

Comments