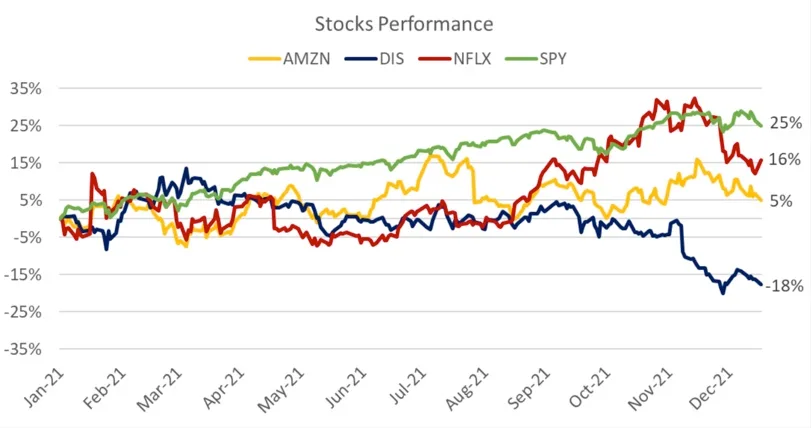

Even after NFLX's performance so far in 2021, Wall Street analysts see long-term gain potential in this streaming stock.

Netflix stock has retreated from its late October high around $690 per share to below $610.

Some investors are worried that the streaming giant's stock will continue to drop. But others are wondering whether Netflix shares will reach new highs in the coming months, making right now a good opportunity to buy.

Wall Street analysts are starting to feel bullish about Netflix. They're setting increasingly higher price targets for its stock.

So let's take a closer look at NFLX and assess its long-term investment potential.

Evercore Forecasts a 20% Return for NFLX

Evercore ISI analyst Mark Mahaney has set his NFLX target at $710, keeping his buy recommendation. This price target opens up an opportunity to achieve an almost 20% return on Netflix shares, compared with today's trading price ($605).

If Netflix stock does reach $710, it will be the company's all-time high.

Mahaney is among TipRanks.com's top 100 analysts. He covers the technology sector and has a success rate of over 60% on his recommendations. Additionally, Mahaney has an average return of 43% within TipRanks.

TipRanks Price Targets for NFLX

According to TipRanks, based on 31 analysts who cover NFLX, the average target share price is $678. This already suggests a great upside potential of around 12% from the current price. On average, the stock is rated a moderate buy.

The highest reported price target is $800, which points to potential gains of over 30% ahead. Such a high valuation probably takes into account Netflix remaining the market leader of the streaming sector in coming years. To do that, it will have to stay ahead of its biggest competitors, Disney and Amazon.

The lowest NFLX price target on TipRanks is $342, which would represent a loss of more than 40%.

Of all 31 ratings on NFLX, 24 analysts label the stock a buy, four indicate you should hold, and three recommend selling.

Our Take

Even after Netflix's big stock rally last fall, we still see room for appreciation. Year to date, NFLX has appreciated by more than 15%. But it is already far from its top. And that leaves room for a possible buying opportunity.

Even so, it's up to the investor to decide whether the company isn't overpriced and whether the Netflix's metrics are evolving as expected by the market. After all, currently, NFLX is trading at multiples much higher than the rest of the streaming industry.

Comments