Market Overview

U.S. stocks rallied on Thursday (Mar. 2), as Treasury yields pulled back from earlier highs following comments from Atlanta Federal Reserve President Raphael Bostic about his favored path of interest rate hikes for the central bank. The Dow Jones Industrial Average rose 1.05%, the S&P 500 gained 0.76%, and the Nasdaq Composite added 0.73%.

Regarding the options market, a total volume of 36,943,072 contracts was traded on Thursday, basically the same as the previous trading day. Tesla's trading volume surged after Investor Day. Silvergate Capital, Salesforce and Snowflake saw unusual activities after earnings.

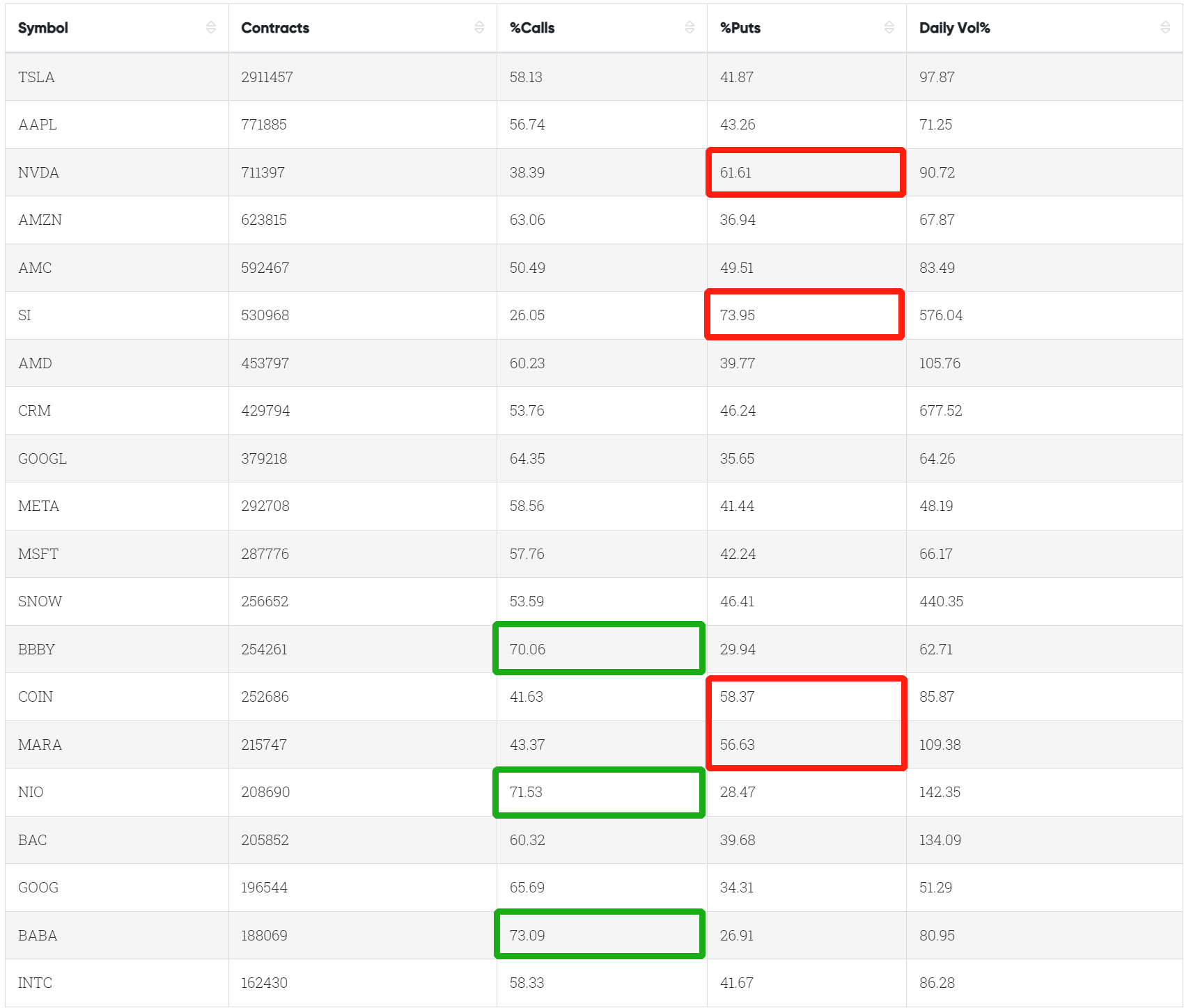

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, AAPL, NVDA, IWM, HYG, AMZN, AMC, SI

Options related to equity index ETFs are popular with investors, with 9.28 million SPDR S&P500 ETF Trust (SPY) and 2.75 million Invest QQQ Trust ETF (QQQ) options contracts trading on Thursday.

Total trading volume for SPY increased by 5%, from the previous day. 58% of SPY trades bet on bearish options.

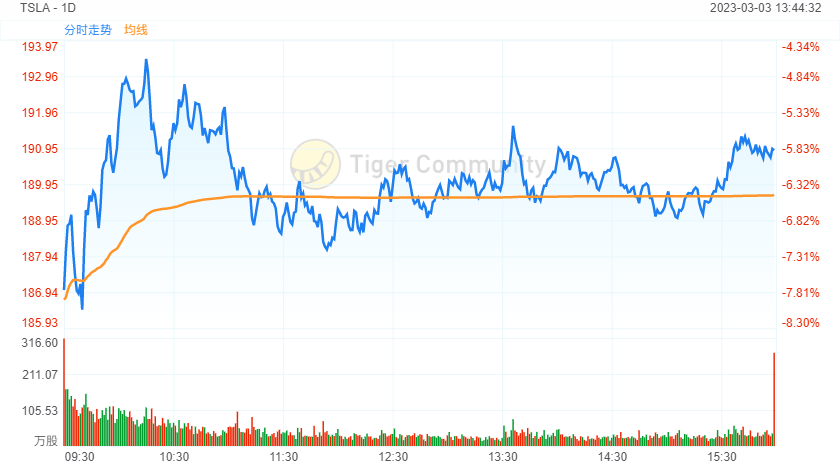

Tesla Inc fell 5.85% on Thursday after Chief Executive Elon Musk and team's four-hour presentation failed to impress investors with few details on its plan to unveil an affordable electric vehicle.

There are 2.91 million Tesla option contracts traded on Thursday, almost double the previous day. Call options account for 58% of overall option trades. Particularly high volume was seen for the $190 strike put option expiring March 3, with 174,892 contracts trading. The next is the $190 strike call option expiring March 3, with 171,094 contracts trading.

Shares of Silvergate Capital Corp slumped 57.72% on Thursday, after the cryptocurrency-focused lender warned it was delaying its annual report and said it was evaluating its ability to operate as a going concern.

There are 531K Silvergate Capital option contracts traded on Thursday. Put options account for 74% of overall option trades. Particularly high volume was seen for the $5 strike put option expiring March 17, with 23,861 contracts trading.

Most Active Options

1. Most Active Trading Equities Options:

Special %Calls >70%: BBBY, NIO, BABA

Special %Puts >50%: NVDA, SI, COIN, MARA

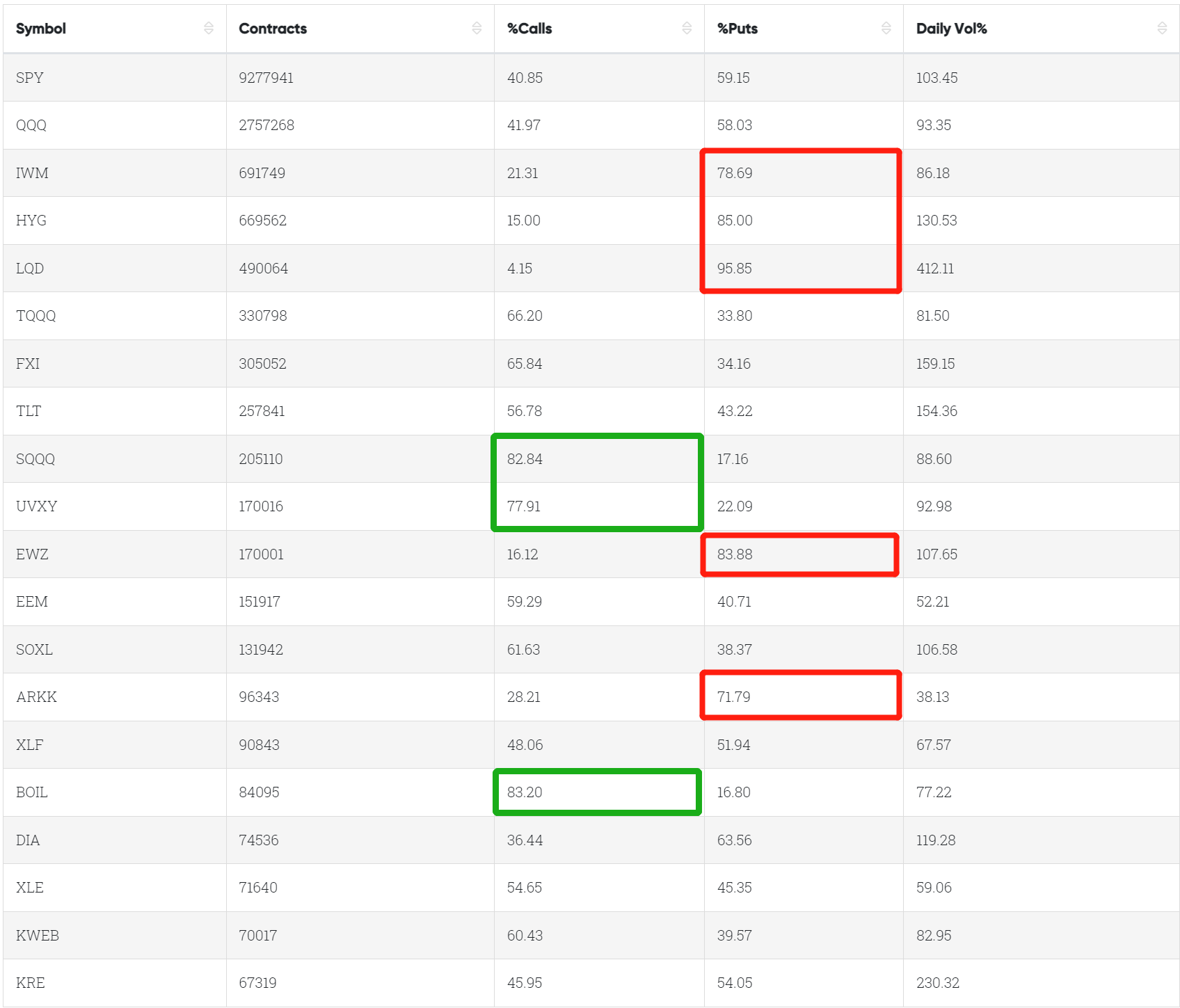

2. Most Active Trading ETFs Options

Special %Calls >70%: SQQQ, UVXY, BOIL

Special %Puts >70%: IWM, HYG, LQD, EWZ, ARKK

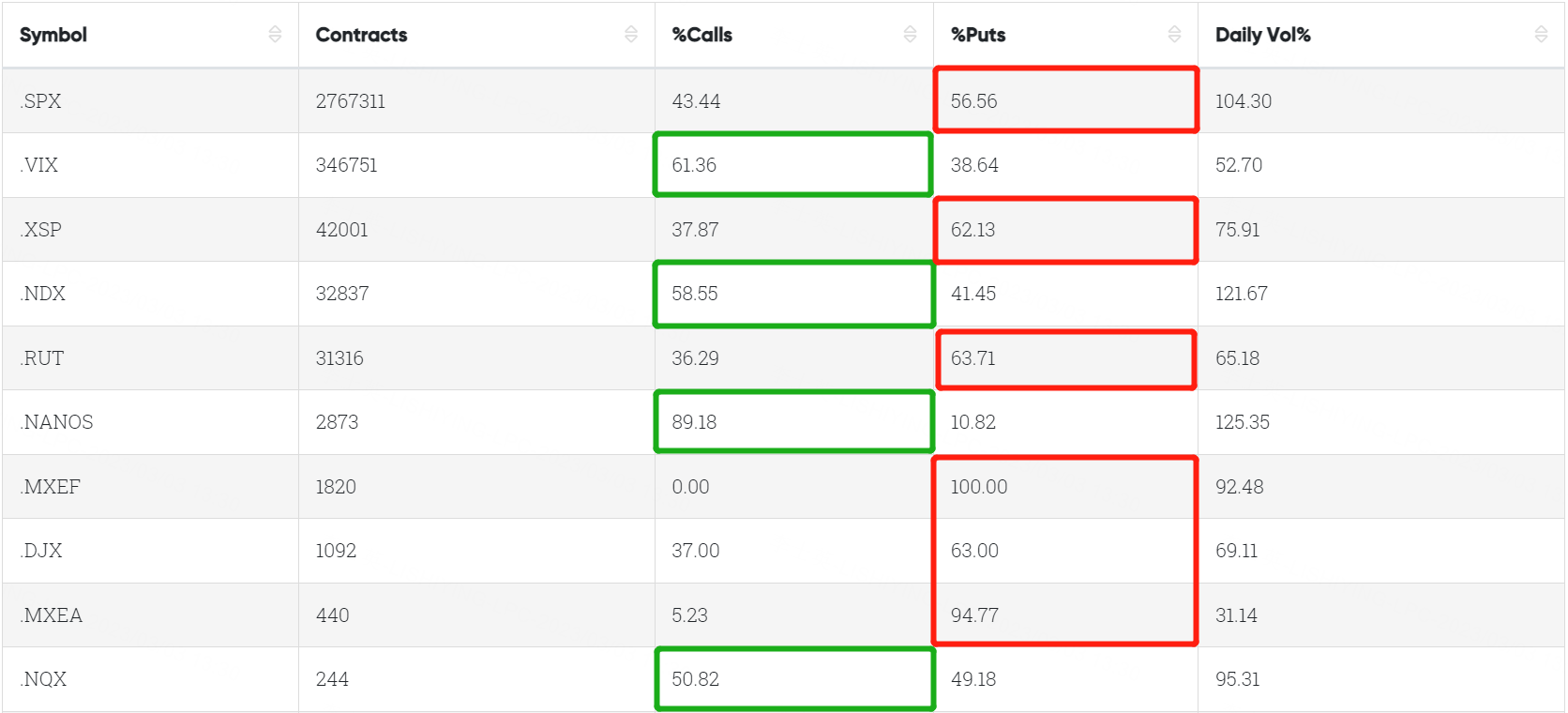

3. Top 10 Most Active Trading Indexes options

Special %Calls >50%: VIX, NDX, NANOS, NQX

Special %Puts >50%: SPY, XSP, RUT, MXEF, DJX, MXEA

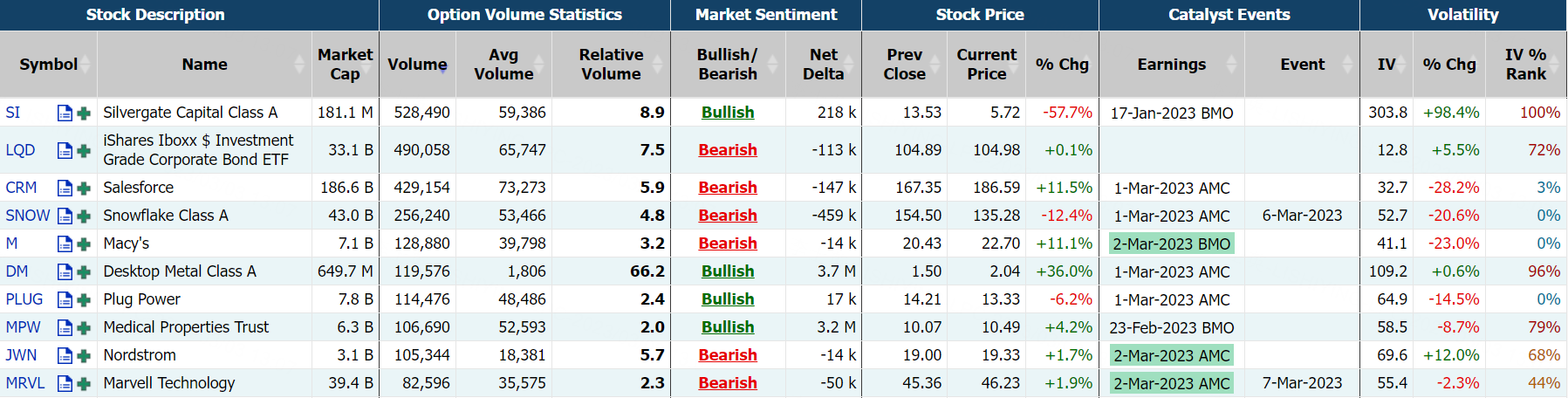

Unusual Options Activity

The yield on 10-year Treasury notes had earlier touched a fresh four-month high of 4.091% on Thursday after data showed the number of Americans filing new unemployment claims fell again last week, indicating continued strength in the labor market, while a separate report showed U.S. labor costs grew faster than initially thought in the fourth quarter. The 10-year yield was last up 6.7 basis points to 4.064%. The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was down 0.4 basis points at 4.885% after earlier touching a fresh 15-year high at 4.944%.

There are 490K $iShares iBoxx Inv Grade Corporate Bond ETF (LQD) option contracts traded on Thursday. Put options account for 96% of overall option trades. Particularly high volume was seen for the $104 strike put option expiring April 21, with 117,876 contracts trading.

Salesforce Inc's shares jumped 11.5% on Thursday after the cloud-based software provider gave an upbeat full-year profit forecast and doubled its share repurchase program, placating activist investors pushing for changes amid slowing growth.

There are 429.8K Salesforce option contracts traded on Thursday. Call options account for 54% of overall option trades. Particularly high volume was seen for the $190 strike put option expiring March 3, with 21,681 contracts trading.

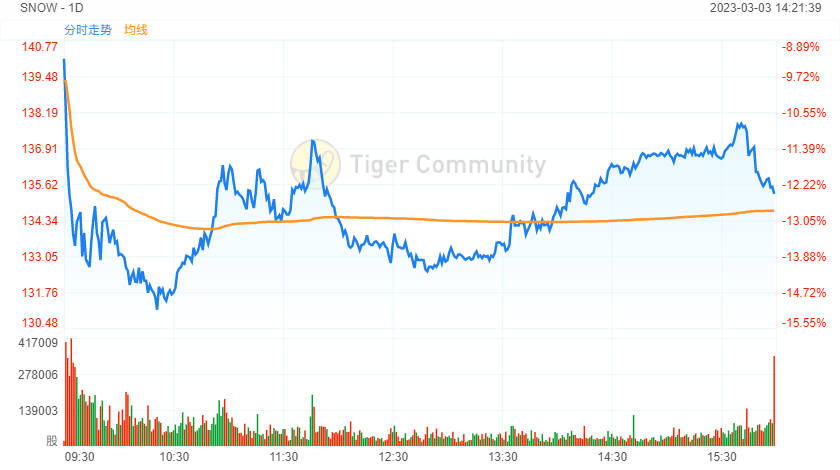

Snowflake shares plunged 12.4% on Thursday after the company provided guidance for the January 2024 fiscal year that fell short of Wall Street’s expectations.

There are 256.7K Snowflake option contracts traded on Thursday. Call options account for 54% of overall option trades. Particularly high volume was seen for the $140 strike call option expiring March 3, with 10,555 contracts trading. The next is the $130 strike put option expiring March 3, with 10,497 contracts trading.

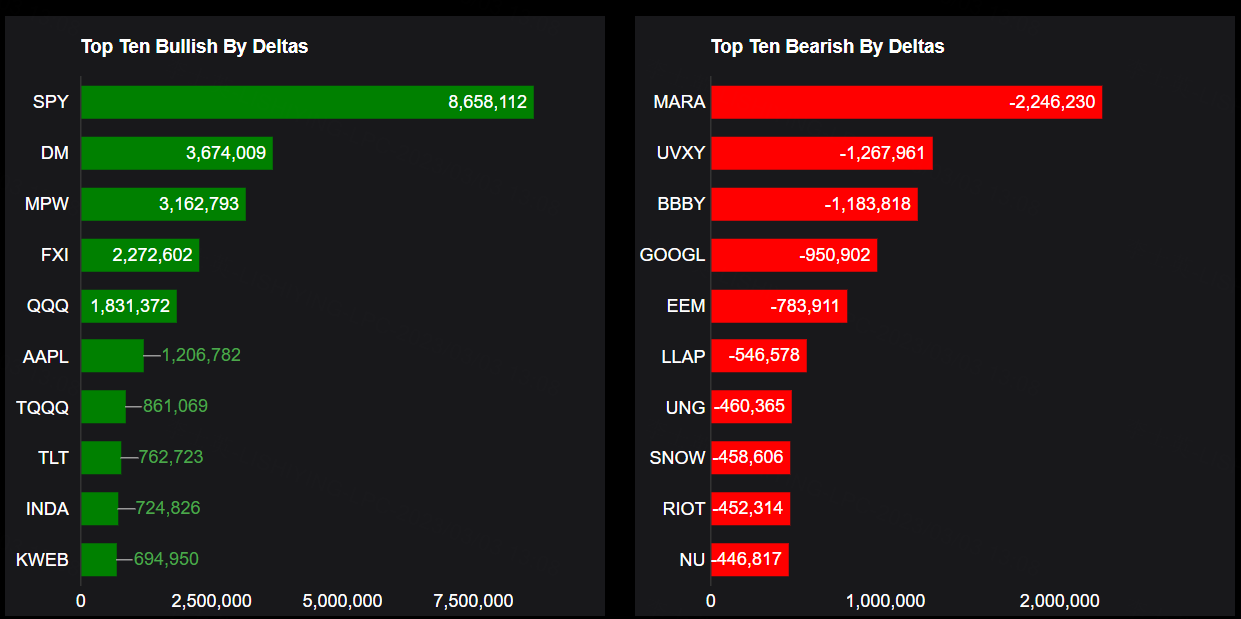

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, DM, MPW, FXI, QQQ, AAPL, TQQQ, TLT, INDA, KWEB

Top 10 bearish stocks: MARA, UVXY, BBBY, GOOGL, EEM, LLAP, UNG, SNOW, RIOT, NU

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments