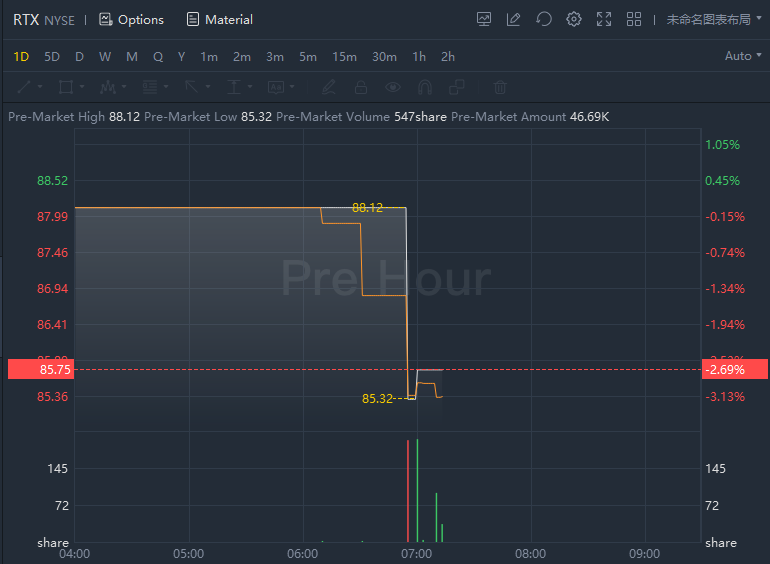

Raytheon slid nearly 3% in premarket trading after posting its financial result.

Raytheon Technologies Corporation (NYSE: RTX) reported fourth quarter 2021 results and announced its 2022 outlook.

Fourth quarter 2021

- Sales of $17.0 billion

- GAAP EPS from continuing operations of $0.46, which included $0.62 of acquisition accounting adjustments and net significant and/or non-recurring charges

- Adjusted EPS of$1.08

- Operating cash flow from continuing operations of $3.2 billion; Free cash flow of$2.2 billion

- Completed the acquisitions of Flight Aware and SEAKR Engineering, and the disposition of RIS' Global Training and Services business

- Achieved approximately $190 million of incremental RTX gross cost synergies

- Company backlog of $156 billion; including defense backlog of $63 billion

- Repurchased $327 million of RTX shares

Full year 2021

- Sales of$64.4 billion

- GAAP EPS of$2.58

- Adjusted EPS of$4.27

- Operating cash flow from continuing operations of$7.1 billion; Free cash flow of$5.0 billion

- Achieved approximately$760 million of incremental RTX gross cost synergies

- Repurchased$2.3 billion of RTX shares

Outlook for full year 2022

- Sales of$68.5-$69.5 billion

- Adjusted EPS of$4.60-$4.80

- Free cash flow of approximately$6.0 billion. Assumes the legislation requiring R&D capitalization for tax purposes is deferred beyond 2022.

- Share repurchase of at least$2.5 billion of RTX shares

Comments