You know the old James Carville quote about the bond market.

It’s a truism in markets that when things get bad enough, investors will reach for the safety of U.S. government debt — even when the proximate cause of the market’s concern is the U.S. government itself.

That’s a point worth remembering as America hurtles towards another debt ceiling deadline showdown, with Treasury Secretary Janet Yellen warning last week that her department will probably reach the federal borrowing limit sometime in October.

While the brinkmanship is already starting to impact yields on shorter-maturity T-bills, with investors asking for more compensation to hold the bonds, there’s no guarantee that a debt ceiling drama will have a similar effect on longer-term U.S. Treasuries.

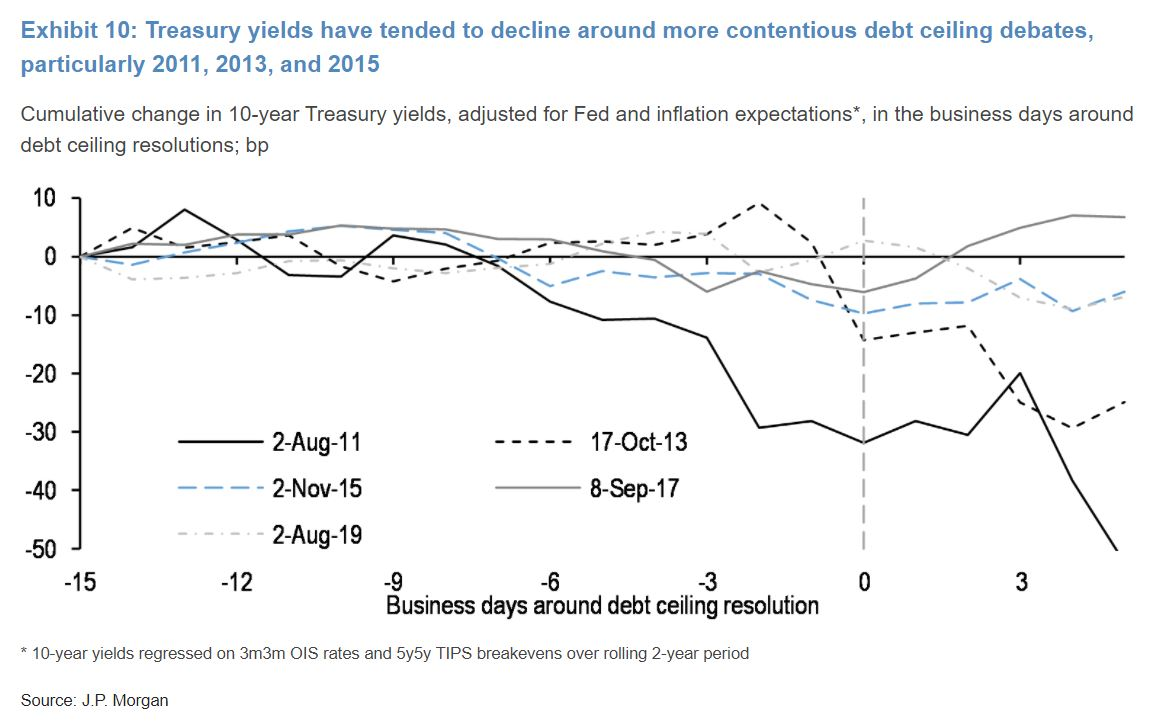

As JPMorgan points out in research published over the weekend, yields on benchmark U.S. government bonds have actually fallen for three out of the past five debt ceiling showdowns thanks to the safe haven bid. The chart below shows the performance of yields on 10-year Treasuries in 2011, 2013, 2015, 2017 and 2019, and adjusted for expectations around interest rates and inflation.

You can see that yields didn’t do much of anything in 2017 and 2019, two years in which Congress managed to raise the debt ceiling with some time to spare. But the story was different in 2011, 2013 and 2015 — when fraught negotiations dragged closer and closer to the deadline.

Back then, nervous investors keen to protect their portfolios against the possibility of a technical default by the U.S. government, reached (obviously) for the safety of U.S. government debt, and yields fell.

“Knowing that the House is not back in session for another 10 days, and that Congress has numerous legislative balls in the air, it’s likely that these negotiations leak into late September and perhaps beyond, running the risk that this lack of action leads Treasury yields to decline as risk aversion increases,” JPMorgan analysts led by Alex Roever write.

Privilege, thy name is the U.S. government bond market.

Comments